Mini-storage conglomerate StorCentric has filed for Chapter 11 bankruptcy protection and is looking for a buyer. StorCentric-owned Drobo has also made its own Chapter 11 filing.

According to the bankruptcy company news outlet, StorCentric and six affiliated debtors, including Drobo, made their filing on June 20. They cited a devastating business impact from the COVID-19 pandemic.

The triggers for the filing were the fact of it making its June 10 payroll late and having insufficient cash to make a June 22 payroll date. A petition.substack note says “The company is facing the imminent June 30, 2022, maturity of its $25m 5.875% fixed senior notes Series 2020-3 (with UMB Bank NA as Indenture Trustee) and with all possible refinancing and funding avenues foreclosed to the company under current market conditions, the debtors were unable to obtain new sources of investment prior to filing.” It had zero cash in hand.

Because of this StorCentric sought a pre-bankruptcy petition financing of $5 million for this from Serene Investment Management LLC.

StorCentric’s filing says it has been operating at a loss for some time. It has between $10 million and $50 million in estimated assets and estimated liabilities in the same range. Its IP is worth, it says, between $50 million to $70 million.

We understand Drobo made its Chapter 11 filing on June 20 and a hearing will be held in the US Bankruptcy Court, California Northern District, San Jose, on July 19. All non-governmental creditors must file their claims with the Bankruptcy Court by October 17. The StorCentric-owned business hopes to restructure and continue in business.

How did we get here?

Data Robotics was founded in 2007 by Geoff Barrall and developed a consumer/prosumer file storage product with hot-swap drives called Drobo. The firm changed its name to Drobo and was bought by/merged with Connected Data in 2013. Connected Data, founded in 2012, also by Geoff Barrall, produced the private cloud file sync’n’share Transporter device.

Drobo was bought by an investment group in May 2015, with ex-Brocade exec Mihir Shah becoming its CEO.

Imation bought Connected Data for $7.5 million in October 2010. Imation had previously bought storage array supplier Nexsan in 2013.

Imation then imploded, with Nexsan and Connected Data bought in a non-cash deal by private equity house Spear Point Capital Management in Jan/February 2017.

Private equity backed StorCentric was started up in 2018 as a new home for the Nexsan array and Drobo prosumer storage businesses, having bought them from their then owners. Its CEO was Mihir Shah and he ran Nexsan and Drobo as separate divisions. The Connected Data Transporter technology became dormant.

StorCentric bought struggling NVMe all-flash array startup Vexata in July 2019. It then bought the Retrospect backup business in late 2019, and the failed and somewhat recovering all-flash array vendor Violin Systems in October 2020.

At this point it had the Retrospect backup business, three storage array businesses – Nexsan, Vexata and Violin – and the Drobo prosumer external storage business.

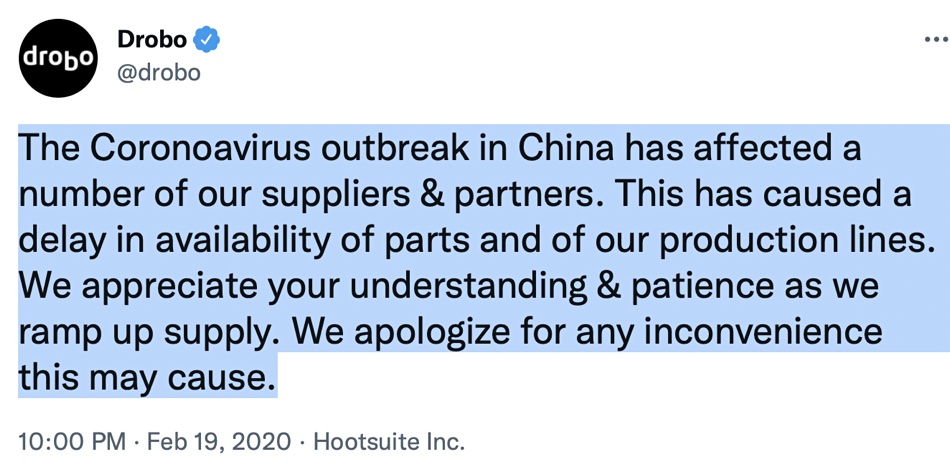

Since then we have had the COVID pandemic, remote working, supply chain problems and the Ukraine war. In February 2020 Drobo tweeted about supply chain issues:

Shah himself blogged about supply chain issues in March 2020, saying “We are in close contact with all of our suppliers and we are trying to mitigate the impact of any delay in the supply chain.”

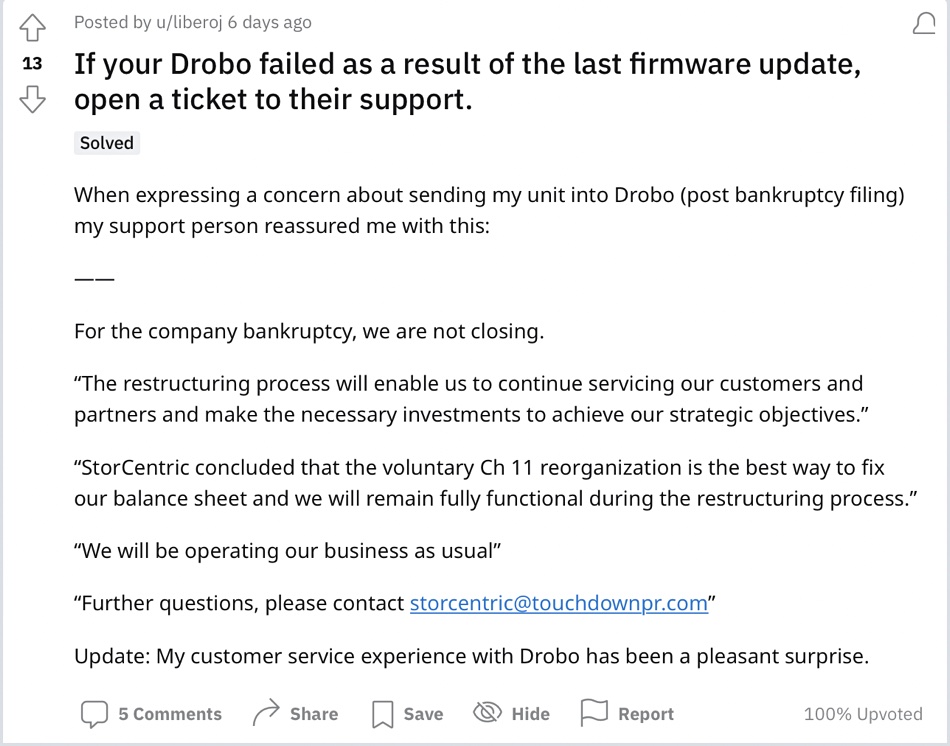

A July 1, 2022, Reddit post said that Drobo was not closing down:

A consensus of posts on the Appleinsider forum is that StorCentric has failed to add new Drobo hardware for two years, and that its software is not up to date with current Apple Mac hosts.

We have reached out to Mihir Shah for a comment and the company issued a statement: “StorCentric has commenced a voluntary Chapter 11 reorganization in order to strengthen and position the company for future success. It will remain completely operational during this process and will continue to service its customers and make the necessary investments to achieve its strategic objectives.”