The good ship Backblaze, loaded with cloud and backup storage, grew revenues 27 percent year on year in the third 2023 quarter, beating expectations, but more than doubled its loss, as customer demand stayed strong in the current unfavorable economic climate.

Backblaze builds its own storage enclosures, called Pods, and over the years has expanded from storing customers’ backups to providing general cloud storage in its datacenters. It also provides a popular service to disk drive buyers, its quarterly disk drive reliability statistics, detailing per-model failure rates as drives age.

A couple of weeks ago it said its third quarter revenues would likely be larger than the second quarter guidance of $21.4 million to $21.8 million. And so it has turned out.

CEO and co-founder Glen Budman’s results statement said: “As highlighted in our October 24, 2022 preliminary results, we had a strong Q3. We had 48 percent revenue growth in B2 Cloud Storage, and total company revenue grew 27 percent. We also made significant progress in our channel program, including the launch of our channel partner portal and signing of several new national resellers. We are pleased to continue to scale in an uneven macro-economic environment.”

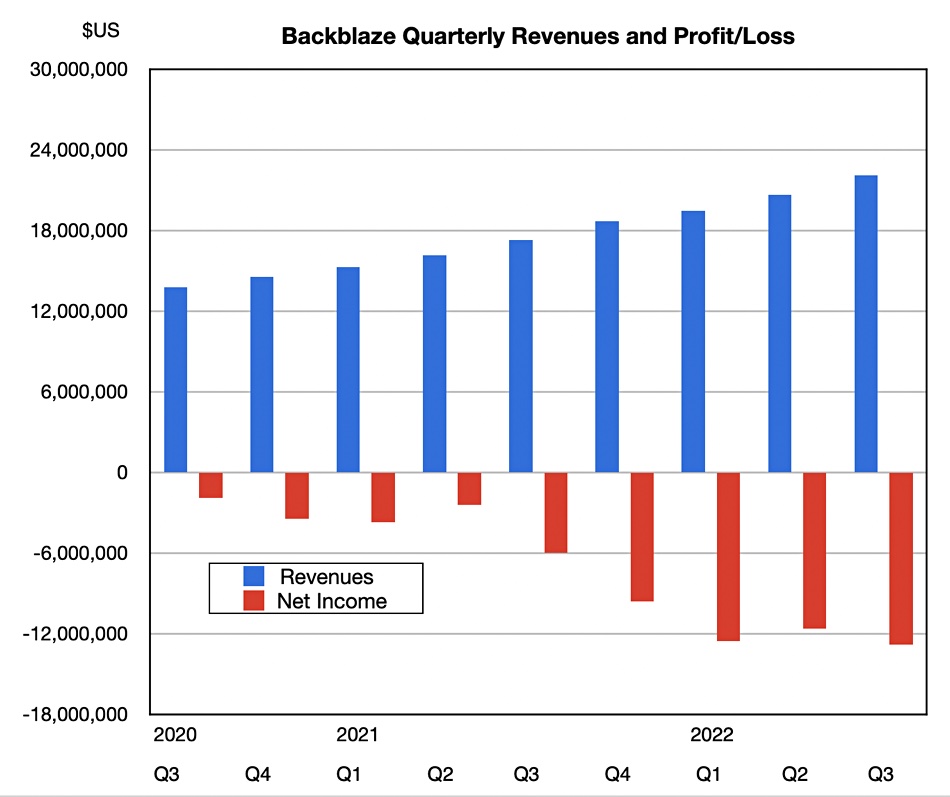

Revenues in the quarter ended September 30 were $22.1 million, with a loss of $12.8 million, compared to the year-ago loss of $5.99 million. However the loss rate has been stable over the last three quarters, hovering between $11.6 million and $12.8 million.

Backblaze had $27.5 million in cash and restricted cash at the end of the quarter. Balance sheet cash, investments and restricted cash is much higher: $80 million. The adjusted gross margin was 76 percent.

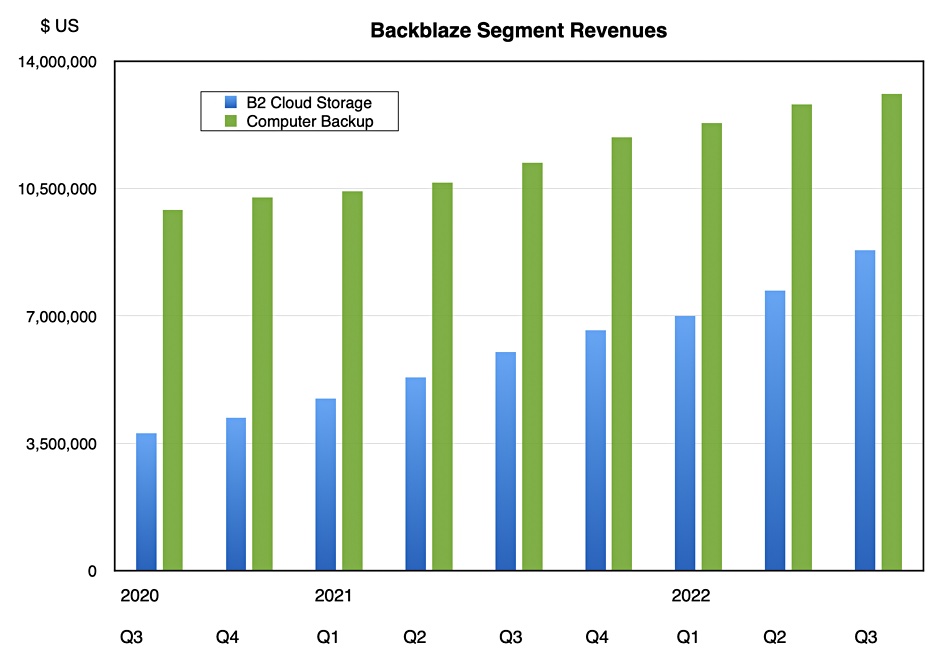

The computer backup business segment pulled in $13.1 million, up 17 percent year-on-year, while cloud storage grew much faster, increasing 48 percent to $8.8 million. A chart shows the cloud storage trend of catching up with backup storage:

Cloud storage now represents 40 percent of Backblaze revenues. Third quarter annual recurring revenue (ARR) was $88.0 million, up 24 percent. The net revenue retention rate (NRR) was 114 percent, as opposed to 110 percent a year ago.

William Blair analyst Jason Ader commented: “Though B2 is positioned well as a low-cost cloud storage alternative (priced at 1/5 the cost of AWS’s S3), Backblaze’s high exposure to SMBs means it could see demand headwinds in an increasingly tougher macro environment. That said, we continue to like the Backblaze story for its large opportunity in providing cloud storage to the underserved midmarket, with the company intently focused on driving greater selling leverage through channel partners.”

The outlook for the fourth quarter is for revenues between $22.5 million and $22.9 million, $22.7 million at the mid-point, which would represent a 21.4 percent on the year-ago $18.7 million, and make for an $84.99 million revenue total for the full year. That would be a 26 percent year-on-year increase. It’s all steady steady growth with no drama and no upsets. Somebody could snap this business up; it’s a great little earner.