The Biden administration has initiated new technology export controls, which may well cripple China’s domestic NAND producer YMTC.

China’s NAND and DRAM production and development are being targeted as part of US initiatives to prevent China gaining military dominance. The US sees China’s military and civilian technology developments as inextricably intertwined and aims to restrict China’s overall technology capabilities where these are based on US knowledge and resources.

The new regulations

Semiconductor industry analyst Dylan Patel wrote: “The US government levied new export regulations and restrictions against China that amount to a full-scale bilateral economic cold war.”

There are two sets of regulations. The first, by the US Bureau of Industry and Security (BIS) in the Department of Commerce, adds additional export controls on “Certain Advanced Computing and Semiconductor Manufacturing Items; Supercomputer and Semiconductor End Use.” It “expands the scope of foreign-produced items subject to license requirements for twenty-eight existing entities on the Entity List that are located in China. BIS is also informing the public that specific activities of ‘US persons’ that ‘support’ the ‘development’ or ‘production’ of certain ICs in the PRC require a license.”

The second set adds “31 persons to the Unverified List (UVL)” where “persons” means a company in China, and number 31 on the list is Yangtze Memory Technologies Co. Ltd. (YMTC). Entities on this list are regarded as being “at significant risk of being or becoming involved in activities contrary to the national security or foreign policy interests of the United States.” Companies on the list are moved to the full Entity List in 60 days unless they pass US end user checks, such as not supplying Chinese military organizations.

Patel thinks the US government wants to prevent China becoming an equal in semiconductor manufacturing. Unless the entities on the UVL can satisfy BIS that they do not pose a risk to US interests, they will transition to the full-scale Entity List on November 7 and then US technology cannot be exported to them unless permitted by a license. The granting of such licenses will face a presumption-of-denial barrier.

The new regulations prohibit export of equipment for making 128-layers or greater 3D NAND more, and DRAM with 18nm half-pitch or less.

Strangling China’s tech development

Gregory Allen, Director and Senior Fellow at CSIS (Center for Strategic and International Studies), looked at the latest regulations and identified four technology chokepoints: AI chip design, electronic design automation software, semiconductor manufacturing equipment, and equipment components. He says: :The Biden administration’s latest actions … demonstrate an unprecedented degree of US government intervention to not only preserve chokepoint control but also begin a new US policy of actively strangling large segments of the Chinese technology industry – strangling with an intent to kill.”

In his view the Biden administration is trying to:

- Strangle the Chinese AI industry by choking off access to high-end AI chips;

- Block China from designing AI chips domestically by choking off China’s access to US-made chip design software;

- Block China from manufacturing advanced chips by choking off access to US-built semiconductor manufacturing equipment;

- Block China from domestically producing semiconductor manufacturing equipment by choking off access to US-built components.

Allen writes: “The US government is attempting to put YMTC’s most advanced NAND production facilities out of business.” In general: “These new restrictions represent a devastating blow for the makers of advanced chips in China.”

But Chinese suppliers have “been purchasing equipment at a pace far in excess of expected market demand. In essence, China has been buying everything it can from the store before it closes. The full consequences of China’s equipment hoarding are not yet clear.”

He says there are three takeaways:

- The US does not want China to have advanced AI computing and supercomputing facilities, so it has blocked them from purchasing the best AI chips, which are all American.

- It does not want China designing its own AI chips, so it has blocked China from using the best chip design software (which is all American) to design high-end chips, and it has blocked chip fabs outside China from accepting entity-listed Chinese chip design firms and chip companies as customers.

- The US has blocked China from buying American advanced chip manufacturing equipment.

Also: “The new export controls not only block the sales of the items but also effectively prohibit US individuals and corporations from facilitating such exports or transferring any relevant technological know-how.”

YMTC fabs could be crippled

The new regulations mean that US citizens currently embedded in Chinese companies on the Entity List must stop working for them. The result is that US employees are quitting Chinese companies on the list.

This is affecting China’s domestic NAND producer YMTC. The company currently supplies about five percent of the NAND chip market but has announced leading-edge technology like XTacking gen 3, which is being used to develop 232-layer 3D NAND – the highest-density NAND in the industry.

YMTC has a single fab but is building a second one. It has also been buying and stockpiling foreign-made equipment to thwart US restrictions. This effort and YMTC’s NAND development generally could be strangled by the latest US actions.

