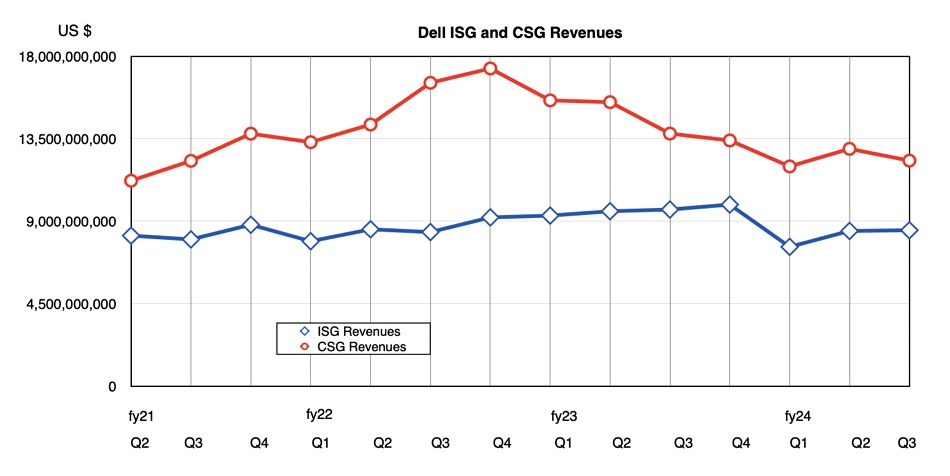

Dell Q3 revenues declined overall but servers showed a quarter-on-quarter upturn as customers bought more AI-optimized compute. The business is now hoping for an AI-boosted recovery next year.

Revenues in the quarter ended November 3 were $22.3 billion, 10 percent lower year-on-year (Y/Y) with a 317 percent increase in net income to $1 billion.

Dell CFO Yvonne McGill stated: “We have proven our ability to generate strong cash flow through profitability and working capital efficiency, including $9.9 billion of cash flow from operations over the last 12 months.”

The company ended the quarter with remaining performance obligations of $39 billion, recurring revenue of $5.6 billion, up 4 percent Y/Y, and deferred revenue of $29.1 billion, up 7 percent Y/Y, primarily due to increases in software and hardware maintenance agreements.

Financial summary

- Gross margin: 23.1 percent flat annually

- Operating cash flow: $2.2 billion

- Diluted EPS: $1.36

- RPO: $39 billion

- Cash and investments: $9.9 billion

The Client Solutions Group (CSG) brought in $12.3 billion, down 11 percent Y/Y. Commercial client revenue was $9.8 billion, and consumer revenue was $2.4 billion. Demand momentum slowed in the quarter. Vice chairman and COO Jeff Clarke said in the earnings call: “The result was CSG revenue was down sequentially and short of our expectations … The recovering ramp in PC demand we were expecting in Q3 has pushed out, with large enterprises and corporate customers remaining cautious with their spending.”

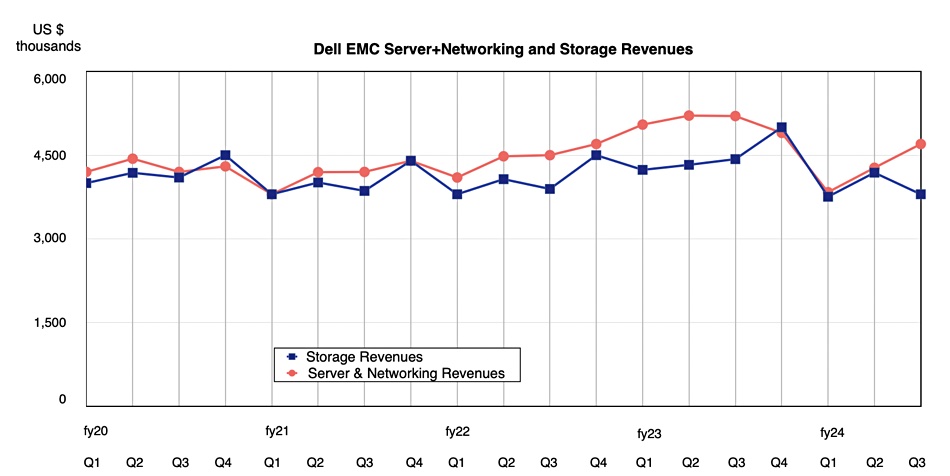

The Infrastructure Solutions group (ISG) recorded $8.5 billion in revenues, an 11.7 percent annual decline. But within that, servers and networking were responsible for $4.7 billion, down 9.4 percent annually but up 9 percent on the prior quarter, with the surge of interest in generative AI netting high-price server sales.

