Cohesity-Veritas has the largest share in the data protection market with Veeam in second place, but Veeam is growing its share fastest with Datto-Kaseya and Rubrik in joint second place.

These IDC market share numbers have been revealed in a 53-page document sent to subscribers by William Blair analyst Jason Ader, who analyzes Rubrik’s market and technology situation.

Ader writes: “Perhaps more than any other vendor, Rubrik deserves credit for changing the way customers view the backup market and making the term ‘cyber resilience’ stick. While the effectiveness of using backup to counteract ransomware helped here, Rubrik successfully pioneered the perception shift from ‘boring old backup’ to a must-have cyber resilience platform, on which the operations of the business depend.”

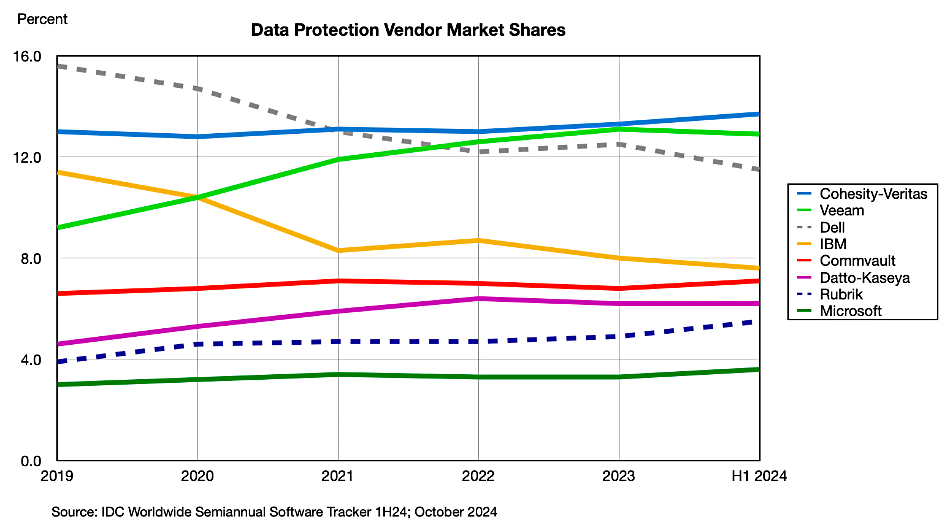

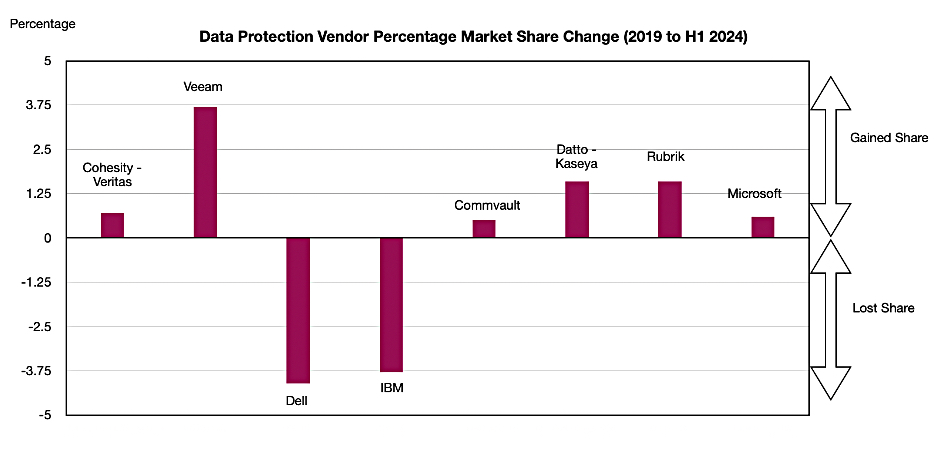

Ader includes an IDC table of vendor positions, using “IDC Worldwide Semiannual Software Tracker 1H24; October 2024” data, to show the changes from 2019 to the first half of 2024:

We have charted this to make the trends more apparent:

Veeam is clearly the fastest-growing vendor in market share terms, with Rubrik accelerating its growth rate from 2023 onward. Datto-Kaseya grew its share up until 2023 then dropped back. We also see two vendors losing market share – Dell and IBM. Plotting the market share changes between the starting and ending periods makes the contrasts between the suppliers quite vivid:

We think there is more scope to grow market share at the low end of the market with small and medium businesses and organizations, as well as by protecting SaaS applications.

Ader says of Rubrik: “The DP (data protection) space is only getting more competitive – with Cohesity’s acquisition of Veritas, Commvault’s revival, and Veeam’s recent financing round – but channel feedback suggests that Rubrik has the leading brand and most market momentum at present. The company’s value proposition is built on the operational simplicity and broad, security-centric feature set of its products and its top-notch go-to-market organization.”

This is now eight-month-old IDC data. Rubrik was positioned seventh in the market in the first half of 2024, and Ader points out: “Given the company’s above-industry growth in 2024 (and expected 25 percent-plus growth in 2025), we suspect that its share in the DP market has continued to improve.”

Given the relatively low market share growth rates, we would suggest that, were Rubrik to acquire another data protection vendor, it would grow its share faster than otherwise, as Cohesity has found out with its Veritas acquisition. Were Rubrik to acquire Commvault or Datto-Kaseya, it could become a top three player.