WANdisco investor and former boss of software giants Sage and Micro Focus Stephen Kelly has gone public with a statement that Board-level changes may be needed to help the company recover from its current accounting troubles and prevent the situation from happening again.

The company’s shares on the AIM market are now suspended, following discovery of severe sales reporting issues that could cut 2022 revenues from $24 million to $9 million. WANdisco now has no confidence in its 2022 bookings expectations. If the sales and bookings numbers are not correct, that means its expectations of incoming cash will have to be revised downwards, and possibly lead to a restructuring of the company.

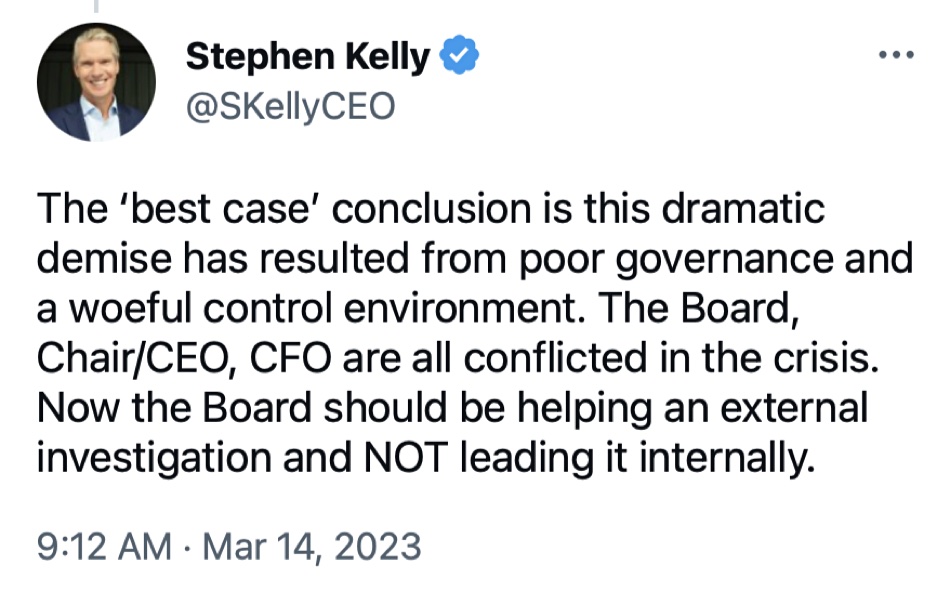

WANdisco investor Stephen Kelly tweeted this morning: “It breaks my heart to post this but so many investors were shocked and saddened to read of the WANDisco situation. This is a tragedy for all stakeholders. Trust is destroyed.”

The company’s 2021 annual report states that the board “sets the Group’s values, standards and strategic aims and oversees implementation within a framework of prudent and effective controls, ensuring only acceptable risks are taken.” Those controls seem to have failed, Kelly says.

He added: “The ‘best case’ conclusion is this dramatic demise has resulted from poor governance and a woeful control environment. The Board, Chair/CEO, CFO are all conflicted in the crisis. Now the Board should be helping an external investigation and NOT leading it internally.”

B&F asked Kelly if the Board needed strengthening with separate chairman and CEO roles. He said: “Key is the oversight, then an external forensic audit/investigation firm – separation of role YES & Board strengthen YES.” (His capitalization has been used.)

He added: “There is an urgent need for INDEPENDENT experienced interim Chair to complete rapid & thorough investigation & create the rescue plan and then the rebuild can start.”

Board membership

Dave Richards, as chairman, president and CEO, has all the power at WANdisco, and this has happened on his watch. Investors who believe that there now needs to be a stronger board, with a separation between the chairman and the CEO roles, face a problem as there are three non-executive directors on the board and three executive directors, all WANdisco staff: Richards, chief scientist and co-founder Dr Yeturu Aahla, and CFO Erik Miller. The three exec directors balance the three non-execs in terms of board member votes.

The non-exec directors are Grant Dollens, Peter Lees, and Karl Monaghan. Bob Corey was vice chair of the board until August 2022 but then resigned, with Lees taking his place. Lees and Monaghan are independent directors and members of the board committee helping FRP Advisory in its job of investigating the sales reporting snafu. Dollens is a non-independent director, meaning he is either an officer, employee or other service provider of the company.

Dollens is the largest WANdisco investor, owning 14.96 percent of its ordinary shares (10,023,135 shares) personally and through Global Frontier Investments, of which he is the managing member, and Global Frontier Partners, of which he is the portfolio manager.

Second disaster averted

WANdisco faced another threat a few days back, as some of its cash is held by the crashed Silicon Valley Bank, putting funds at risk. That risk has now gone away with SVB in the US being bailed out by American authorities while its UK arm was bought out by HSBC, with a quick resolution worked out in a deal by the Bank of England and UK government.