TrendFocus data for calendar Q3 disk drive shipments show that about a fifth fewer drives were shipped than a year ago as big cloud buyers moved to 18TB drives.

The industry’s three suppliers shipped around 38.6 million drives, according to TrendFocus’ preliminary estimates for the quarter, which would be 42 percent fewer units than a year ago and down 14 percent on the previous quarter.

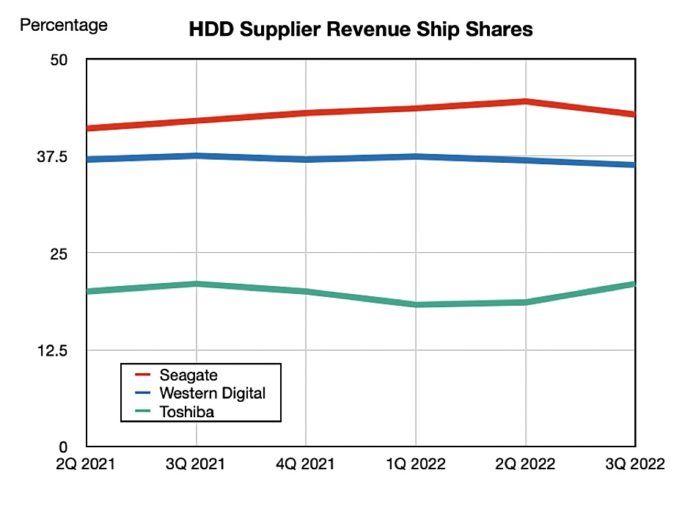

TrendFocus splits the data into nearline (high-capacity 3.5-inch) drives, mission-critical (10K 2.5-inch), client PC and consumer electronics (retail) shipments. Nearline drives represent 80 percent of the total drives shipped and 71 percent to HDD industry revenue. Wells Fargo Analyst Aaron Rakers tracks this and his chart shows the inexorable rise of the nearline disk drive category;

A plateau effect can be seen in the capacity shipped from 2021’s Q2 onwards. Large scale buyers of high-cap disk drives buy capacity rather than units and higher capacity drives will lead to fewer units shipped unless overall capacity demand rises faster than per-drive capacity.

That has not been happening recently and Rakers said TrendFocus: “noted a strong positive mix shift with cloud companies moving to >18TB along, [which] with lower mid-capacity model shipments to OEMs resulted in ~250EB of capacity shipped or down ~2 percent y/y and q/q.”

There were some 2 million mission-critical drives shipped in the quarter; down 46 percent annually, although up 27 percent on a quarter-on-quarter comparison. Shipments in the 2.5-inch mobile and CE markets of 8.5-9 million also declined on a quarterly basis by 10-15 percent, the same percentage fall as 3.5-inch desktop PC and CE shipments of 12.5 million.

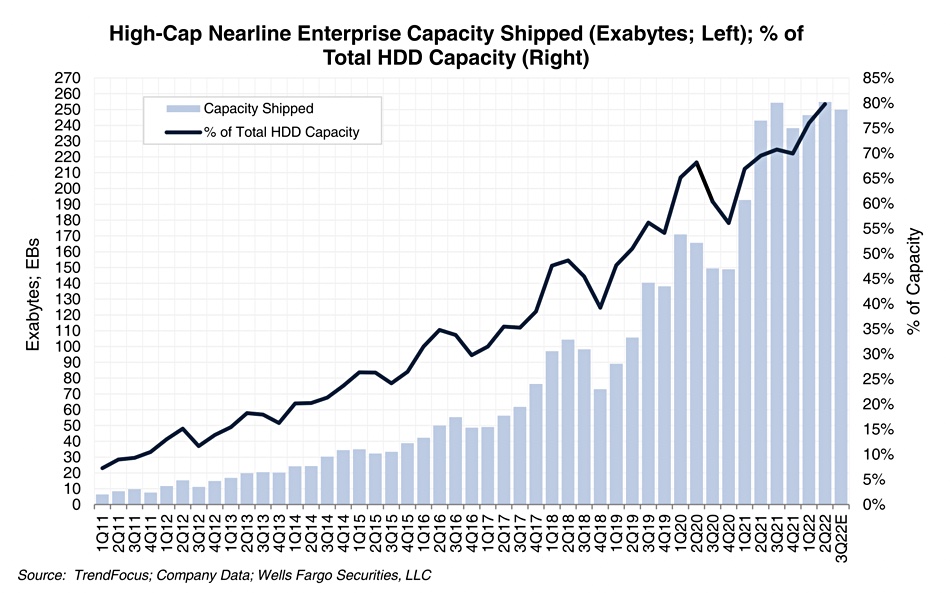

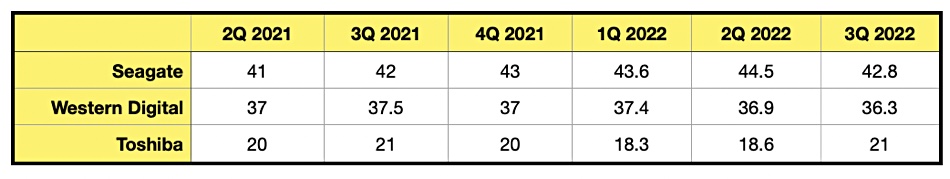

We’ve tabulated and charted supplier shipment shares;

Toshiba’s curve has turned up while both Seagate and WD have turned down.

The biggest threat to the HDD industry is that pentalevel cell (PLC) NAND – with 5 bits per cell – could be cheap enough with high-enough endurance to start replacing nearline drives used for backup and archiving. At the moment SSDs have a near 5x price premium per TB compared to disk drives – see this Gartner chart – and PLC SSDs are still in the future with their properties unknown.