Clarke added: “We shipped over $0.5 billion of AI-optimized servers, including our XE9680, XE9640, XE8640 and the R750 and R760xa servers. Customer demand for these AI servers nearly doubled sequentially, and demand remains well ahead of supply … The XE9680 is the fastest ramping solution in Dell history. ”

Dell shipped more than $0.5 billion of AI-enhanced servers in the quarter, and Clarke said: “The pipeline for AI-optimized servers tripled quarter-over-quarter during Q3.” So elevated AI server sales should continue.

Storage didn’t benefit from the AI boost, bringing in $3.8 billion, down 14.2 percent annually and 8 percent sequentially.

The chart above shows the abrupt server and networking revenue upturn in Dell’s Q3 while storage revenues fell back sequentially.

McGill said there was demand growth in data protection and PowerScale, Dell’s scale-out filer product line.

In Clarke’s view: “AI continues to dominate the technology in business conversation. Customers across the globe are turning their operations upside down to see how they can use generative AI to advance their businesses in meaningful ways.” We would expect this to drive up storage sales as more data will need to be stored for AI analysis, but it is not happening yet.

Clarke added: “We are … seeing the beginning of a traditional server rebound, and historically, storage follows a couple of quarters later.

“This eight-quarter digestion of what was built or bought … through the course of COVID has now worked its way through the system … Datacenters need to be updated, upgraded [with] additional capacity … More data is being created.”

In the current storage supplier reporting season, Dell, HPE, and NetApp have reported declining storage revenues while Pure Storage and Nutanix have grown their businesses. If Clarke is right, all five should see strengthening demand over the next few quarters. He didn’t use the word “recovery” but did say: “We have early positive signs that there’s a changing in the demand profile of traditional servers.”

Looking forwards to the next quarter, McGill said: “Sequentially, we expect ISG revenue to be up mid-single digits, driven by sequential growth in traditional servers and seasonal growth in storage. We expect CSG revenue to be down low-single digits sequentially. We’re seeing pockets of stability in PC demand, but have yet to see a broader recovery in the PC market.”

The guidance for Dell’s next quarter is for revenues of $22 billion +/-$0.5 billion, a 12 percent annual decline at the mid-point, and producing $88.1 billion revenue for the full 2024 year, a 14 percent annual decline. Looking further ahead, McGill said: “We’re seeing signs of stability and inflection in parts of the portfolio, including traditional and AI-optimized servers. We expect revenue to return to growth next year.”

Clarke said the AI server market represents an expansion of Dell’s total addressable market (TAM): “It’s not coming at the cost of our traditional servers.” That implies that it will provide a TAM-enhancing tailwind for storage as well.

Storage and AI

We would think that would be more for file and object storage than for block (SANs). Clarke agrees, saying in answer to a question: “Is there a relationship between storage and networking with AI? Absolutely.

“These are typically clusters – small clusters, large clusters, [with] high bandwidth needed. We see it ultimately deployed out where the data is being created. Much of the data that will be created in the future is outside of the data center. Much of that data is unstructured. Much of that opportunity is really a nice tie to what we do with our own structured and object assets. And then networking is the high-speed interconnect fabric. They matter, they matter more, whether it’s Infiniband or Ultra Ethernet, those are all exciting new technologies for us.”

But analyst Simon Leopold asked: “Is AI pulling money away from storage?” Clarke reiterated his points about AI server processing pulling along unstructured data growth in its wake, and concluded: “I don’t think AI pulls away storage dollars.

“I think what we see is the effect of eight quarters of server decline has impacted storage. Customers are cautious historically as the server business rebounds and recovers. We think our experience tells us that storage lags it by about a couple of quarters. That’s what we’re expecting. We see nothing that suggests that’s different. And in the meantime, the opportunity around unstructured is immense, and we’ll continue to focus on that.”

Comment

Storage suppliers need to get high-capacity file and object stores linking at high speed to AI-munching servers. Any supplier not doing this is heading toward irrelevancy.