Data processing unit startup Fungible is facing increasing competition as its avenues for growth become restricted and ever more fiercely contested.

The company was founded in 2015 to develop and build data processing unit (DPU) chips, which would offload intrasystem storage, network and security processing in large-scale datacenters from server x86 CPUs. DPU chips can process the instructions in these tasks more efficiently than general-purpose x86 CPUs. Offloading such east-west traffic and processing loads would enable x86 processors to do more application processing and save costs in datacenters with hundreds or thousands of such servers.

However, seven years later, and three years after its last funding round, it faces five strong competitors – AMD, Intel, Kalray, Marvell and Nvidia – and has yet to announce any major customers or OEM deals.

Founders Pradeep Sindhu and Bertrand Serlet both have illustrious tech backgrounds. Sindhu was the founding CEO and chairman of Juniper Networks, then vice chairman, CTO, and chief scientist, leaving to startup Fungible. Serlet was SVP of Software Engineering at Apple, after which he founded consumer cloud storage business Upthere, which was bought by Western Digital in 2017. Prior to that he was SVP of Software Engineering at Apple, a software engineering director at Steve Jobs’ NeXT before that, and a one-time researcher at Xerox PARC where he overlapped with Sindhu, another PARC alumnus.

Fungible raised $32.5 million in an A-round in 2017 followed by $60 million in a B-round the same year. Then it took in a further $200 million in 2019.

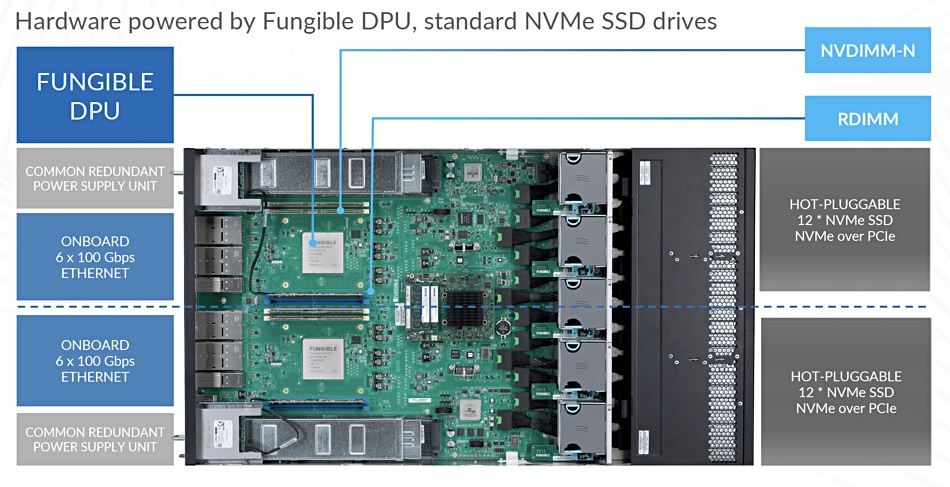

It developed two impressive DPU chips: the device front-end F1 for storage, analytics, AI server or security appliance use, and the server-based S1 for bare-metal server virtualization, node security, storage initiator, local instance storage and network function virtualization (NFV).

Two F1s are used in Fungible’s FS1600 scale-out disaggregated storage node with storage accesses coming in across an NVMe over TCP interconnect.

Acquisition and composability

Fungible bought the assets of composability software developer Cloudistics in September 2020. This became part of Fungible’s Data Center Composer, a centralized software suite that enables bare-metal composition, provisioning, management and orchestration of infrastructure at all scales.

At the time Sindhu said: “We are doubling down on our vision of revolutionizing datacenter infrastructure at all scales. We see progress towards this grand vision in two parts. The first, which we’ve already achieved, is to develop a new class of microprocessors called the Fungible DPU that promises to provide significant improvements in infrastructure performance, economics, security and reliability.”

“The second, equally important part is to build software that dynamically composes disaggregated DPU-powered servers into one or more computational clusters, each designed to run a specific workload. With these two parts working together synergistically we are taking a leap forward toward the holy grail of providing high performance and high agility in datacenters.”

That holy grail proved unreachable.

Eric Hayes was hired as CEO in July last year. The company has built up a sales channel with a global program launch in April this year, and has partners in Asia.

Also in April it launched Fungible GPU-Connect (FGC), a technology to link pools of GPUs to servers across a virtual PCIe network running on Ethernet, and managed by its DPU hardware. Service provider customers could compose (provision, allocate, deploy and manage) GPU resources to servers on demand. There was no partnership with any GPU vendor announced, and Nvidia had its own competing GPUDirect technology.

In August, the Hayes-led Fungible laid off staff and scaled its composable systems ambitions back to concentrate on its storage cluster technology. It said the pivot was required as the composability market’s development was slow, partly due to an absence of standards.

At the time it said: “Two years ago, Fungible decided to augment its DPU portfolio with higher-level composability software solutions through acquisition and organic development. Despite our best efforts, Fungible was unable to realize traction in the orchestration space compared to the success it has experienced with its DPU-based storage technology.”

Entrenched DPU player competition

The main players in the DPU market are AWS, with its in-house Nitro tech; Intel with its IPU sold to hyperscalers; AMD, which bought DPU chip startup Pensando; Nvidia with its in-house BlueField tech, which it claims is faster than Fungible; newcomer Kalray with its MPPA tech; and Marvel with its Octeon 10 product.

Nvidia has a strong partnership with VMware, Kalray has announced a big OEM deal, while AMD, Intel and Marvell are companies with strong channels through which they can pump product. All this limits Fungible’s DPU market. For example, VAST Data has chosen Nvidia’s BlueField DPU for its Ceres storage enclosures; that’s one potential OEM gone. Dell is buddying up with VMware and Nvidia for VxRail systems; that’s another door closing.

AMD’s Pensando DPU is available from the top server OEM’s factories: Dell’s VxRail HCI DPU-powered system and PowerEdge servers, and HPE’s ProLiant. Chris Ratcliffe, Networking Solutions Group marketing lead at AMD, said: “That means we’re good for a diverse set of enterprise and CSP/SP workloads.”

The composable systems market is fast developing and settling around CXL as the standard but this requires a new generation of servers using AMD’s Genoa and Intel’s Sapphire Rapids processors. It also needs CXL end-point hardware and system software, neither of which is a Fungible core competency. That helps explain Fungible’s pivot away from composability.

The storage market for shared NVMe SSD chassis is hotly contested, with Dell, HPE, IBM, NetApp, Pure Storage, and VAST Data present – all well-funded and delivering products to the market. Like Lightbits, Fungible focused on NVMe over TCP, seeing it as the logical upgrade to iSCSI SANs, but the mainstream suppliers support NVMe/TCP as well. Increased array speed and lower-latency becomes a relatively small benefit in the overall scheme of things when set against mainstream suppliers’ sales channel strength and customer loyalty.

The funding door for storage tech startups has also been closing unless they are concerned with data analytics software, think Alation ($123 million) or key:value SSDs, think Pliops ($100 million), but Fungible competitor Lightbits swam against this tide by raising $42 million in June, as did edge HCI player Scale Computing, which took in $55 million in July.

We understand from sources that Fungible tried to raise more money but could not do so. Some more people were let go and now the executives, board and investors face the quandary of how to sustain the company’s growth and future in a market with strongly entrenched competitors. We have even begun to hear unconfirmed rumors of it being acquired.

Asked about this, Fungible VP for marketing Jennifer Bell said: “Fungible remains committed to its clients and partners and does not comment or speculate on acquisition rumors.”