Backblaze had a revenue uplift in its fourth 2023 quarter as cloud storage demand rocketed upwards.

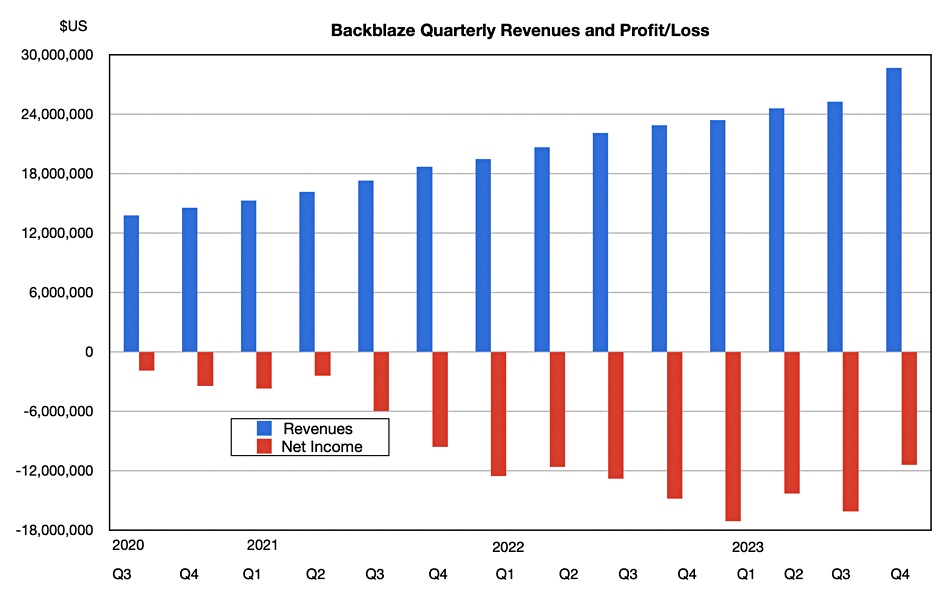

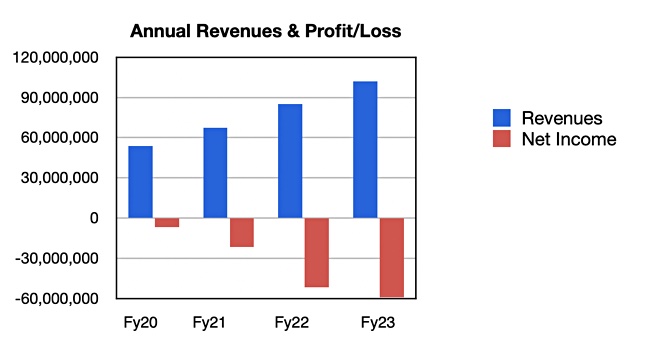

Revenues in the quarter ended December 31 were $28.7 million, a 25 percent year-on-year (Y/Y) increase. There was a loss of $11.4 million, better than the year-ago $14.8 million loss. Full 2023 year revenues were $102 million, 20 percent higher Y/Y, with a $58.9 million loss. That contrasts with 2022 revenues of $85.2 million and a $71.7 million loss.

