We are all watching a slow-motion collision as datacenter-oriented filers from NetApp and others meet cloud-centric filers from Nasuni and its peers.

The well-established network attached storage (NAS) concept is to have a filer in a datacenter providing external file storage I/O services to users and applications on local and remote servers. The two leading suppliers are NetApp (ONTAP) and Dell (Isilon/PowerScale) with Qumulo (CORE) and others such as VAST Data coming on strong.

For these suppliers the public cloud represents competition. The public cloud can replace on-premises filers but it can also enhance them in a hybrid and multi-public cloud environment. Thus NetApp has ONTAP present in the main public clouds and customers can move applications using ONTAP to, from, and between their datacenters and the public clouds, and find the familiar ONTAP environment in each.

Dell is moving in the same sort of direction with its APEX initiative, as is Qumulo.

The core of these companies is the on-premises filer. The public cloud represents a burst destination for their filer users’ applications and a place for some applications to run, while others – such as data sovereignty-limited, or perhaps mission-critical applications – stay on premises. The cloud can also be a place to offload older, staler, data into lower cost S3-type object stores.

Nasuni’s inversion

Nasuni inverts this model, coming from the sync’n’share file collaboration market. Its core is in the public cloud with accessing applications in datacenters of all sizes, from central to edge sites like retail outlets, treated as remote access users equipped with edge caches – either physical boxes or virtual machines.

The company’s UniFS file system stores all its file data in S3-type online object storage vaults in the cloud, not offline archive tiers. It uses the edge (filer) caches and its algorithms to provide fast local access.

Western Digital is a Nasuni customer that synchronizes and shares large design and manufacturing files between its global sites. Such file sync happens in less than ten minutes, instead of hours and hours.

This cloud-as-core model is also used by CTERA.

Ransomware Protection as a Service

Nasuni is changing from just providing file storage and infrastructure to providing add-on cloud data services, such as file system analytics and Ransomware Protection as a Service (RPaaS). It detects incoming ransomware file patterns, such as specific file extensions, and activity anomalies.

It will move to stop a ransomware source acting on file data if a customer sets a policy. Chief product officer Russ Kennedy said automated recovery will be added next year. “Nasuni customers have billions of potential recovery points through every file system change being recorded in an immutable way.”

Its software captures all metadata changes – anything up to the root – and puts them in small manifest files.

Nasuni and NetApp

While not as big as NetApp, Nasuni is a substantial startup. We were told by Kennedy at a June IOT Press Tour briefing that it has more than 680 customers and 13,600 edge locations worldwide. Over 10 customers are paying Nasuni $1 million a year and 187 customers are paying more than $300,000/year. Its strategy is to go public.

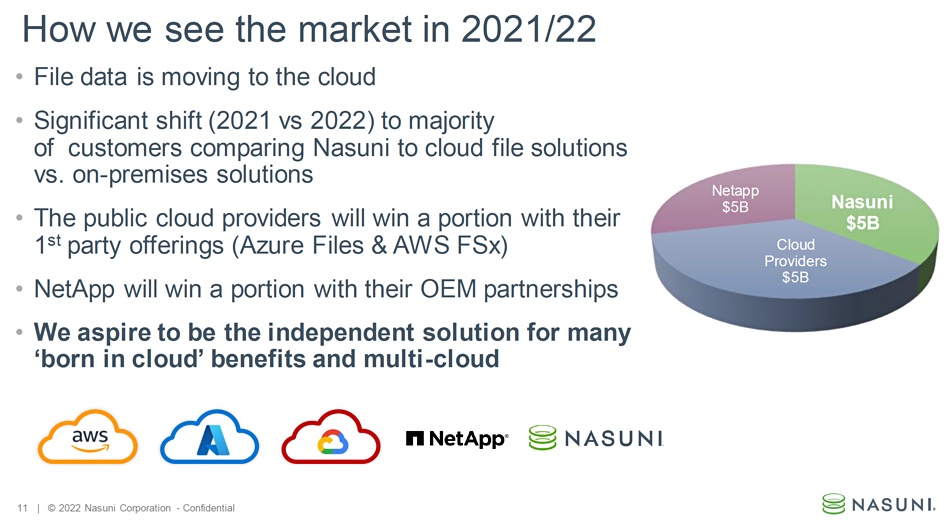

Nasuni sees itself having a $5 billion total addressable market (TAM) in cloud file services over 2021/2022, with NetApp having an equal TAM, along with the major cloud providers:

In a way Nasuni has parked its cloud object store-backed edge filer cache tanks on NetApp’s on-premises lawn. As has CTERA. How will the on-premises filer suppliers respond?

We may well see the adoption of cloud-based core file storage technology and access to/from remote sites by Dell, NetApp, Qumulo, and their peers as they respond to the market dynamics.

We asked Kennedy about NetApp, Dell, and Qumulo doing this. He said it would take years for them to build a similar cloud-based structure. For example, Nasuni has an orchestration center that handles global file locking. It is a cloud service unique to Nasuni, Kennedy said, that uses DynamoDB and elastic services.

This may be a key difference between Nasuni and the on-premises/hybrid cloud filers. The difficulty inherent in building an equivalent cloud-based infrastructure from scratch is indicated by something Kennedy told us: Nasuni has had talks with on-premises providers about them using its UniFS cloud facilities. They could get cloud-based remote site sync and so forth via UniFS talking to their filers.

But the talks have not led to this actually happening, nor any other partnering activity. In a way, we have reached a sort of equilibrium. Cloud-based Nasuni has an on-premises filer presence with its edge caches, but these are not full-blown filers. The on-premises filer suppliers – Dell, NetApp, Qumulo, etc. – have and are building a cloud presence, but this is not as capable as the ones Nasuni and CTERA have built.

Unless customers show a significant preference for cloud-based file system technology, both the on-premises and cloud-based filers will grow. They’ll collide, but there will be no outright winner. Because unstructured data is growing and a rising tide lifts all boats.