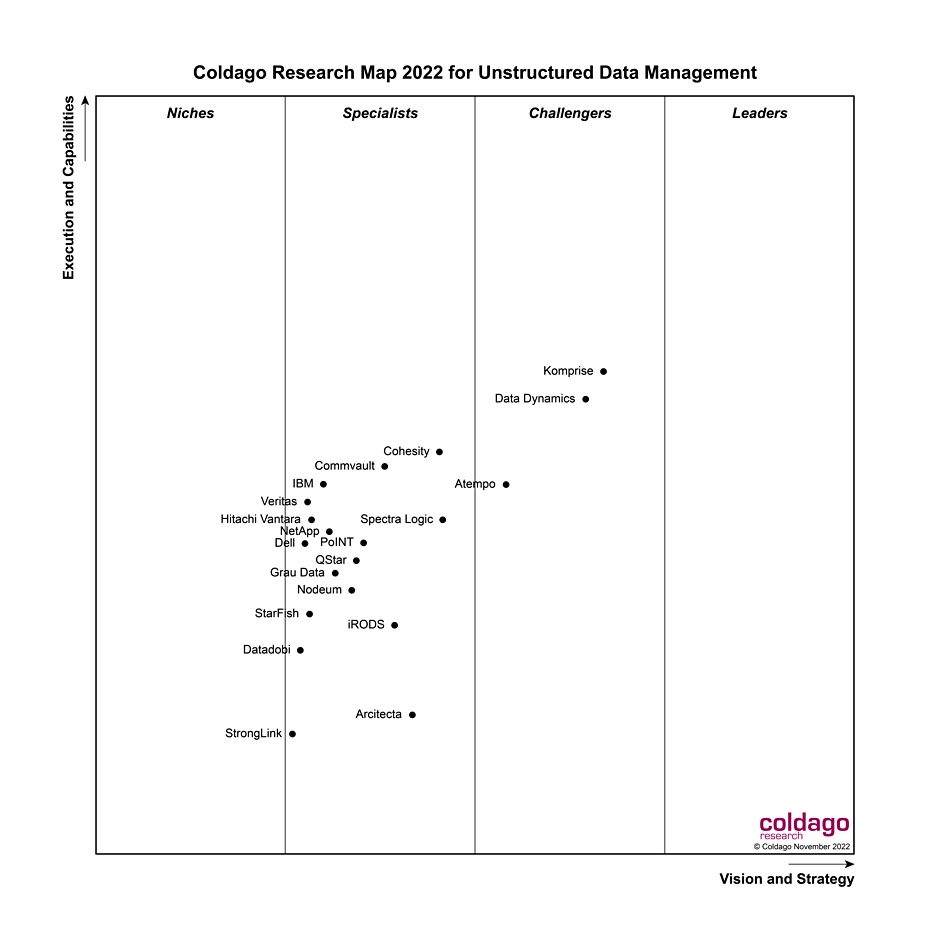

Research house Coldago has released a Research Map 2022 for Unstructured Data Management listing 20 vendors with Komprise, Data Dynamics, and Atempo ranked highest.

There are four supplier groupings: Leaders, Challengers, Specialists, and Niche players. They are placed in a 2D space defined by an Execution and Capabilities vertical axis, and Vision and Strategy horizontal axis similar to Gartner’s Magic Quadrant. The overall map space is divided vertically into four segments, one for each of the groupings above. Vendors placed higher and to the right are rated most highly.

Companies listed in alphabetic order are Arcitecta, Atempo, Cohesity, Commvault, Data Dynamics, Datadobi, Dell, Grau Data, Hitachi Vantara, IBM, iRODS, Komprise, NetApp, Nodeum, PoINT Software & Systems, QStar, Spectra Logic, StarFish, StrongLink and Veritas. Here’s the chart:

There are some surprises looking at the chart and the vendor list. There are no leaders, for example, and 16 of the vendors are grouped in the Specialists’ section.

We asked Coldago lead analyst Philippe Nicolas some questions to find out more about the report.

Blocks and Files: How do you define unstructured data management?

