Privately owned ExaGrid has reported a double-digit growth quarter with its customer count passing 3,600.

This purpose-built backup appliance (PBBA) maker was launched 20 years ago and has raised a total of $107 million in funding, with the last round bringing $10.6 million in 2011. It has been effectively self-funding since then and is cash-positive.

ExaGrid president and CEO Bill Andrews claimed: “ExaGrid’s continued momentum results from a highly differentiated product with a 75 percent competitive win rate and the ongoing expansion of our sales team and working with our channel partners across the globe.”

It competes with Dell’s PowerProtect, Quantum’s DXi, and HPE’s StoreOnce. It deduplicates incoming backup data but does so globally across a set of customer’s appliances, unlike PowerProtect, which deduplicates on a per-box basis. ExaGrid also takes in fresh backup data and stores it in undeduplicated form in a so-called Landing Zone. This is both to speed ingest and to have faster restore for the most recent backups as no rehydration is required.

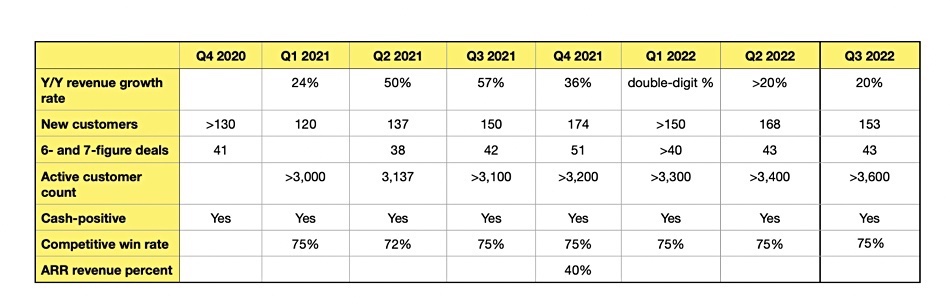

ExaGrid told us it grew 20 percent year-on-year in calendar Q3 quarter and gained 153 new customers. Among these were 43 contracts signed that are worth six or seven figures in revenue terms. We have tabulated the numbers from two years’ worth of these releases about its momentum to show the overall picture:

Andrews claimed: “ExaGrid has the best cost up front and over time, the fastest backup and restore performance, the ability to recover from a natural or man-made site disaster, and the ability to recover data after a ransomware attack, which remains top of mind in today’s world.”

The mainstream PBBA market is mature and stable. General development of the technology is incremental at the component level with no major architectural advances; it is basically about upgrading to larger capacity disk drives during refresh cycles and bumping up the controller CPU power and DRAM.

ExaGrid’s sales pitch centres on the landing zone, fast restore, scale-out characteristics, and global dedupe.

There is a developing high-end PBBA market with all-flash or memory-cached systems providing a new ultra-fast restore technology niche. Think of Pure’s pioneering FlashBlade, VAST Data’s Universal Storage system, StorONE, and the memory-cached InfiniGuard system from Infinidat. There is no general sign yet that this more expensive architecture has any appeal to the mainstream PBBA market inhabited by ExaGrid, Dell, HPE, and Quantum.

We think that in the next couple of years we will see the mainstream PBBA suppliers start to adopt SSDs in response to Pure and its followers. PLC (5bits/cell) flash could spur this if it is used in SSDs. If we envisage a PowerProtect system using SSDs for some or all of its storage, its ingest and restore speed could match or beat ExaGrid, particularly if NVMe SSDs are used. That could drive ExaGrid to respond in kind.