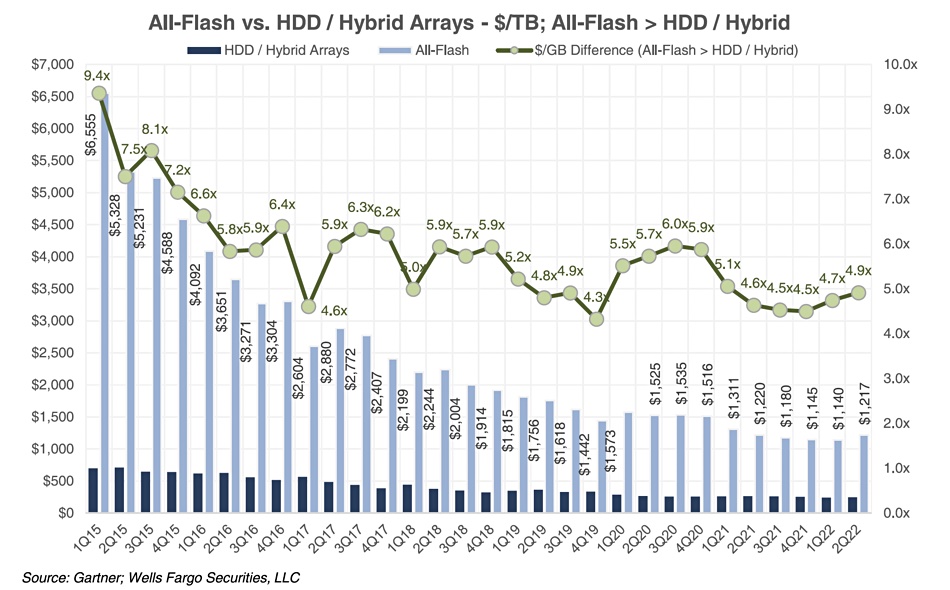

According to Gartner, all-flash-array revenues will pass disk drive and hybrid array revenue next year and grow to 55 percent of all external storage revenues in 2026.

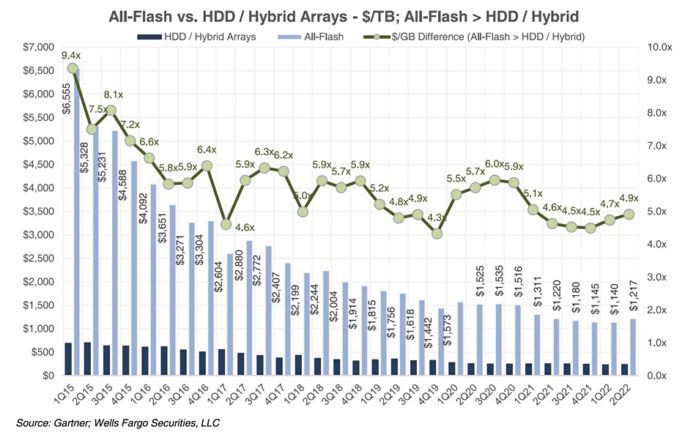

The research house has just issued its external storage report for the second 2022 quarter to subscribers, and we have seen a Wells Fargo summary. It gives all-flash arrays, which it terms solid state arrays (SSA), a 4.9x price premium over HDD/hybrid arrays in $/GB terms, with AFAs at $1.217 and HDD/hybrid at an implied $0.248 per GB:

The AFA vs HDD hybrid revenue crossover forecast shows HDD/hybrid array revenues leveling off at around $10.25 billion/year from this year with SSA revenues growing to the $12.25 billion area in 2026:

