…

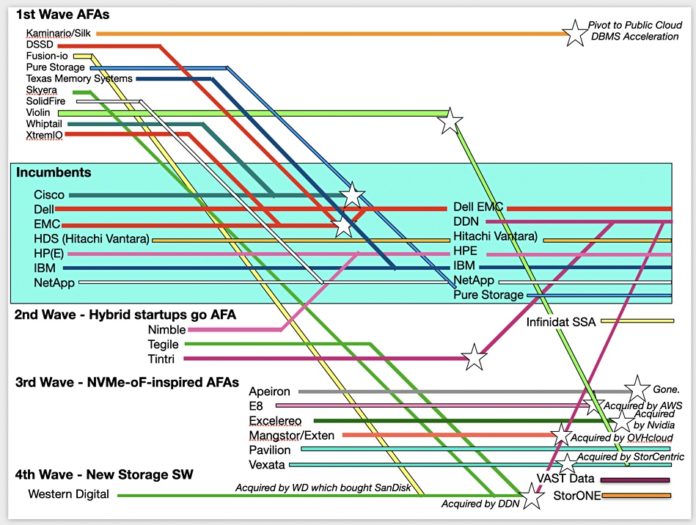

An updated all-flash array history chart includes newer entrants like VAST Data and StoreOne, older ones like Fusion-io, Violin and Vexata, and more acquisitions. Enjoy this snapshot and tell me if there are any omissions. (You can see I’m running out of space!)

…

William Blair analyst Jason Ader tells subscribers: “We hosted investor meetings with Box CEO Aaron Levie and CFO Dylan Smith, and came away with reinforced confidence in the increasing value of the Box Cloud, its strong product-market fit and competitive differentiation in an era of its distributed work and content fragmentation, and the replicable rhythm of its suite-selling, go-to-market motion. Box’s ultimate objective – which we believe is beginning to come to fruition after many years of toil – is to create a centralized, cloud-based platform that will help distributed workers access and collaborate with their content and eliminate the various content silos that negatively impact their productivity.” Ader says secular trends are working in Box’s favor, and management is executing on both top-line acceleration and higher profitability.

…

DPU chip hardware, system, software and composability startup Fungible announced the launch of its Fungible Partner Exchange (FunPX) partner program. FunPX allows resellers, distributors, and technology providers worldwide to connect, collaborate, and grow their composable infrastructure capabilities by delivering best-in-class technology solutions necessary to cloudify the world’s datacenters. Brian McCloskey, Fungible chief revenue officer, said: “We are investing in the tools, people, and processes to enable our partners to grow with us by providing immediate access to the essential information they need to win and help our mutual customers realize the benefits that the Fungible portfolio can bring to their infrastructure.”

…

Granular and air-gapped backups are critical to data recovery when – not if – a business falls victim to ransomware. Those are among the key takeaways from a new Enterprise Strategy Group (ESG) study, titled “The Long Road Ahead to Ransomware Preparedness“. The authors surveyed information technology (IT) and cybersecurity professionals working within organizations across North America and Western Europe. The study was sponsored by Keepit, which claims to be the world’s only vendor-neutral and independent cloud dedicated to Software-as-a-Service (SaaS) data protection based on a blockchain-verified offering.

