Western Digital execs revealed its disk and flash/SSD roadmaps at a May 10 Investor Day event. We covered the disk part of this in a previous article. Here we look at flash.

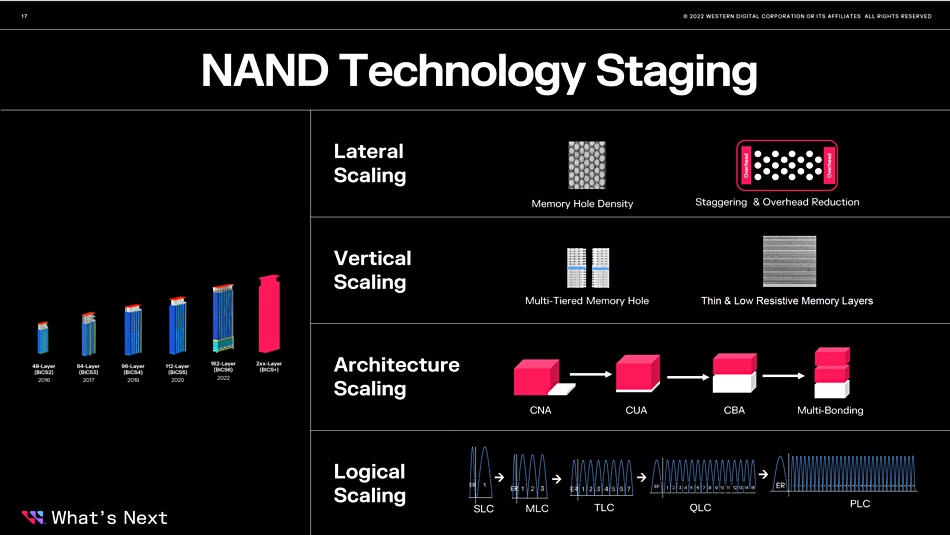

EVP Robert Soderbery, head of the flash business unit, talked about growing the capacity of a flash die by increasing the layer and shrinking the lateral dimensions of a cell. The latter means that more cells can fit in a layer and thus fewer layers are needed to reach a set capacity level. A slide showed a 10 per cent increase in lateral density through a 40 percent reduction in cell size.

President of Technology Siva Sivaram used a slide showing that Western Digital’s 162-layer NAND, at a 1Tbit x4 die capacity and 100TB wafer size, had a 68mm2 cell size compared to Kioxia and Seagate’s 69.6 and 69.3mm2 cell size – and they are building 176-layer NAND.

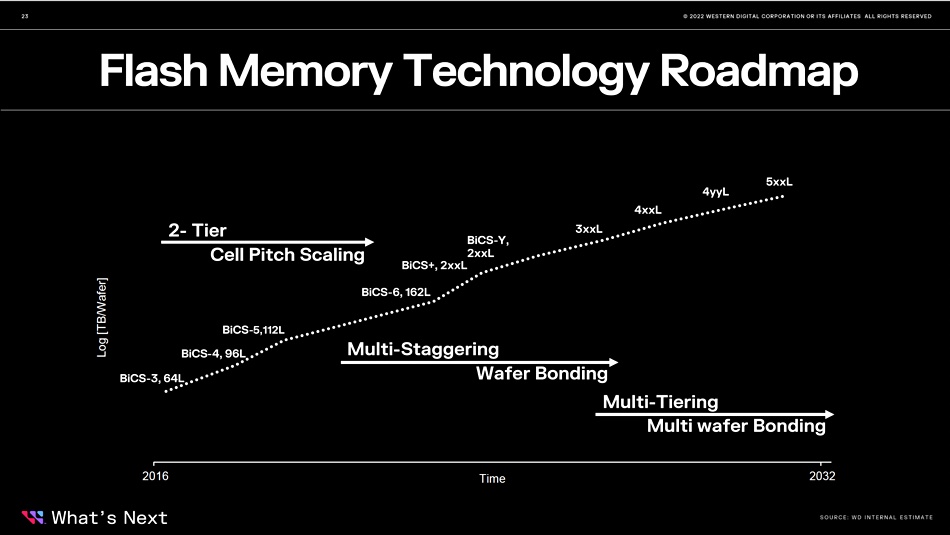

Sivaram said Western Digital’s charge trap NAND cell had a 40MB/s program performance vs competitors’ 60MB/sec. He presaged 200+layer 3D NAND coming, calling it BiCS+. We have previously understood this to be 212-layers and called BiCS 7. A Sivaram slide showed what looked like string-stacking, called multi-bonding, and penta-level cell (PLC 5bits/cell) technologies coming.