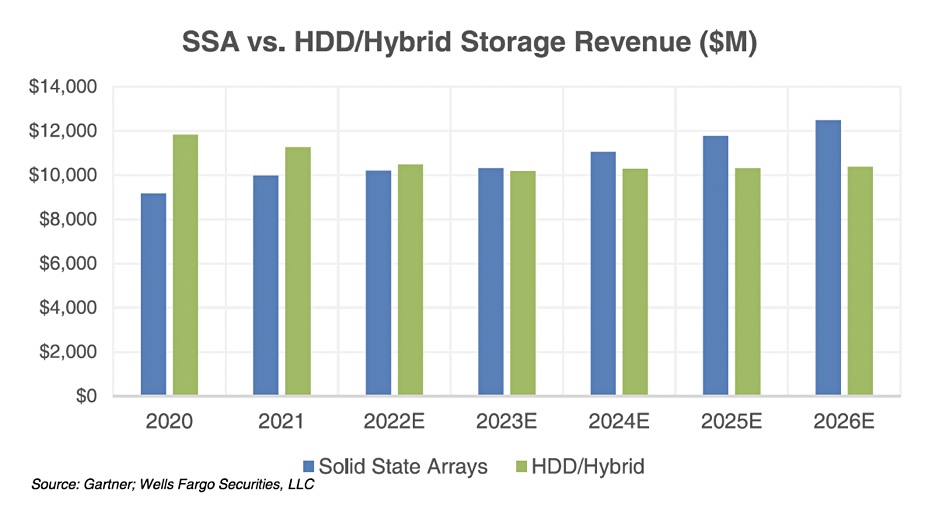

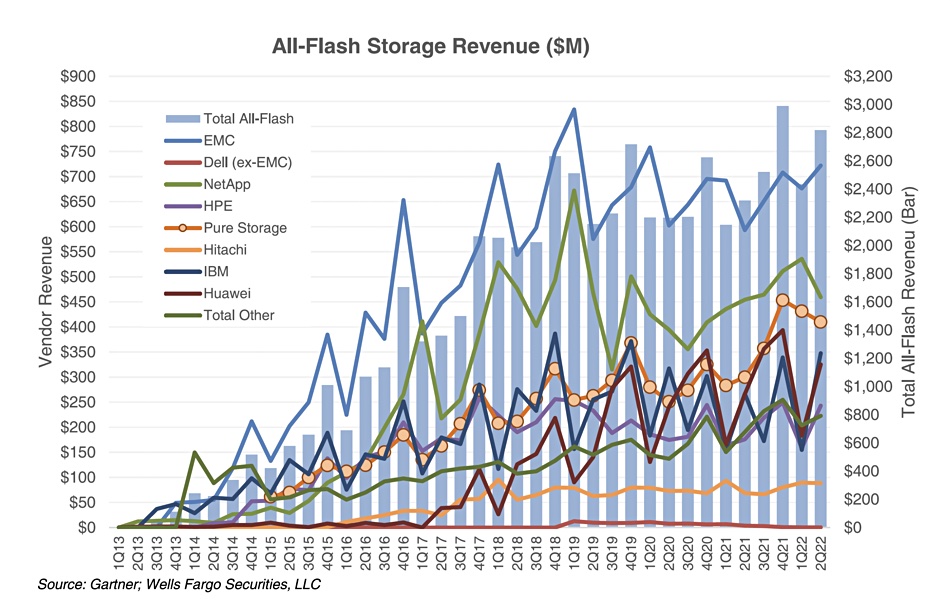

The Wells Fargo summary includes a chart showing suppliers’ all-flash storage revenues with Dell EMC first, NetApp in second place, and Pure Storage third for the calendar quarter. We’re told Pure’s revenues in the quarter (not Pure’s fiscal quarter) were $410 million and that was less than Dell’s high-end VMAX (now PowerMAX) SSA array revenues of $426 million, up 38 percent on the year; such is the revenue uplift power of a new IBM mainframe cycle. Pure’s Flash Array product line revenues rose 43 percent on the year, though.

IBM and Huawei are in fourth and fifth place, and HPE in sixth place with Hitachi bottom of the chart in seventh position. For historical reasons, Gartner separates out EMC from Dell when estimating all-flash revenues.

NetApp’s overall external storage revenues for the quarter were down 4 percent annually, with SSAs up 1 percent. Dell led the overall external storage market with $1.57 billion in revenues, up 14 percent annually.

Gartner estimated the external storage compound annual revenue growth rate to 2026 to be 1.5 percent. Within that, SSAs were growing 4.6 percent and HDD/hybrid arrays declining 1.6 percent. The analyst group cut the numbers another way, saying primary storage revenues would grow 0.2 percent while secondary storage revenues would rise 7.1 percent.