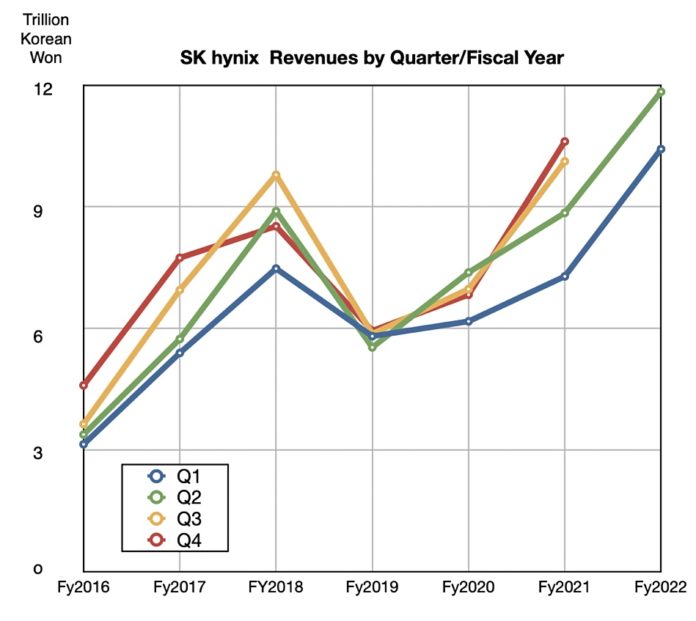

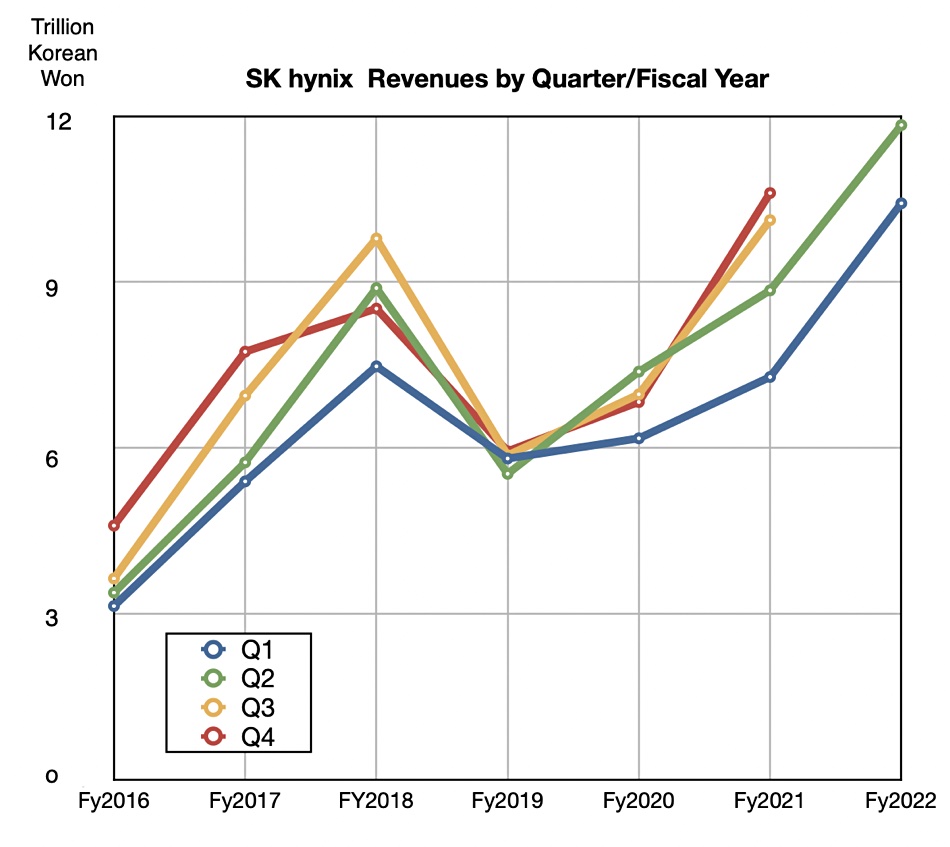

Korean memory and flash foundry operator SK hynix has reported record turnover in calendar Q2 but is trimming its expectations and CAPEX plans as smartphone and PC sales fall and datacenter purchases get constrained.

Revenues in the quarter were ₩13.8 trillion ($10.97 billion), up 33.8 percent year-on-year, with a profit of ₩2.88 trillion ($2.29 billion), a rise of 44.9 percent.

A spokesperson said: “Although DRAM product prices fell during the second quarter, revenues increased as NAND prices rose and overall sales volume increased. [The] continued rise of the US dollar and the addition of Solidigm’s sales also worked as positive factors for the quarterly revenue.” This was enough to overcome the negative influences of the Russia-Ukraine war and Chinese Covid lockdowns.

SK hynix improved the product yield from its 1anm DRAM and 176-layer 4D NAND processes, which it said boosted profitability.

Wells Fargo analyst Aaron Rakers reckons’ SK hynix’ DRAM revenues were ~₩8.84 trillion (~$7.02 billion), up just 4 percent annually. Its NAND revenues were ~₩4.56 trillion (~$3.62 billion), up 76 percent, helped by the acquisition of Solidigm, Intel’s NAND and SSD business.

SK hynix is now number 3 by revenue in the NAND market, with an 18 percent share, with Samsung number 1 (35.3 percent) and Kioxia second (18.9 percent). Western Digital (12.5 percent), Micron (10.9 percent) and YMTC (4.4 percent) are in the 4th, 5th and 6th positions respectively.

Memory demand, SK hynix predicted, is expected to slow in the second half of the year: shipments of PCs and smartphones have already fallen in the first six months of 2022. The demand for server memory supplied to datacenter customers is also likely to slow as customers use up their inventories instead of buying fresh chip supplies, SK added.

It will review next year’s CAPEX investment plan while keeping a watchful eye on product inventory levels in the second half of the year. SK Hynix said is confident that this uncertain period will give way eventually to renewed growth because the long term demand for memory is strong.

Rakers says he believes that DDR5 server DRAM adoption will occur in 2023 as new server CPU platforms ramp, such as Intel’s delayed Sapphire Rapids Xeon-SP and AMD’s Genoa EPYC CPUs.