The latest look at storage supplier revenue trends show the flash and disk media companies taking a dive and systems suppliers like Dell, Pure Storage, and Snowflake enjoying a rise.

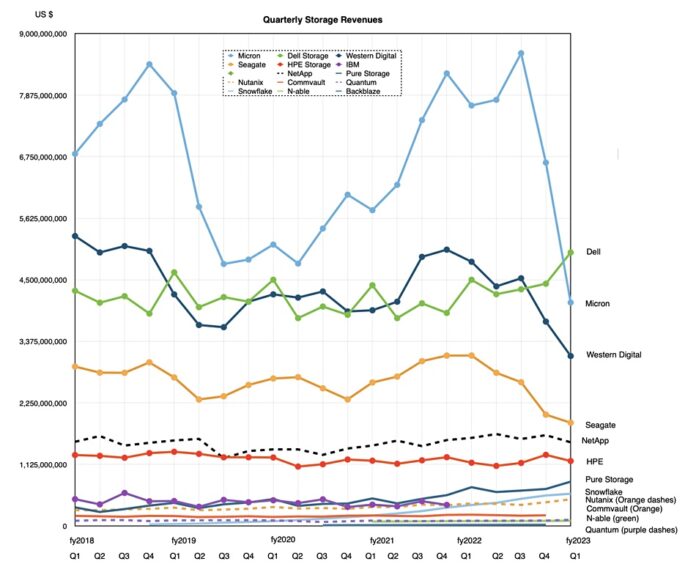

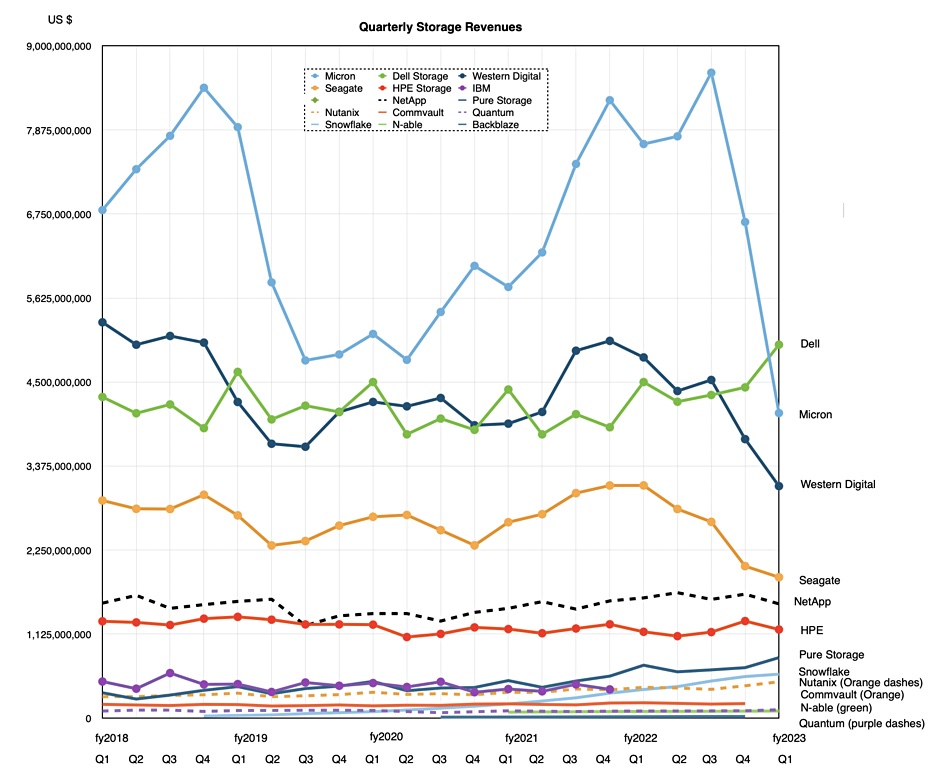

We track the revenues of publicly owned storage suppliers over time and every so often compare them all in a chart with the most recent one showing this pattern:

All the suppliers’ quarterly revenue reports are normalized to HPE’s financial year. We are looking at just the storage revenues from systems suppliers such as Dell and HPE.

We last reviewed storage supplier revenue trends in September 2022 and the media suppliers were riding high. The NAND supply glut and general economic situation have brought this low, with Micron revenues falling below those of Dell’s storage business, and both Western Digital and Seagate revenues tumbling below Dell as well. Dell has been on a rising trend since mid-2021.

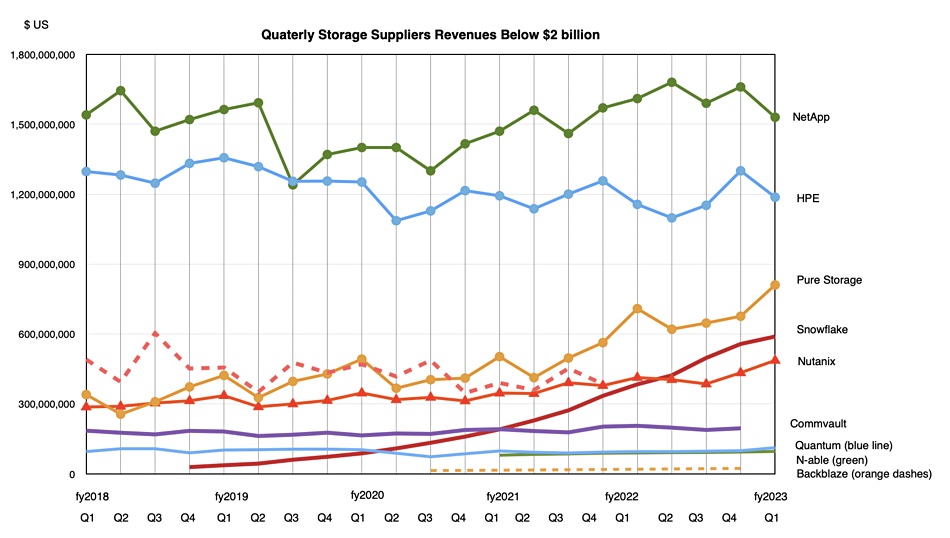

If we redraw the chart to exclude all suppliers with revenues greater than NetApp we get a clearer picture of what’s happening to suppliers in this area of the market:

NetApp is slowly distancing itself from HPE in storage revenue terms, though both rise above the rest. Three suppliers are edging towards HPE – Pure, followed by Snowflake and Nutanix, which has been overtaken by Snowflake.

Four suppliers form the bottom level of our chart: Commvault, Quantum, N-able and Backblaze.

We think it likely that Rubrik may IPO later this year or in 2024, perhaps followed by other privately-owned business including Cohesity, Databricks and even Veeam perhaps, and then their numbers would then appear on this chart as well.