Forrester has looked at the multi-model database market – what it calls translytical products – and decided that Oracle has the top translytical technology, with GigaSpaces last.

Forrester senior analysts and VPs Noel Yuhanna and Mike Gualtieri have produced a report called “The Forrester Wave: Translytical Data Platforms, Q4 2022“. In it, they define translytical platforms as “next-generation data platforms that are built on a single database engine to support multiple data types and data models. They are designed to support transactional, operational, and analytical workloads without sacrificing data integrity, performance, and analytics scale.”

The characteristics of such software products include optimization for both reads and writes, distributed in-memory architecture, multi-model, advanced workload management, AI/ML, and cloud architectures to support modern workloads. Example workloads are real-time integrated insights, scalable microservices, machine learning (ML), streaming analytics, and extreme transaction processing.

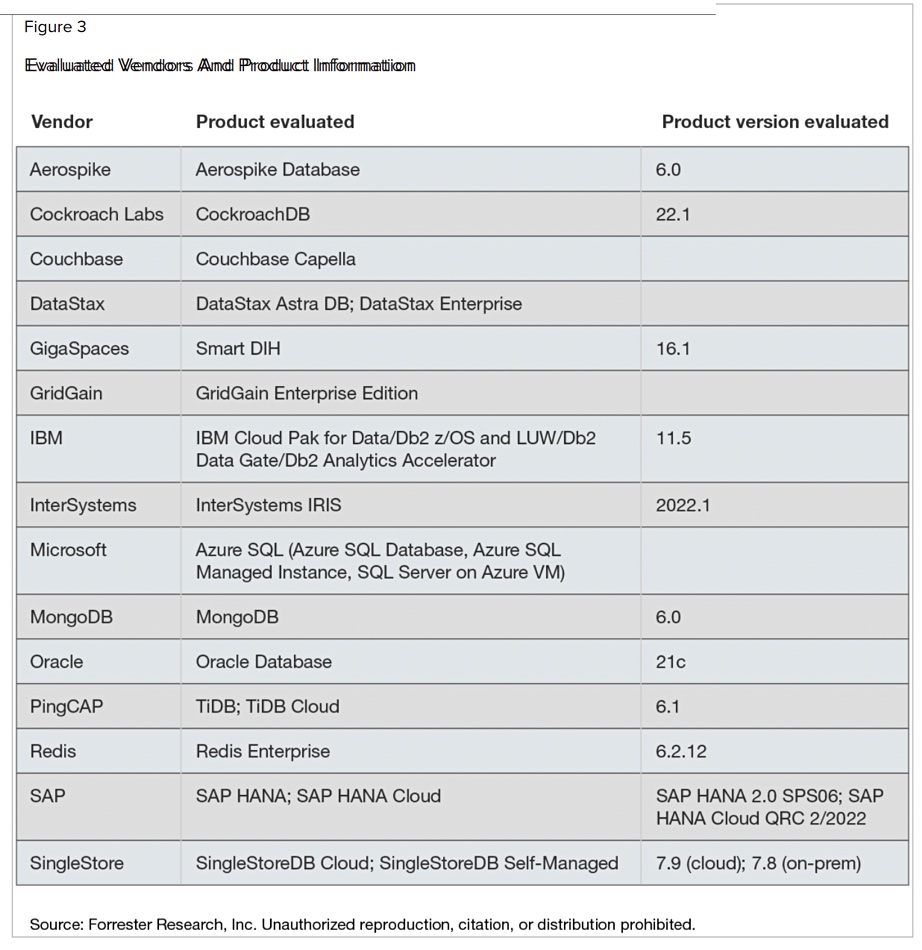

Forrester analyzed 15 vendors – the top vendors in the market place in its view, and not an exhaustive list. A table lists the vendors and their products:

These are ranked in a Wave diagram, in sections called Challengers, Contenders, Strong Performers and Leaders – a typical four-way analyst’s way of grouping vendors. They occupy curved quadrants in a square space defined by a vertical weaker-to-stronger current offering axis and a weaker-strategy-to-stronger-strategy horizontal axis. The size of a vendor’s circular symbol indicates its market presence, with a bigger symbol equalling a stronger presence. Naturally the symbols tend to get bigger as we move from bottom left to top right in the Wave space.

There is only one challenger – GigaSpaces – and it’s on the boundary between Challengers and Contenders. There are five Contenders: Cockroach Labs, GridGain, DataStax, Aerospike and another boundary sitter, PingCAP. We have four Strong Performers, whose names may be more familiar: SingleStore, Couchbase, IBM and Redis.

Five vendors are in the Leaders section: Microsoft, InterSystems, MongoDB, SAP and the runaway number one, Oracle.

Then the report lists each vendor in turn, discussing their strengths and weaknesses. The leaders’ highlights start with Oracle, which has strong translytical capabilities in architecture, fault tolerance, multi-model, data modeling, transactions, analytics, access control, data protection, and performance. It has challenges relating to its ability to scale dynamically, the need for advanced database administration skills, and high initial cost. It also needs to improve its support for streaming, search, and developer tools.

SAP is strong in data modeling, streaming, and a broad set of translytical use cases, but it lags in administration automation, high-end scale, and availability of translytical consultants.

MongoDB has strengths in multi-model, data modeling, streaming, fault tolerance, dev tools and APIs, and a broad set of use cases. Three possible weaker areas are extensibility, handling a high volume of data and ultra-low latency.

InterSystems IRIS’s comprehensive translytical capabilities are proven at a massive scale, and its integrated development environment shines. The challenges are workload management, partnerships, innovation, maintaining an edge in a crowded marketplace and staying at the top vs competition.

Microsoft’s strengths are in multi-model, transactions, analytics, dev tools and APIs, and extensibility. There are concerns about latency.

For the Strong Performers the report singles out:

- Redis is beloved by developers worldwide but must boost analytics capabilities;

- IBM has exceptional translytical capabilities but lags in platform automation tools;

- Couchbase offers strong capabilities but needs to work on analytics and insights;

- SingleStore is architected for translytical prowess but needs more tooling;

- PingCAP is MySQL-compatible and cloud-native but lags enterprise capabilities.

Interested parties can find out more about the translytical market landscape in another Forrester document – “The Translytical Data Platforms Landscape, Q3 2022” – which looks at 21 suppliers. You can purchase that here.