Half of Israel’s 2022 tech startup unicorns are no longer worth a billion dollars or more. That’s the conclusion of Viola, an Israeli private equity company, in its 2022 end-of-year report, which says an investment bubble has burst.

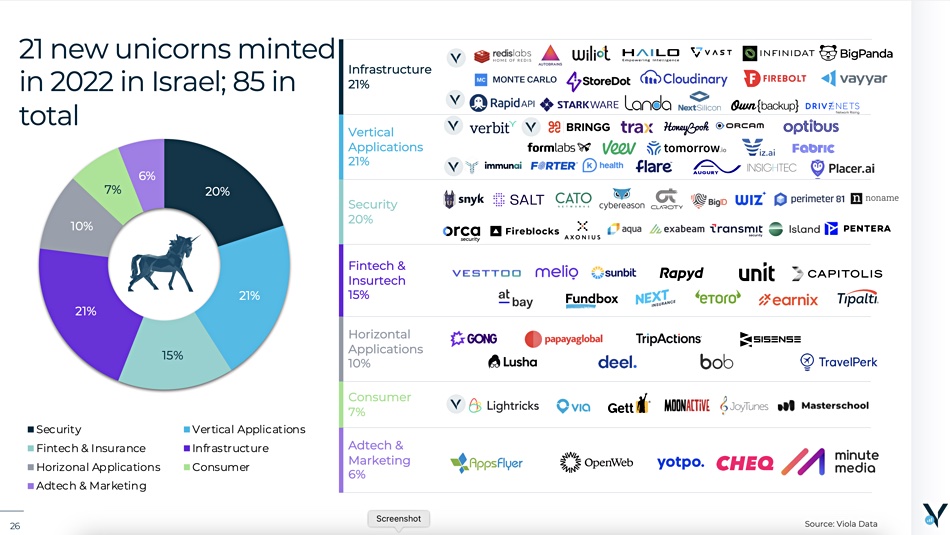

Viola’s report mentions storage unicorn suppliers, and adds that 21 new Israeli unicorns were minted in 2022:

We can recognize four storage-related suppliers in the Infrastructure section at the top of the list: RedisLabs, VAST Data, Infinidat and OwnBackup.

Viola says there has been a “dramatic valuation correction” in 2022 and a decline in VC startup funding in Israel, particularly in rounds greater than $99 million. There were $8.3 billion worth of rounds in the second half of 2021, $4.5 billion in the first 2022 half, and a forecast of just $1.1 billion in the second 2022 half. This funding activity has been “negatively impacted by the public market’s performance.” This has occurred with a shift from a post-COVID high to a looming recession with companies missing top line targets and lowering their spending. There was less startup capital invested, fewer deals, longer inter-round periods and lower valuations, Viola says.

The report states: “We believe only 50 percent justify their unicorn status based on our estimation of their current revenue and offering.” As for new funding, it adds: “Late-stage companies will increasingly utilize debt” because the cost of VC financing is rising. Debt avoids significant shareholder dilution and prolongs the startup’s runway to profitability without setting a valuation price”.

Could the four Israeli storage startup unicorns mentioned above no longer enjoy unicorn status? We think it unlikely because their 2022 growth and funding status was good:

- Infinidat – a high-end array supplier with somewhat opaque funding details since its $95 million C-round in 2017. There was, Crunchbase says, a $45 million debt raise in 2018, followed by an unspecified venture round in 2019 and a D-round in 2020. This featured Goldman Sachs, TPG Growth, Claridge Israel, Moshe Yanai and ION Crossover Partners, but the amount has not been revealed, leaving us with a public total of $370 million raised. This may understate the true position as we think something around $40 million to $80 million was raised in the D-round.

- OwnBackup – supplies Backup-as-a-Service to Salesforce, Microsoft Dynamics and Service Now customers. It raised $167.5 million in January 2021, and $240 million in August 2021, taking its total raised to $507 million-plus with a $3 billion-plus valuation.

- Redislabs – supports and sponsors the open source NoSQL Redis (Remote Dictionary Server) key-value database. It raised $60 million in 2019, $100 million in 2020 and $110 million in 2021, with $347 million raised in total.

- VAST Data – scale-out high-end filer supplier which raised $40 million in 2019, $100 million in 2020 and $83 million in 2022 with $263 million in total funding. It no longer has hardware on its books but it is a hardware and software-based design house.

Our thinking is that these four suppliers have retained their unicorn status and could grow more in 2023.