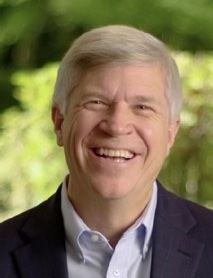

Rob Crooke, the CEO of Solidigm – SK hynix’s acquired Intel SSD business – has suddenly departed.

Crooke ran the Intel SSD business when it was sold to SK hynix for $9 billion in January. SK hynix set it up as a separate business unit and branded it Solidigm with Crooke as the CEO.

Now SK Hynix has confirmed a new leader: “Noh-Jung (NJ) Kwak, current co-CEO of SK hynix, has been appointed Interim Chief Executive Officer. This change follows the departure of Rob Crooke, who served as Solidigm’s CEO since the company’s launch. We are grateful to Rob for his leadership and important contributions in establishing Solidigm. Our team members remain focused on delivering an unmatched product portfolio and best-in-class service to our customers.”

Solidigm told us that “Woody Young, a current member of the Solidigm Board, has been appointed President of Solidigm.” Young is an ex-investment banker.

In addition we’re told: “The Solidigm Board has commenced a search for a new CEO to lead Solidigm. In the interim, we are confident that this senior leadership team is very well-positioned to lead Solidigm and to continue to serve the best interests of our customers.”

The company reiterated: “All of us at Solidigm are grateful to Rob for his leadership and important contributions in establishing Solidigm.”

A person close to the situation told B&F that Solidigm employees were informed at the same time as official statement was released. “Rob was simply gone,” they said.

In Crooke’s time as Solidigm’s CEO the company upgraded its datacenter PCIe 4 connected SSDs, released the P44 Pro gaming SSD. It also started promoting the penta-level cell (5bits/cell or PLC) NAND concept as the follow-on to today’s QLC (4bits/cell) flash.

Crooke also was involved in the decision to keep Solidigm’s NAND technology separate from SK hynix technology for a period, with eventual fusion assumed to take place some years in the future. It is more costly for a company to have two NAND production technologies.

SK hynix recently reported a 7 percent revenue drop in its third 2022 quarter to ₩11 trillion ($7.7 billion) with net profit falling 67 percent year-on-year to ₩1.10 trillion ($771 million) and is reducing cap-ex investments.

It may be that a strategic difference over Solidigm’s technology independence from SK hynix and capital spending contributed to Crooke’s departure, however, this just speculation.

Micron is also feeling the squeeze from the global economic situation and has announced capital spending reductions.