In four years’ time over 95 percent of shipped hard disk drives will be high-capacity nearline 3.5-inch drives, and SSDs will outstrip the “other disk drive” categories, including notebook, desktop PC, external, and mission-critical 10K rpm 2.5-inch enterprise drives.

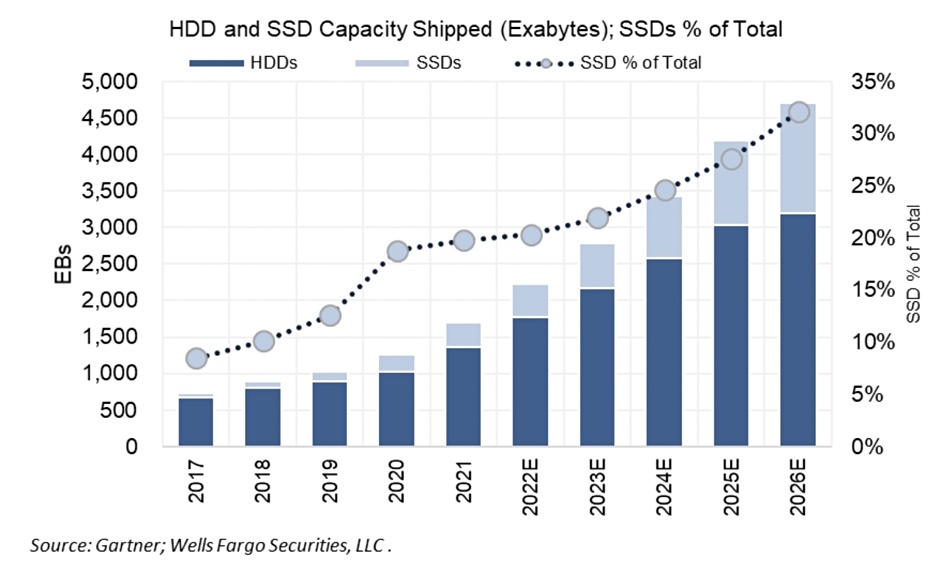

Or so says a newly published Gartner HDD and SSD market forecast which predicts that SSDs will account for 32 percent of the shipped HDD+SSD exabytes in 2026, about 1,400 EB, with HDDs accounting for about 3,200 EB – as a Gartner chart shows:

Wells Fargo analyst Aaron Rakers, who saw the Gartner forecast, told subscribers Gartner’s analysts believe that enterprise SSDs will see strong growth through the forecast period at a ~37 percent CAGR (Compound Annual Growth Rate) with total SSD capacity shipped growing to 32 percent of overall HDD/SSD capacity shipped by 2026 (vs its approximate ~20 percent share in 2021).

Gartner is predicting HDD capacity will grow at a 16 percent CAGR from 2022 to 2026 compared to more rapid acceleration of SSDs. It is slated to have a 68 percent share by 2026 as opposed to its (approximate) 82 percent share of exabytes shipped currently.

HDD unit shipments overall will decrease at a 15 percent CAGR between this year and 2026. That’s because notebook, consumer and mission critical unit shipments will fall more than business-critical / nearline shipments will grow. Gartner predicts 16 percent CAGR for business-critical / nearline shipments.