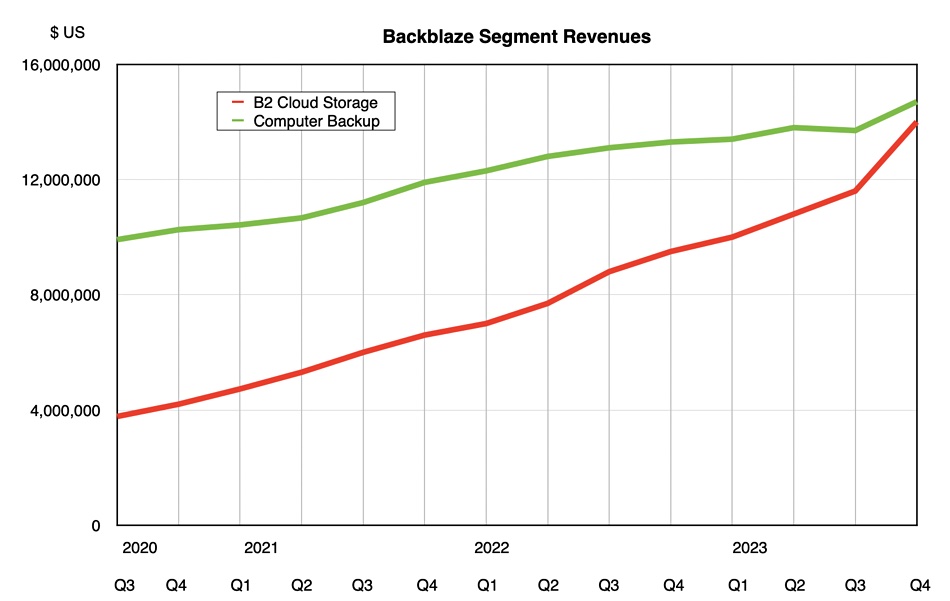

CEO Gleb Budman said: “Backblaze capped off a strong finish to the year with our B2 Cloud Storage revenue growing 47 percent in Q4 and delivered adjusted EBITDA profitability for the first time as a public company.”

B2 Cloud Storage revenues were $14 million, almost catching up with Computer Backup revenues of $14.7 million. They only grew 10 percent Y/Y and, if the relative progress continues, will be eclipsed by B2 Cloud Storage next quarter. William Blair analyst Jason Ader told subscribers: “With strong growth expected to continue in 2024, we expect B2 Cloud will represent more than 50 percent of revenue within the next two quarters. The above-average growth in B2 is being driven by strong differentiation versus AWS, higher ASP customers, and the recent 20 percent price increase.” There was no increase in customer churn in general as a result of the price increase.

Budman said: “We exited 2023 with accelerated revenue growth and dramatically improved profitability and cash usage metrics. I’m excited for the coming year as Backblaze continues to move up in the mid-market.”

He had said at the end of the last quarter: “We believe that we’re at an inflection point with higher revenue growth expected in Q4 and 2024. And so it came to pass. Backblaze was within guidance for quarterly revenue and beat guidance for its end-of-year total.”

Computer Backup revenues ramped up 7.3 percent sequentially. Annual recurring revenue was $117.6 million, up 28 percent. Total average revenue per customer was $228 versus the year-ago $181. Customer count increased from the year-ago 506,456 to 511,942. But there was a decline in the backup customer count:

- B2 Cloud Storage number of customers was 97,842 versus 86,874 in Q4 2022.

- Computer Backup number of customers was 431,745 versus 436,080 in Q4 2022.

Budman said: “We saw a 1 percent to 2 percent licensed usage decline in quarter … That number in general is something that we’re looking at whether it’s a relevant metric going forward into the future, because it’s so heavily influenced by the number of consumer customers on that product line. Whereas we are increasingly focused on servicing … more upmarket businesses. And so you can imagine … one consumer customer is treated the same as one customer that pays us six figures.”

Next quarter Backblaze hopes to see revenues of $29.8 million +/- $0.2 million with full 2024 guidance of $127 million +/- 1 $1 million, which would represent a 24.5 percent growth rate at the midpoint. Ader commented: “Management is continuing to see good progress in its move upmarket, especially in established areas such as media streaming, boosted by investments in direct sales and channel partners (which are helping identify and close larger deals).”

He also noted: “The company is implementing a new sales commission program, and will be hiring a new SVP of sales (current head of sales Nilay Patel is moving to a new executive role focused on AI initiatives).” Budman said in the earnings call that the AI initiatives “are aimed to help support customers in managing the explosive growth of AI data and its use cases.”

He added: “The workflow types that we’ve seen customers follow is where they will often upload information. Sometimes it’s from cameras, sometimes it’s from existing assets they have, sometimes it’s from systems that are generating data. That data flows into Backblaze, it’s stored in B2. Then they use our combination of free egress and partnerships with other GPU clouds to send the data to those locations for processing. And then that processed data then gets put back into Backblaze B2 for a combination of one, being served up as part of the application itself to customers, and two, for longer term retention around backups and archives that AI data. We also have some customers that use it as the original place where they store the data before it gets used for model training.”