Researchers at TrendFocus reckon that all disk drive shipments declined sequentially in Q1, with nearline-only shipments growing year-on-year but declining slightly quarter-on-quarter and all other categories seeing double-digit percentage quarter-on-quarter declines.

Total disk ships in the quarter ranged from 53.0 million to 55.2 million – 54.1 million at the mid-point – which would be down 16 per cent year-on-year

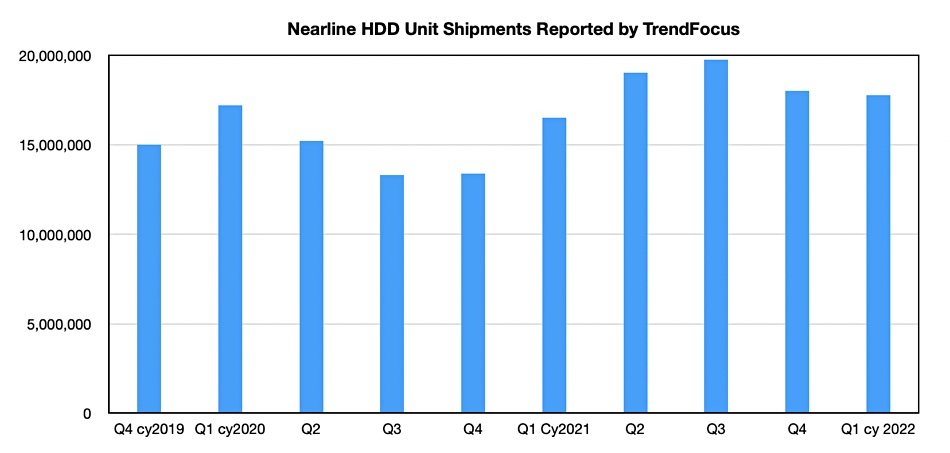

There were an estimated 17.5 million to 18 million nearline HDDs shipped in the quarter – 17.75 million at the mid-point – which compares to 16.5 million a year ago and 18 million last quarter (Q4 calendar 2021) and 19.75 in the quarter before that (Q3 2021). Nearline unit ships have declined over the past two quarters, although the latest quarter is still higher than the year-ago 16.5 million.

Wells Fargo analyst Aaron Rakers told subscribers that “Assuming an ongoing increased average TB/drive (estimated 13.5TB/drive vs 13.1TB/drive in Q421), we would estimate that nearline capacity ship growth slowed to the mid/high-20 per cent year over range vs +60 per cent year over year in Q421.” He estimates that nearline HDD revenue in the quarter was >$3.5 billion, up over 12 per cent year-on-year.

The other HDD categories:

- Mission-critical HDD shipments were less than 2.9 million, falling nearly 20 per cent quarter-on-quarter;

- 2.5-inch mobile and consumer electronics (CE) HDD ships were under 16 million, declining more than 15 per cent quarter-on-quarter;

- 3.5-inch mobile and CE HDD ships were about 18 million, down over 10 per cent quarter-on-quarter.

Mission-critical disk drives are being replaced by faster SSDs. Rakers points out there was a measurable decline in notebook demand during the quarter. People bought fewer notebooks, rather than buying the same number of notebooks as before but with SSDs fitted instead of disk drives. That sent the notebook HDD segment downwards. The desktop drive decline was attributed to seasonal weakness and worries about the economy.

TrendFocus also reckons Western Digital grew its HDD unit ship share by 200 basis points quarter-on-quarter – that’s two per cent, to an about 37 per cent share. That compares with Seagate staying flat at around 44 per cent and Toshiba declining two per cent or so to about 19 per cent. Rakers thinks that WD’s share gain comes from increased nearline disk shipments.

We have charted TrendForce disk shipments over the past few quarters:

The TrendFocus numbers for a quarter are estimated and often get revised in subsequent quarters, so this chart is only a rough indication of what’s going on. Most nearline drives are bought by hyperscalers these days and their buying patterns can be lumpy. Having said that, it will be interesting to see if growth resumes over the next two or three quarters, or stays flat.