Philippe Nicolas: Data management is a large topic with sometimes fuzzy boundaries and different definitions exist from vendor to vendor depending on their product capabilities or vertical targets. We consider for this report only unstructured data for open systems for enterprises around various solutions capabilities such as analytics, data movement, security, governance and compliance, product architecture and management, media, systems and devices support. Each of these topics having several sub-categories with more than 60 criteria in total. We exclude pure backup, archive or data access vendors and also ones with limited alignment with our criteria.

Blocks and Files: How were the suppliers measured?

Philippe Nicolas: Coldago has collected lots of data during the past 12 months meeting vendors, end-users and partners, scrutinizing products and companies announcements, case studies, reference architectures, solutions developments, integrations and partnerships. We also exchanged data with many of them then digested, segmented, grouped and normalized all this data to make comparison and ranking easier. The 12 months period is important but a company with a new product announced, let’s say in April, could be included but not with this recent product, a minimum maturity and market adoption are required.

As a general rule, we don’t compare products but analyze companies playing in a domain with at least one product. It means that a vendor is studied in a multi-dimension approach considering its company profile, business and strategy, and of course products, solutions and technologies, being an important part but just a part of it. So clearly the report is not a product comparison, it ranks companies in a specific segment. Having said that, too many point products also creates confusion and complexity, a company with one product for analytics, one for data movement, one for compliance, a partner component to support special devices… is clearly negatively impacted.

We also consider partnerships, OEM and reseller agreements but listed companies must own their products and technologies and control associated developments. These partnerships feed the original vendor position and at the same time reduce the position of the distributor of the solution that implicitly recognizes its lack in the area.

They can leverage open source components of course. We also have decided to include open source solutions based on their impact on the market for several years; this is the case for iRODS from Renci for instance.

Blocks and Files: Is this the first Coldago Unstructured Data Management report?

Philippe Nicolas: Yes, this report is the first one, even though we have monitored this domain for many, many years, having collecting data for a long time. It complements the two other reports, File Storage and Object Storage, we have published for a few years. An updated version of these two will be released in the coming weeks with some interesting new models.

Blocks and Files: How do you define the four categories of suppliers?

Philippe Nicolas: [The] leaders part represents world champions with their status based on their installed base, technology reality and directions, market vision and business strategy. We didn’t find any leader in unstructured data management, nobody dominates the segment.

The Challengers group comes after the Leaders with companies having less visibility, reduced adoption and execution capabilities, but with the goal to become more global and adopted and then move to the Leaders section.

The Specialists list is used for companies with specific solutions but limited market adoption, often dedicated to a few verticals. As they become more global in terms of product coverage and companies operations and execution, the goal of these players is to move to the challengers part.

The Niches area is reserved for recent vendors or very small ones with an attractive product but limited skills, vision, resources, adoption and execution capabilities.

And just a last remark, being a specialist is very good, especially for users that can consider these vendors in their vertical, industry or specific needs.

Blocks and Files: Why is Quantum not included?

Philippe Nicolas: Oh very easy, I was intrigued by Quantum in this area so I sent them a full matrix to fill and they chose to answer with ActiveScale only, their object storage platform. I was surprised, and I’m sure you’re too, so I replied that considering their answer with this product, Quantum can’t participate as ActiveScale is a target device. Quantum will be listed of course in the object storage report with that product.

Blocks and Files: Arcitecta is included but not Hammerspace. How does Hammerspace fail to meet the report’s criteria for unstructured data management?

Philippe Nicolas: Hammerspace will appear in a few days in the Cloud File Storage Map but we consider, based on their positioning in the last 12 months around file access, and even performance, that they can’t be included in this report. They did a brilliant job promoting their new positioning. It may change in the next one but it’ll really depend on their next 12 months. Again we rank companies, not product, and we watch corporate news and events, business and strategy, products, solutions and technologies. At the same time, you can easily imagine that some other vendors could disappear from this report next year.

Bootnote

The report sections are: Introduction, Market, Products and Technology Trends, List of Vendors and Products, The Coldago Index, The Coldago Map, Vendors’ Details, Future Directions, Criteria and Methodologies, Vendors to watch, added and dropped, Map Definition and, finally the Conclusion.

To find out more and to purchase a copy send a message to reports@coldago.com.