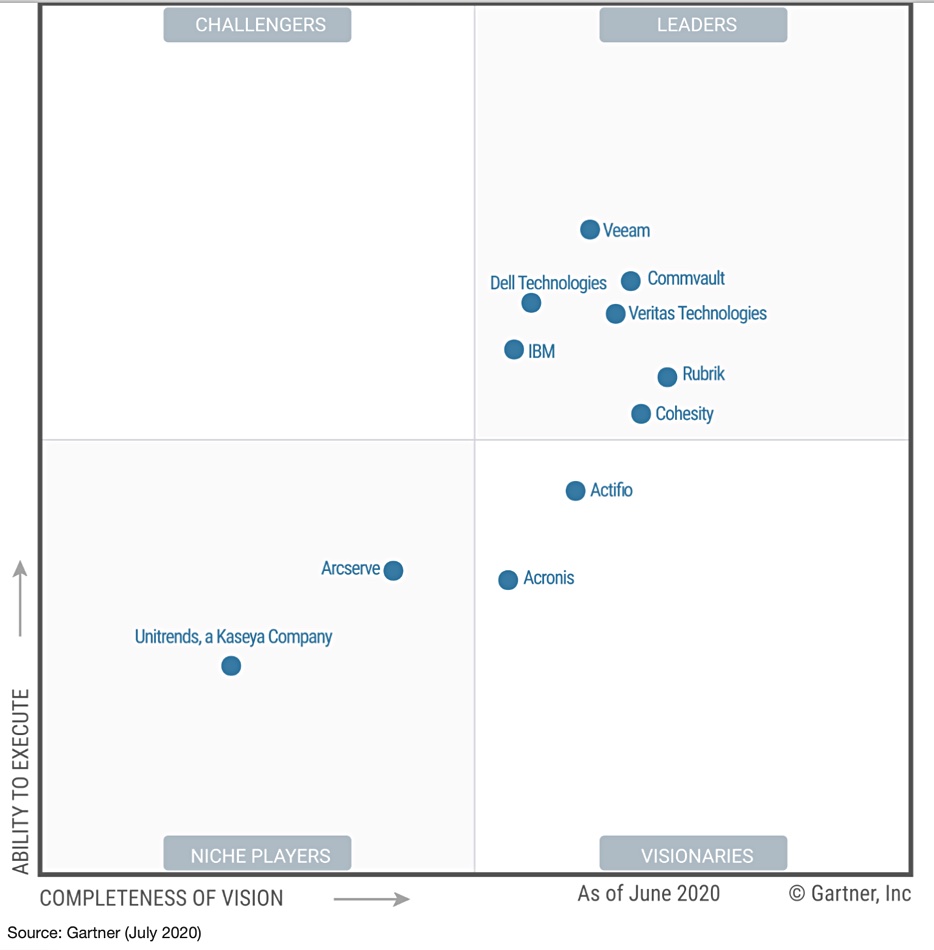

The Gartner gurus have updated their Backup and Recovery Magic Quadrant, moving two of 2019’s ‘visionaries’, Cohesity and Rubrik, into the leaders’ quadrant.

Update: 2020 MQ for backup and recovery diagram added.

We have seen a copy of the report and Magic Quadrant (MQ) chart. The authors write: “The move toward public cloud, heightened concerns over ransomware, and complexities associated with backup and data management are forcing I&O leaders to rearchitect their backup infrastructure and explore alternative solutions.”

That is fast progress for both companies, but faster for Cohesity than Rubrik, which made its first appearance in 2019. That year Rubrik and Arcserve complained publicly that their position in the visionary and niche player’s quadrants respectively were unfair.

This year Rubrik has made it to the leaders’ quadrant but Arcserve remains boxed in with the niche players. Arcserve did not respond to requests for supplemental information,” Gartner says. “Gartner’s analysis is therefore based on other credible sources, including Gartner client inquiries, Gartner Peer Insights, press releases from Arcserve and technical documentation available on Arcserve’s website.”

Dell and IBM are in the Leader’s quadrant as before but in other changes:

- Commvault and Veeam are the top two in the leaders quadrant but Veeam has overtaken Commvault with a higher ability to execute.

- Veritas is a leader for the fifteenth time in a row, and Commvault for nine years in a row

- Acronis moves from niche player to visionary. The MQ report says Acronis has a widening capability gap and “trails competition in its ability to provide comprehensive data protection capabilities for public cloud, hyperconverged infrastructure (HCI) and network- attached storage (NAS) environments.”

MicroFocus, a niche player in 2019, no longer in the MQ.

Actifio moves higher up the visionaries’ quadrant with Gartner noting limited presence outside North America, lack of tape support, and its “list price for software licenses and annual maintenance is higher than most vendors evaluated in this research”.

In response, an Actifio spokesperson told us: “Gartner relies on revenue and growth for its Ability to Execute axis. Companies that sell hardware, be they appliances or “bricks,” get what one might call an unfair advantage (in this case a spot in the Leaders quadrant) compared with vendors with pure software or SaaS models.”

Like Arcserve, niche player Unitrends did not respond to Gartner requests for supplemental information.

Gartner awards so-called Honourable Mentions to certain other backup suppliers; Clumio, Druva, HYCU, and Zerto.

Clumio, HYCU and Zerto were not included in the MQ because they did not meet Gartner’s revenue criteria. Druva was not included as it did not meet the criteria for minimum number of enterprise backup customers that deployed the solution at the scale.

As a reminder, Gartner’s Magic Quadrant is a 2-axis chart plotting Ability to Execute” along the vertical axis and Completeness of Vision along the horizontal axis. There are four subsidiary quadrants or squares; Challengers and Leaders along the top, and Niche Players and Visionaries along the bottom.

Here’s last year’s backup and recovery MQ for comparison;