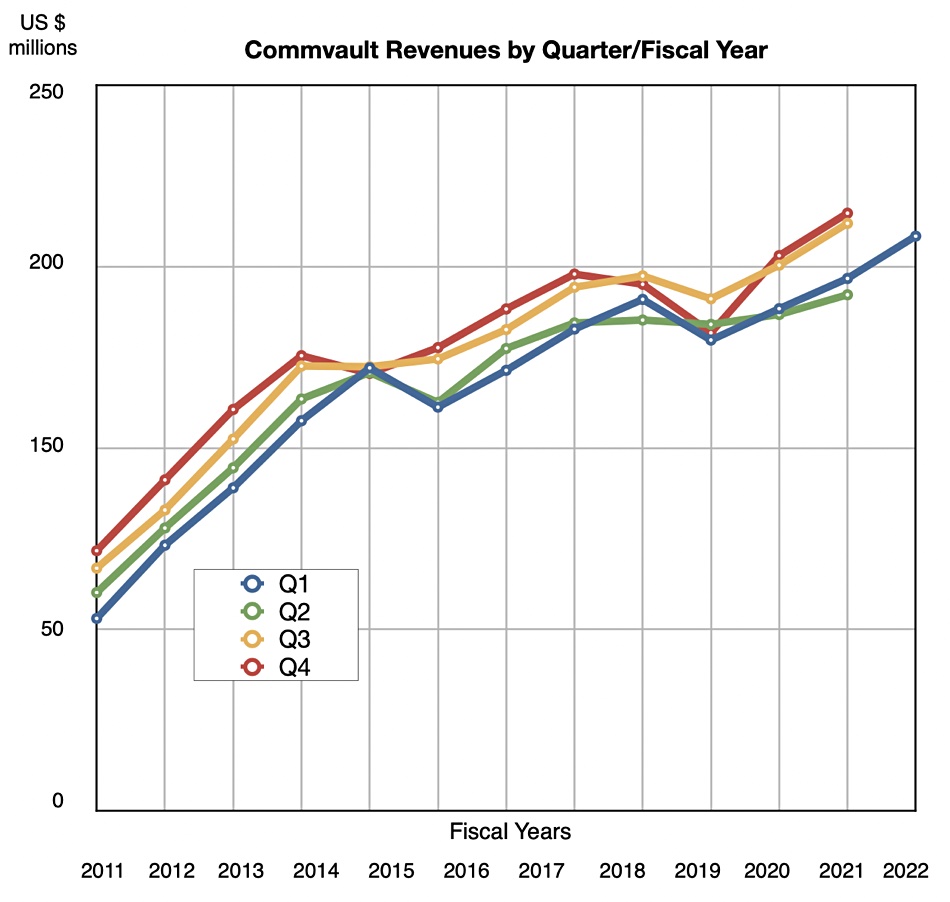

For the ninth consecutive quarter, data protector Commvault has grown its revenues.

Commvault reported revenues of $198.0 million for the first quarter of fiscal 2023, which ended June 30 2022, a rise of 8 percent year-on-year. Profit was $3.5 million compared to $13.9 million a year ago, a 74.7 percent drop. The company said it beat all of its guided metrics for the quarter.

Update; earnings call information added. 27 July 2022

President and CEO Sanjay Mirchandani, said: “We delivered another quarter of solid results. … We believe customers will continue to prioritize our best in class data protection and management solutions as they embrace the cloud and hybrid IT. We are confident in our strategy.”

Software and products revenue was $92.4 million, an increase of 13 percent annually, and driven by a 24 percent increase in larger deals (deals with greater than $0.1 million in software and products revenue). The actual number of large deals was 184, one down on the year-ago number but the average larger deal revenue value was about $379,000, a 24 percent increase from the prior year.

Asked about the increased deal size, a Commvault spokesperson said: “It is our expanding partner ecosystem [that] enables us to reach more Enterprise level customers globally, and increase the value of those deals.” An example is Commvault’s partnership with Oracle to offer Metallic on Oracle Cloud Infrastructure: “By adding native OCI integration and support, we now have industry leading capability across all hyperscalers. … We are confident this will enable us to further accelerate our growth of larger deals.”

Services revenue in the quarter was $105.5 million, up 4 percent year over year and primarily due to the increase in Metallic SaaS revenue.

Financial summary

- Gross margin: 83.6 percent compared to 85 percent last quarter

- Total recurring revenue: $170.8 million, up 20 percent year-on-year

- Annualized recurring revenue: $594.5 million, a 12 percent annual rise

- Operating cash flow: $22.4 million vs $37.2 million a year ago

- Total cash: $258.7 million compared to $267.5 million last quarter

In the earnings call Michandani said: “We’re in a great position as a company, we’re profitable, generate significant free cash flow, and have no debt on our balance sheet.”

It would look a like a rock solid, set of results, with no red flags and no unexpected opportunities, but there was a profits-revenue ratio fall. Profits were 7.6 percent of revenues in the year-ago Q1; now they are just 1.8 percent.

Ransomware-related data protection worries provide a nice tailwind, keeping sales up, and the Metallic SaaS offering is being welcomed by Commvault’s customers. A Commvault exec told us: “Faced with the relentless threat of ransomware attacks, more and more customers are mitigating risk by replacing their multiple point products with Commvault’s integrated software and SaaS solution for air-gapped ransomware protection.”

He added: “Protecting data is not a luxury – especially in these times. Customers and prospects need to continue focusing on best-in-class data management solutions. Ever since the early days of the pandemic, and the knock-on supply chain challenges that resulted from that, protecting data, and reducing costs of inefficient legacy and point solutions are top of mind for decision makers.”

The outlook for the next quarter is for revenues of between $184 million to $188 million. The $186 million midpoint represents 4.6 percent growth over last year, down from the current quarter’s growth rate due to foreign exchange headwinds and some European customer concerns. Commvault’s spokesperson said: “Our transition to a sustainable and profitable recurring revenue model is well underway. Our team is focused on execution, and we’re committed to driving responsible growth in the years ahead.”