Model9, the mainframe to cloud object storage data mover, has reorganized its product set, adding cyber-protection and a facility to feed cloud-based AI, machine learning and data warehouses with mainframe data.

Startup Model9, founded in 2016, began life on a mission to replace complex, slow and costly mainframe tape backup storage with Virtual Tape lIbrary (VTL) software sending data to public cloud object storage and S3-supporting on-premises stores. It now has three product lines: Manager to move and store backup/archive data in the cloud; Shield to cyber-protect copies of mainframe data; and Gravity to move mainframe data to the cloud and there transform it and load it into cloud data warehouses and AI/ML pipelines.

Co-founder and CEO Gil Peleg told IT Press Tour attendees in Tel Aviv that Model9 isn’t about replacing mainframes with the public cloud. “It will be a hybrid mainframe cloud world for the next twenty to thirty years.”

The company’s software parallelizes transmission of mainframe data to the public cloud or on-premises object stores, making it both faster and much much cheaper and simpler to use than mainframe tape for backup. For example, it uses IBM’s non-billable zIIP facility to process its data, meaning its mainframe compute is free. Other mainframe backup data movers to tape use the standard mainframe CPUs and their processing cycles cost money.

Model9 opportunity

Model9 has gained credibility in the mainframe world with several public case studies. It is working with mainframe-focussed system houses such as Accenture and Infosys, and has been brought into deals by the newly-formed Kyndryl – IBM’s spun off services business – and also by Cohesity. Its software is available in the three public cloud marketplaces. It thinks it has little effective competition and a large opportunity ahead of it. How large?

That depends upon the number of IBM mainframes in customer datacenters. IBM doesn’t release such numbers. We understand 71 per cent of Fortune 500 companies use mainframes; assume two each and that’s 710. Assume that’s half IBM’s base and we think there will be at least 1,500 IBM mainframes out there. A 2016 Quora thread suggested 10,000 with some estimates reaching up to 40,000.

Let’s say 10,000 and further assume Model9 has penetrated five per cent of IBM’s base; 500 systems. That gives it huge growth potential. Each sales cycle is multi-month in length – possible a year or longer – and requires a direct sale, either to the end user or to a partner. That means Model9 will have to grow its worldwide sales and office presence. It had a $9 million A-round of funding in 2020, with Intel Capital taking part. That’s not a lot of money in the storage startup world.

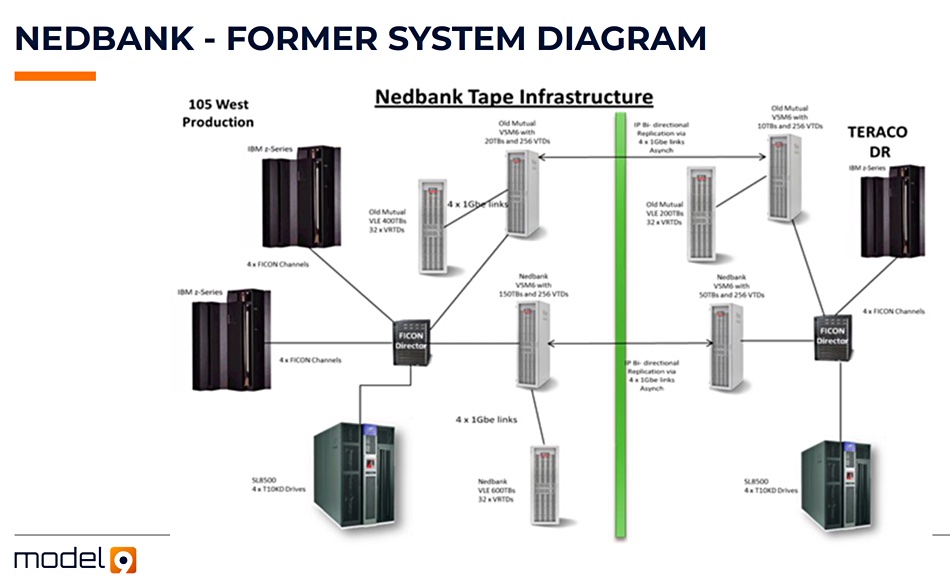

Is it effectively self-funded? Model9 can charge customers a lot of money while saving them even more money. Here is a picture of customer Nebank’s infrastructure for backup before using Model9:

