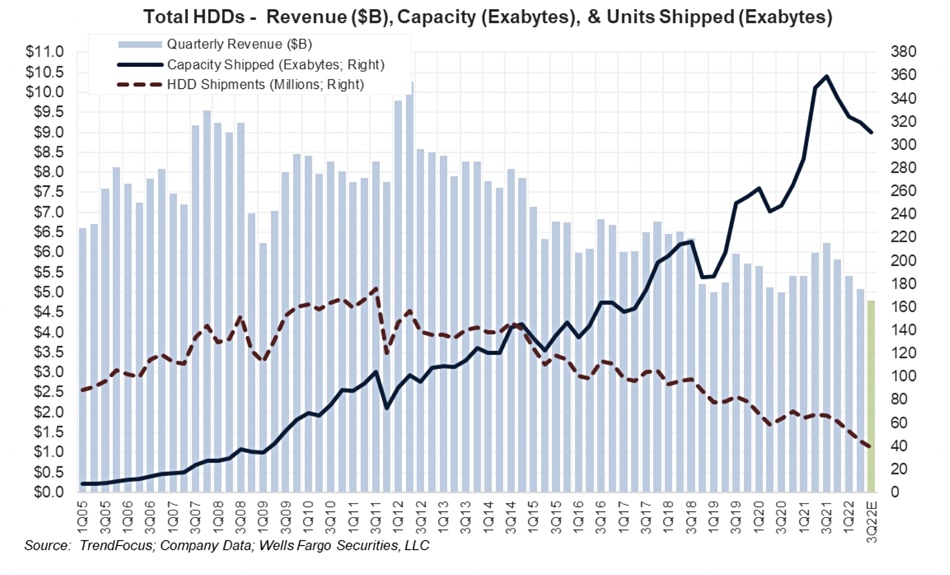

TrendFocus is expecting around 39 million disk drives to be shipped in calendar Q3, down 42 percent on the same period a year ago and 14 percent lower than the prior quarter.

The cause of the drop is weaker demand from cloud providers, inflation, the conflict between Ukraine and Russia war, and supply chain difficulties, says TrendFocus.

One area bucking the trend is nearline (high-capacity) disk drives where capacity is forecast to be flat as fewer high-cap drive shipments are offset by increased capacity per drive.

According to Wells Fargo analyst Aaon Rakers, TrendFocus estimates that planned HDD unit volumes in for Q3 and Q4 will be in the region of 35 million, which compares to the Q2’s 44.7 million and Q1’s 52.8 million. Total 2022 disk drive unit ships could be 170 million, equating to a 34 percent decline on 2021.

TrendForce thinks that demand will start to rise in Q2 of 2023 as cloud buyers use existing inventories, however that is subject to imporvements in the overall economy. The analyst also thinks per-drive capacity increases will come from adding platters, with 11-platter nearline drives using the existing 10-platter drives’ 0.5mm thick aluminum-based substrates.

A 10-platter conventionally recorded 20TB drive would then become an 11-platter 22TB drive, and a 22TB shingled would transition to a 24.2TB drive.

TrendFocus says thinner platters would enable 12-platter drives to be built. How this would play out with high-capacity recording methods such as Western Digital and Toshiba’s MAMR and Seagate’s HAMR is an interesting question. It could mean that less aggressive MAMR/HAMR technology would be needed to reach a capacity point such as 30TB.

A 12-platter version of an existing 10-platter 20TB drive would reach 24TB, leaving 6TB to be made up by MAMR or HAMR tech.

The research group suggests Seagate may need to improve HAMR disk drive production quality to reduce scrap rates and increase profitability.