The entry of YMTC into the advanced NAND manufacturing sphere coincides with Samsung’s technology falling behind and turmoil at Kioxia and Western Digital with industry consolidation a distinct possibility – or so says semiconductor research and consulting firm SemiAnalysis.

Its report, titled “2022 NAND – Process Technology Comparison, China’s YMTC Shipping Densest NAND, Chips 4 Alliance, Long-term Financial Outlook”, notes that YMTC’s Xtacking 3.0 technology uses 232-layer 3D NAND technology, the highest-density NAND in the industry.

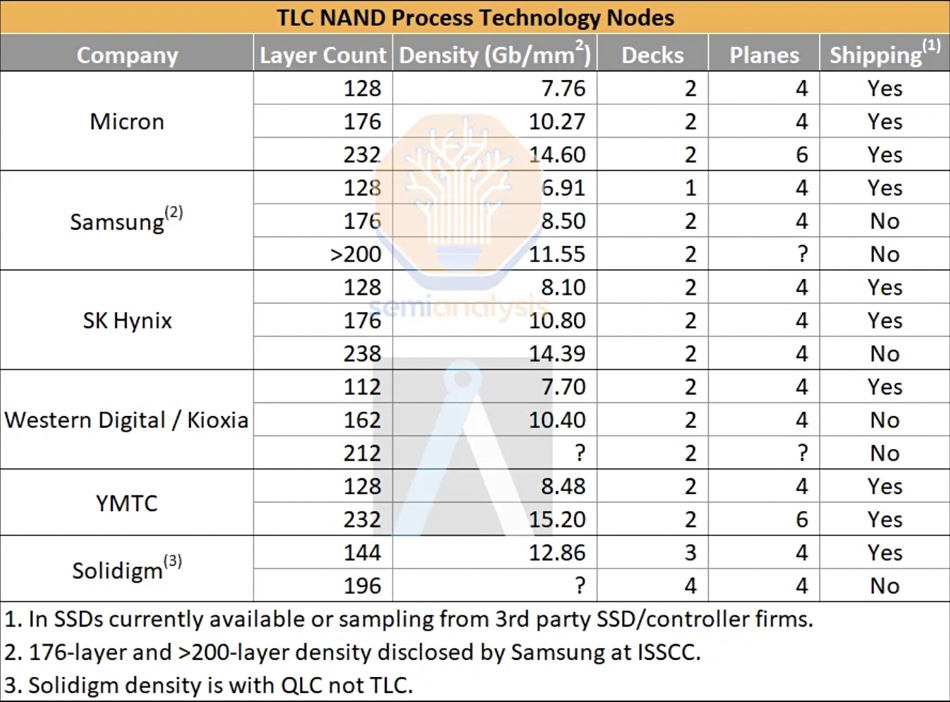

The report contains a table summarizing TLC NAND process technology at the foundry operators:

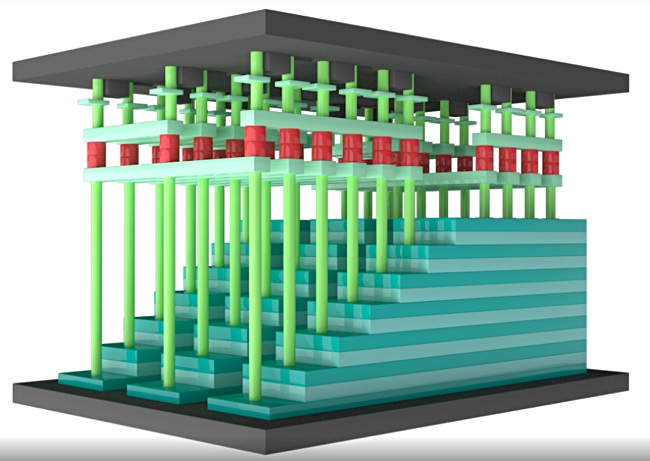

This shows that YMTC’s 232-layer NAND has a GB/mm2 density of 15.2, higher than the next best supplier, Micron, with its 14.6 GB/mm2. This is attributed to YMTC’s use of a separately fabricated CMOS controller die which is bonded to the string-stacked (two-decked) NAND die. This is the key architectural distinction of its Xtacking design.

Samsung has the lowest density at the >200-layer count, 11.55 GB/mm2, and both that and its earlier 176-layer technology are not shipping as products. SemiAnalysis claims Samsung has fallen behind the other suppliers due to cultural issues, such as a top-down management style.

China-based YMTC, sustained by massive state subsidies, is building a second fab. SemiAnalysis says more are coming: “The third fab is under construction. Funding for the fourth fab is allegedly under way with construction starting as early as the middle of next year. Each of YMTC’s fabs will have 100,000 wafers per month output.” We understand the second fab will have a 200,000 wafers per month output. Extend that to the third and fourth fabs and we’re looking at YMTC producing 700,000 NAND wafers per month.

At a minimum its NAND wafer output could be four times what it is now, 100,000/month, assuming yields are similar, its pricing will be helped by the state subsidies, and the report claims: “They will structurally change the NAND industry.”

How?

Kioxia and Western Digital

The report identifies Kioxia and Western Digital as two players potentially vulnerable to consolidation. Kioxia is owned by a Bain-led consortium, but with Toshiba having a 40 percent share. Toshiba is facing breakup pressure due to its under-performance with the board changing CEOs fairly frequently and negotiating with outside parties on a break-up strategy to increase shareholder value. Any such restructuring of Toshiba would put Kioxia under second-order pressure and its ownership vulnerable to change.

Kioxia and Western Digital are joint venture partners in Japan-based NAND foundries and WD is a natural potential owner of Kioxia through a takeover or merger. But Western Digital is facing breakup pressures of its own, with a separation between its hard disk drive and NAND/SSD divisions proposed by activist investor Elliott Management. Western Digital is currently examining such strategic options.

The report says that a corollary of YMTC’s entry as a larger NAND player will be that NAND prices fall and suppliers will need great market share to get fabrication scale and hence cost-efficiencies. Alternatively, they will need a financial cushion, such as a DRAM business, to absorb lower NAND profit margins – or losses. Neither Kioxia nor Micron have that, whereas Micron does.

SemiAnalysis says Western Digital is looking for buyers of its NAND business. Micron made a $12 billion offer which did not include Western Digital’s SSD operations, only its joint venture NAND fab and development assets. It also claims Micron had earlier approached Kioxia and Western Digital about partnering on NAND R&D to reduce costs.

Closer Micron and Western Digital alignment seems to be what the two are hinting at in their jointly produced Memory Center of Excellence report. This is with regard to obtaining US CHIPS and Science Act funding for NAND R&D and production. Neither company has responded to our questions about this. Various analysts we spoke to were divided in their opinions.

+ Comment

We’re left thinking two things, which are admittedly speculative. Samsung could concede NAND market share to Micron, SK hynix/Solidigm, YMTC, and Kioxia/WD. Secondly, if Kioxia ownership does come into play, Micron could be a buyer, and so become WD’s partner in the joint venture. Thirdly, Micron could buy WD’s foundry, NAND, and R&D assets to become Kioxia’s joint venture partner. Either way, a NAND player gets absorbed by Micron.