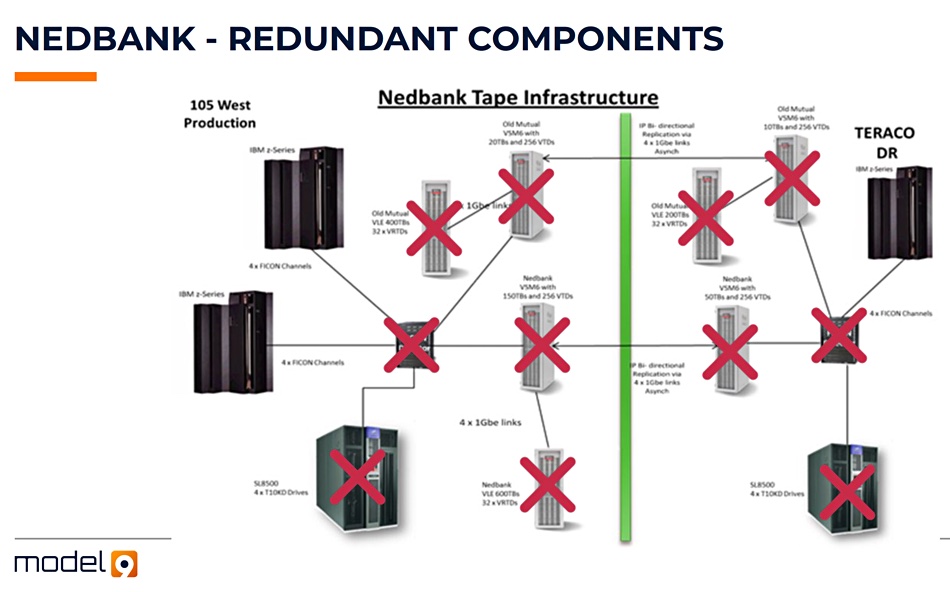

All this infrastructure and associated process complexity adds to and strengthens the gravitational force holding data penned up in the mainframe. Model9 can break that prison. Here is the infrastructure after using Model9’s software:

That’s an awful lot of kit that can be sold off, software that no longer has to be licensed, and datacenter space that can be retired.

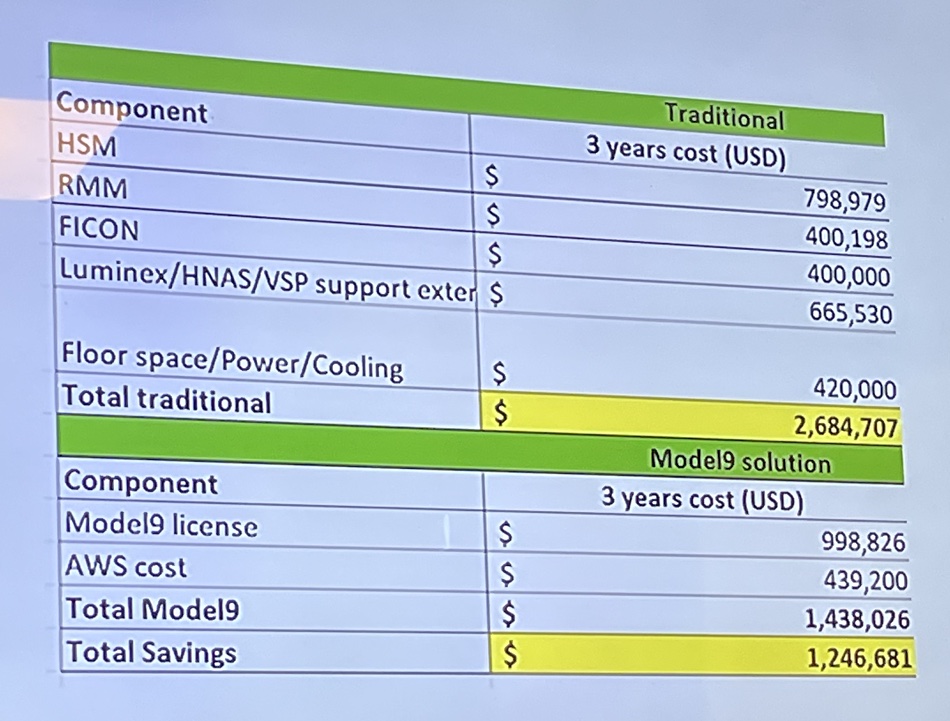

We saw some financial numbers from a Model9 POC which were impressive:

The three-year cost for the Model9 subscription licences, charged by capacity, was $998,826 – near enough a million dollars – yet the customer was saving $1.25 million. These are seriously large sales and Model9 would be self-sustaining if there were enough of them – but there aren’t. Yet.

Peleg told me that all Model9 customers renewed their subscription licenses – not a single customer has walked. Also second and subsequent sales can be charged at a higher per/TB capacity rate. He said mainframe customers are used to price increases.

Even so, he said, Model9 will probably seek a second funding round and money would clearly be needed to grow and deepen the company’s presence in various regions worldwide. It should be easier to attract VC interest this time around. Mainframes are not sexy, but AI/ML training and big data warehouse analytics are hugely glamorous, with Model9 able to feed mainframe data to SnowFlake, Yellowbricks and other cloud warehouse businesses. Without Model9 these cloud ML training and analytics facilities are a closed book to mainframe customers.

Peleg said IBM had created a ML Inference processor which will be in the coming z16 mainframe. An inference processor, not a training processor. With Model9, mainframe customers can send their training datasets to the cloud in a Model9-mediated extract, load and transform (ELT) process with all chargeable computing done in the cloud at a much lower cost than mainframe cycles. Once trained, the data model can be shipped back to the mainframe and ML inference runs done there for instant results.