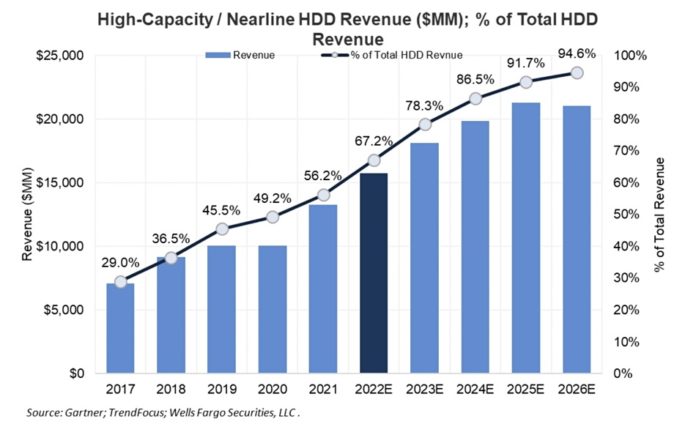

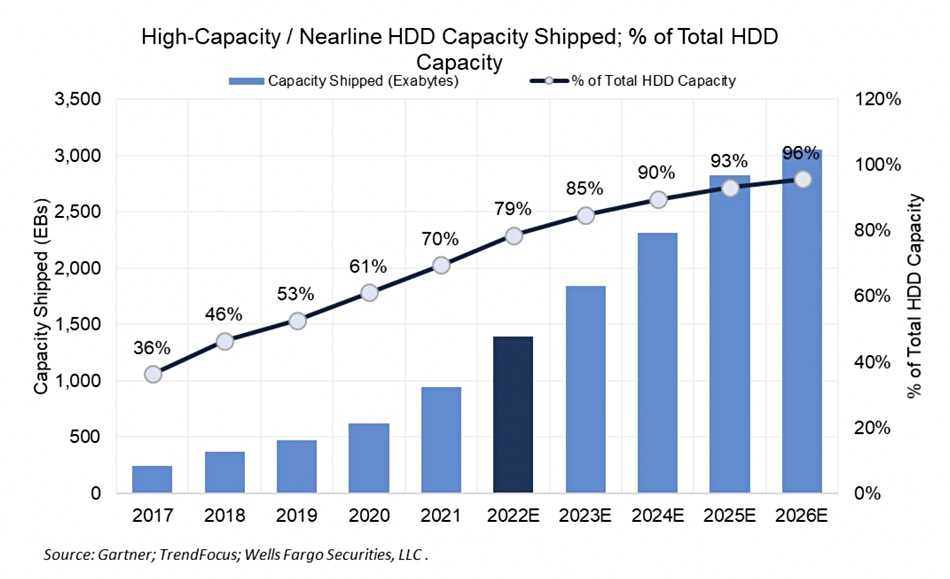

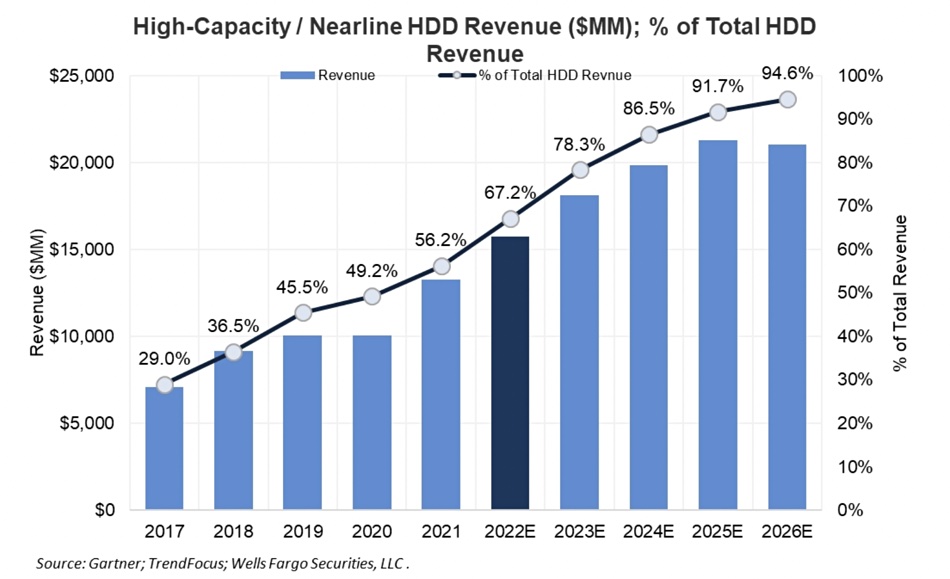

Nearline capacity will grow at a 22 percent CAGR during the forecast period and represent ~96 percent of all HDD capacity shipped by 2026, up from ~70 percent of the HDD pie in 2021. Effectively every other disk market segment becomes a tiny niche and we can expect vendors, meaning Seagate, Toshiba and Western Digital, to each exit some of these segments of the disk market as drive production becomes uneconomic.

Gartner expects the disk drive product mix to change as high-capacity HDD shipments expand and the other disk drive markets decline, with average selling prices (ASPs) growing from $91.42 in 2021 to $196.85 in 2026 (+115 percent). Despite this rise however, HDD vendor revenue will fall at a 1 percent CAGR over the forecast period in contrast to a positive 8 percent CAGR for SSD revenues.

If Gartner’s analysts are right them this will probably spur more intense competition between the three HDD suppliers –Seagate, Toshiba and Western Digital – as they try to take market share from each other to offset the slowdown in revenue growth.