Intel is moving its Altera FPGA-based Programmable Solutions Group (PSG), which are used in its Infrastructure Processing Units (IPU) and other products, into a separate business unit with an IPO planned for 2026/2027.

Update. Intel’s IPUs are the responsibility of its Network and Edge Group (NEX), not PSG. Hence OSG issues re IPUs have been transferred to NEX. 10 Oct 2023.

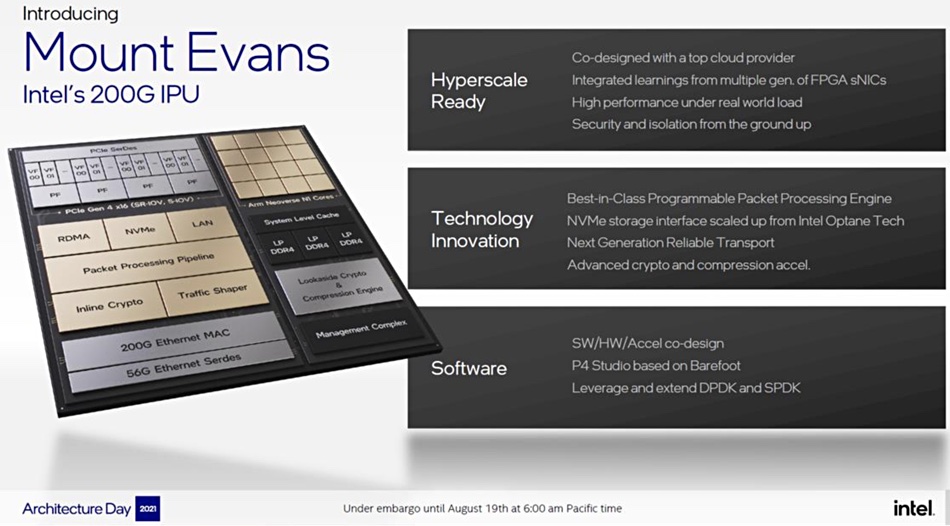

The main news is covered in this Register report but we’re going to look into the IPU angle here. The Mount Evans IPU, now called the IPU E2000, sits between an x86 processor and its network connections and offloads low-level network, security, and storage processing, so-called infrastructure processing, from the host CPU.

Other vendors such as startups Fungible and Pensando called their similar products Data Processing Units (DPUs) but IPU seems a more accurate term, especially as an x86 CPU processes application and infrastructure data as well as code.

IPUs are said to enable host server CPUs to do more application work and free it up from doing internal device-to-device, east-west type processing in a datacenter. The more servers you have, the more benefits you get from offloading them. That meant hyperscalers were the initial market with enterprises reluctant to buy due to cost, lack of standards and server OEM support. Nvidia’s BlueField smart NIC has IPU-type functionality and muddied the marketing waters.

AWS has developed its own DPU technology with its Nitro ASIC card, reducing the prospective market for the startups. Pensando and its Arm-based IPU product was bought by AMD in April last year for $1.9 billion and AMD is now selling its Pensando DSC2-200 product to cloud providers such as Azure and other hyperscaler customers.

Fungible was bought by Microsoft for $190 million at the end of 2022 for its datacenter infrastructure engineering team’s use. That means Azure and that in turn threatens the AMD Pensando business.

Intel has three IPU technologies: Big Springs Canyon, Oak Springs Canyon, and Mount Evans, based on FPGA or ASIC technology. Both Mount Evans and Oak Springs Canyon are classed as 200GB products.

Big Springs Canyon is built around a system-on-chip (SoC) Xeon-D CPU with Ethernet connectivity. Oak Springs Canyon was its first gen 2 product and uses Agilex-brand FPGA technology with the Xeon-D SoC. It supports PCIe gen 4 as well as 2 x 100Gbit Ethernet. Intel is shipping Oak Springs Canyon to Google and other service providers.

The second gen 2 Intel IPU is called Mount Evans and uses an ASIC instead of an FPGA, featuring 16 Arm Neoverse N1 cores. ASICs are custom-designed for a workload whereas FPGAs are more general in nature, hence ASICs can be faster. Mount Evans was designed in conjunction with Google Cloud and includes a hardware-accelerated NVM storage interface scaled up from Intel Optane technology to emulate NVMe devices. It is shipping to Google and other service providers.

Intel’s NEX business unit, led by Sachin Katti whom was appointed SVP and GM for NEX in February, has these three IPUs in its product portfolio plus an IPU development roadmap. This mentions the 400GB Mount Morgan and Hot Springs Canyon gen 3 products, and a subsequent unnamed 800GB IPU product, presumably gen 4. Mount Morgan is ASIC-based, following on from Mount Evans, while Hot Springs Canyon is FPGA-based, succeeding the Oak Springs Canyon product. Both are scheduled to ship in the 2023/2024 period. The 800GB product is slated to ship in 2025/2026.

PSG standalone operations will start on January 1 with CEO Sandra Rivera in charge, currently the EVP and GM in charge of Intel’s Datacenter and AI unit, and possible private investors putting money in before the IPO.

AWS and Azure have in-house IPU technologies and don’t appear to be potential Intel IPU customers. Nvidia looks set to take a large share of the enterprise SmartNIC/DPU market, potentially limiting Intel’s ability to expand IPU sales into general large server farm enterprises.

Google can develop its own semiconductor products like its AI-accelerating Tensor Processing Unit. That is a potential threat to Intel, which gets enormous market credibility as an IPU supplier with this Google deal. Katie’s NEX needs to ensure the Google co-development continues.