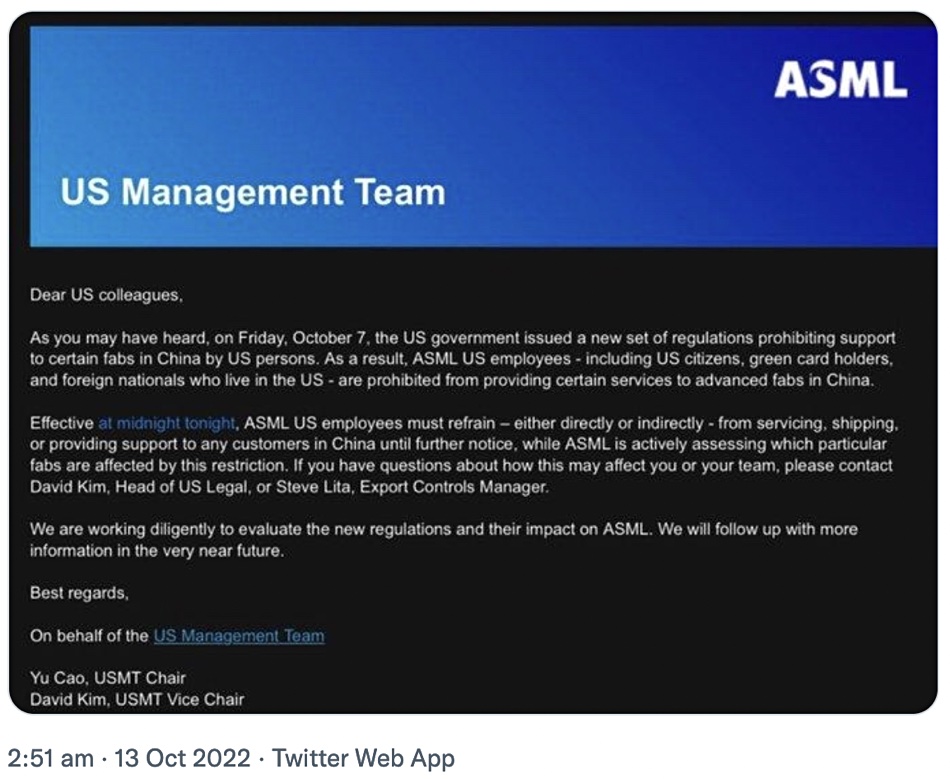

Bloomberg reported that Dutch photolithography equipment supplier ASML has banned its employees in the US from working with Chinese customers. ASML is the largest supplier of semiconductor photolithography systems and the only supplier of EUV (extreme ultraviolet lithography) equipment, which is needed for the latest generations of semiconductor chips. YMTC is an ASML customer.

ASML says the Biden administration restrictions could cost it $550 million in lost sales.

Digitimes reported that Applied Materials, LSM Research, and KLA are withdrawing their engineers and other staff from Chinese semiconductor plants, such as those operated by YMTC. There is more about this here.

This means that YMTC will receive no help from these suppliers in installing, supporting, and servicing the equipment it has bought from them. Failed components will only be able to be replaced by cannibalizing other machines.

Japan’s Nikkei media outlet reported that Apple has rowed back on its planned use of YMTC NAND in iPhone products sold in China.

YMTC could also be added to the Entity List in two months’ time and then become a pariah for shippers of US-based technology – just like Huawei.

Several non-Chinese semiconductor suppliers have fabs in China as part of their global supply chains – for example, Korea’s SK hynix (DRAM at Wuxi fab) and Solidigm subsidiary (NAND at Dalian fab), Samsung, Taiwan’s TSMC, and Intel. These fabs would have been crippled by the new regulations. However, temporary licenses are being granted.

An SK hynix statement said: “Our discussions with the Department of Commerce led to an approval to supply equipment and items needed for development and production of DRAM semiconductors in Chinese facilities without additional licensing requirements.” The approval lasts for 12 months.

Externally owned fabs in China

The FT reports that TSMC has been given a 12-month authorization for its fab in Nanjing and the WSJ says Samsung has a similar 12-month license.

Seagate has a disk drive manufacturing plant at Wuxi in China’s Jiangsu province, which employs around 6,000 people. Toshiba is planning to make disk drives at a TDK plant in China’s Guangdong province. Disk drive read/write heads use semiconductor devices and these appear not to be specifically mentioned in the latest BIS regulations. We have asked Seagate whether it will be affected by the latest regulations, but not yet received a response.

TrendForce says: “The [NAND] ban may greatly limit non-Chinese customers’ adoption and consideration of YMTC products, and impact Samsung’s Xi’an plant and Solidigm’s process migration plan in Dalian.”