BiCS+ will have 55 percent more bits/wafer than BiCS 6 (162-layer), a 60 percent better transfer speed and 15 percent more program bandwidth.

Sivaram’s 3D NAND roadmap showed a route to 500+ layers in 2032.

Western Digital makes three main classes of SSD – consumer, client and cloud (enterprise), along with automotive and IoT drives – using its own NAND, controllers, and firmware. It has a 37 percent share of the consumer SSD market, 20 percent of the client market, but only 8 percent of the cloud market. Soderbery wants to get that cloud market share higher, to 16 percent, and says the cloud SSD market is separating into three segments: compute (for cache and direct access), storage (capacity-optimized), and boot and journaling (endurance-optimized).

The BiCS 4 (96-layer) was good for storage (TLC 3 bits/cell) and boot segments, and BiCS 5 (112-layer) was good for storage (TLC and QLC) and boot. BiCS 6 (162-layer) will be good for compute, storage (TLC, QLC), and boot.

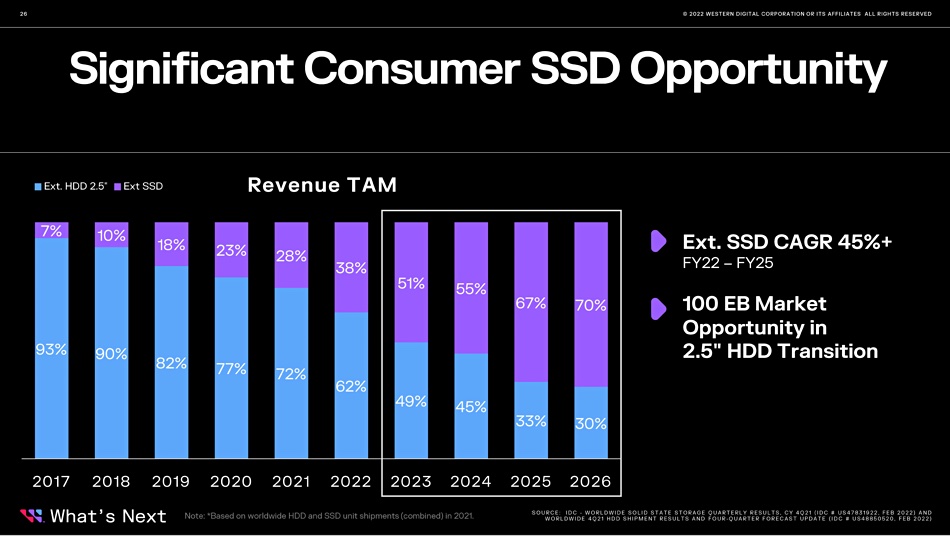

Soderbery sees a significant consumer SSD opportunity as flash replaces 2.5-inch disk. In 2022 62 percent of consumer drives were disk and 38 percent SSDs. In 2026 that is forecast to have changed to 30 percent disk and 70 percent SSD. He thinks there is a 100EB opportunity in this disk-to-SSD transition with consumer SSDs having a greater than 45 percent CAGR from 2022 to 2025.

Overall WD has a 14-16 percent overall SSD market share target. Wells Fargo analyst Aaron Rakers noted that WD is forecasting flash capacity shipped in the cloud to grow at ~37 percent year-on-year from 2022 to 2027, and told subscribers: “This is where WD’s qualification/ramp of their NVMe SSDs is a key focus for the company.”

That is probably Soderbery’s key goal: get the cloud/enterprise NVMe SSD sales up while not foregoing growth in the consumer and client markets. WD is betting that its cell density and layer count advantages will translate to better price/performance and so enable it to win share, grow its business, and, maybe, fend off activist investor Elliott Management.