…

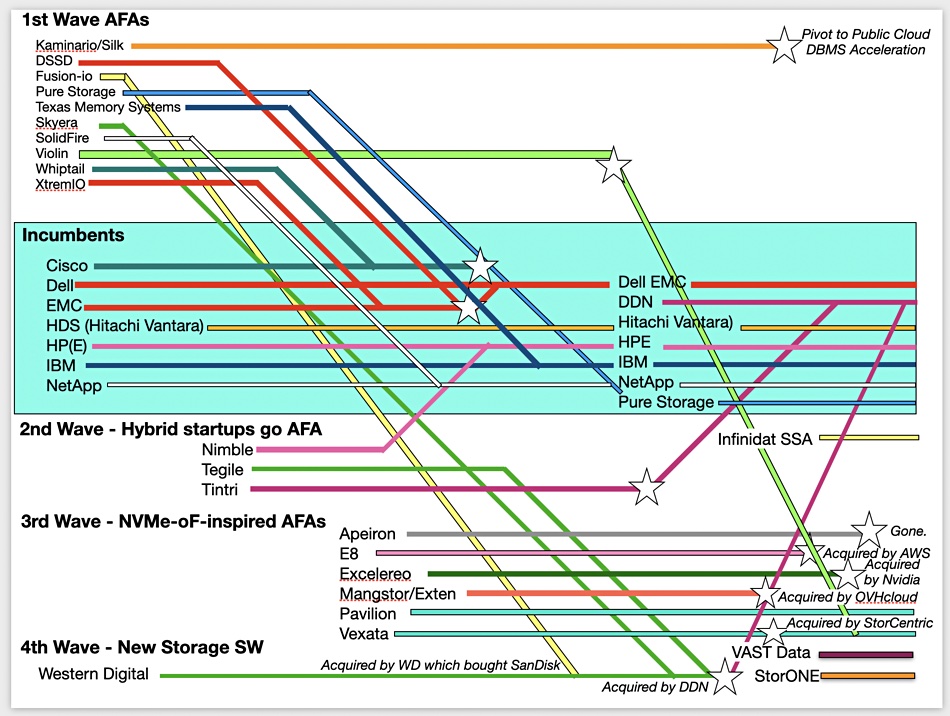

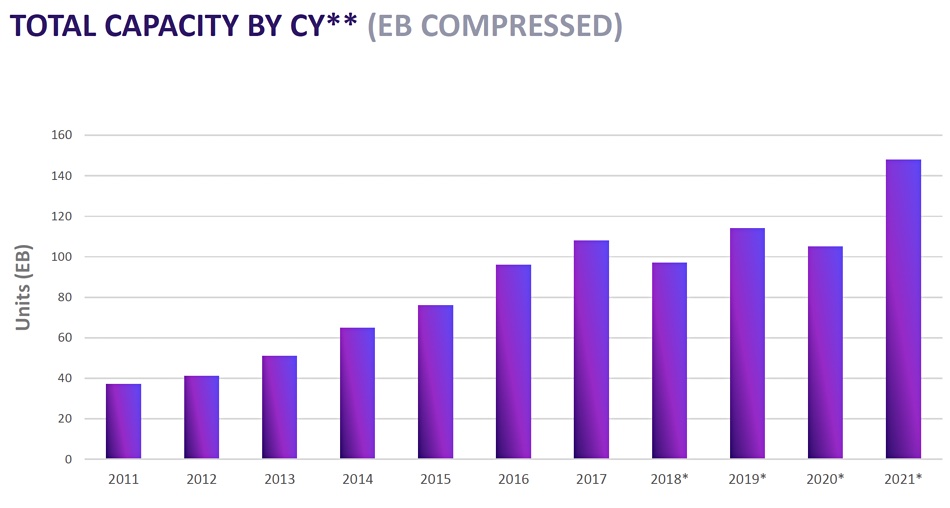

The Linear Tape Open (LTO) organization has issued a ten-year history of compressed capacity shipped and units shipped from 2011 to 2021.

Total shipped compressed capacity in exabytes rose 40 per cent from 2020 to 2021, reaching 148EB – a record. The depressed 2018, 2019 and 2020 numbers were due to LTO-8 supply problems as the two media suppliers, Sony and Fujifilm, argued amongst themselves, settling in late 2019. Then the COVID-19 pandemic upset customers’ buying patterns again. These have been overtaken by the great rise in unstructured data needing cheap and resilient storage which leads to the 40 per cent capacity shipped jump from the 105.7 compressed EB shipped in 2020.

Unit sales (tape cartridges) rose slightly year-on-year as an LTO-issued chart shows:

It would be good to know the split between on-premises and public cloud/hyperscaler sales, but those numbers are a closely guarded secret.

…

Media and entertainment market object storage supplier Object Matrix announced that partner Scale Logic launched its Object Storage offering based on Object Matrix tech. Scale Logic says that, with its active archiving functionality for long-term data retention, the system enables users to offload, migrate, store, and centralize files from various sites within a less expensive, secondary tier. This functionality frees up space while decreasing costs and the need for additional IT resources. It includes built-in support for WORM and S3 object locking to enable continuous data integrity.

…

HPC storage supplier Panasas has announced the appointments of Jeff Whitaker as VP of marketing and product management, Kieran Penwill and Chris Sassone as sales directors of EMEA and APAC, respectively, and Mike Sheppard as global director of channels and alliances. Brian Peterson, Panasas COO said: “The ActiveStor Ultra product line has received high praise from both established and new customers, and Panasas has enjoyed a sharp increase in demand over the last 18 months. As a result, we are investing further in our teams and our products to support our expanding global customer base.” Current VP corporate marketing Todd Ruff says on LinkedIn he’s looking for a new post.

….

Renesas Electronics Corp. introduced the first clock buffers and multiplexers that meet PCIe 6 specifications. It is offering 11 new clock buffers and four new multiplexers. The devices, which also support and provide extra margin for PCIe 5 implementations, complement Renesas’s low-jitter 9SQ440, 9FGV1002 and 9FGV1006 clock generators to offer customers a complete PCIe 6 timing solution for datacenter/cloud computing, networking and high-speed industrial applications. The PCIe 6 standard supports data rates of 64GT/sec (that’s gigatransfers per second) while requiring very low clock jitter performance of less than 100 fs RMS.

…

SoftIron, which supplies purpose-built and performance-optimized Ceph-aligned datacenter systems, announced the expansion of its CTO office as it realigns internally and expands into new engineering roles. Kenny Van Alstyne, SoftIron CTO, said the development reflects SoftIron’s desire to expand its patent portfolio and intellectual property while deepening its engagement with the open source community through high-level strategic engineering initiatives. The company is looking for engineers who are passionate and dedicated to the open source ethos and in developing sophisticated software that makes a meaningful impact. The first two projects that will benefit will be Ceph and SONiC, which was recently donated to The Linux Foundation.

…

An IDC Perspective report on VAST Data by analyst Eric Burgener – “Growing Data Demands Are Driving VAST Data’s Continued Hypergrowth” – is extremely laudatory. Burgener writes: “With $220 million in the bank, continued triple-digit growth for the future, and a net revenue retention from existing customers of over 300 percent, VAST Data is very strong financially and sustainably differentiated from the competition. Not only is it a vendor to watch in enterprise storage, it is the vendor to watch.” The man is in love. He adds: “One extremely notable aspect of [its Gemini] go-to-market model for customers is that they get hardware discounts based on the volume of all VAST Data purchases that go through Avnet, not just their own. This means that customers deploy like enterprises with appliances but buy like hyperscalers with very high discounts.” Get this seven-page VAST Data love-in doc here.

…