Seagate is lowering its sales guidance for the fiscal first quarter ending September 30 against a worsening macro-economic backdrop.

The disk drive manufacturer had expected (Q1 fy2023) revenues to be $2.5 billion give or take $150 million, but now expects the figure to be nearer to $2.1 billion, plus or minus $100 million. Its year-ago Q1 fy2022 revenues were $3.12 billion and the revised Q1 fy2023 number represents a 32.6 percent drop on this.

CEO Dave Mosley said in a statement: “Since our earnings call in mid-July, weaker economic trends in certain Asian regions have amplified customer inventory corrections and supply chain disruptions. We have also seen more cautious buying behavior among global Enterprise/OEM and certain US cloud customers amid ongoing macro-economic uncertainties. These external factors are impacting near-term mass capacity demand while continuing to weigh on the consumer centric legacy markets.”

The drive maker is cutting back expenses as a consequence, with Mosley adding: “As we operate under these dynamic market conditions, we continue to take proactive steps to minimize the impacts to the business. We are further reducing our production output, lowering expenses, and moderating fiscal 2023 capital investments. The combination of lower revenue, increased under-utilization charges and less favorable product mix in the September quarter will result in a sequential decline in margins, with non-GAAP EPS now expected to be meaningfully below our prior guidance of at least $1.20.”

He thinks this is a relatively short-term event. ”We continue to see solid demand for our 20+ terabyte product family and remain on-track for volume and revenue crossover with the 18-terabyte platform in the September quarter. The long-term demand drivers for mass capacity storage remain intact and Seagate’s strong product roadmap and deep customer relationships make us well positioned to capture these significant future growth opportunities.”

Seagate EVP & CFO Gianluca Romano spoke at an investor conference about this and Wells Fargo Aaron Rakers told subscribers: “Mr Romano highlighted weakening demand from both enterprise/OEM customers and consumer segments – key focus being on the company’s comments on a slowdown at ‘certain’ US cloud customers (our checks point to persisting/increasing supply chain challenges). In terms of Asia-Pac/China demand, Seagate is seeing ‘very slow’ demand – across all segments (consumer, client, VIA, & cloud), driven by lower-than-expected economic growth that is now trying to be addressed with certain stimulus efforts. Seagate believes this will rebound – eventually; no timing provided.”

In Europe, Seagate reports impact from the Russia-Ukraine war and overall macro difficulties, in addition to continued supply disruptions. It expects some resolution to this in the next few months.

The US situation features component challenges affecting client demand, and some impact in nearline cloud-driven demand, slowing deployment pace. It is seeing higher inventory levels at some customers.

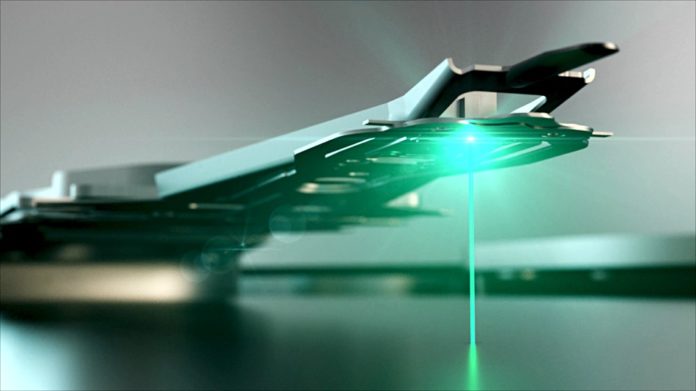

Romano said Seagate is still confident about its HAMR roadmap timing, with the volume ramp of their 30TB HAMR-based HDDs starting in mid-2023. It expects CMR and HAMR to co-exist going forward, but eventually moving to HAMR-based lower capacity drives. The company reiterated the HAMR ramp of moving from 30TB to 36TB to 40TB, etc.

Comment

We think that the other disk drive manufacturers, Toshiba and Western Digital, will be similarly affected and expect them to confirm as much quite soon. HPE has just reported flat results, with server sales down 3 percent. On the other hand, Pure Storage has just raised its full-year 2023 revenue growth outlook to 26 percent year-on-year from the previous 22 percent.