NetApp grew all-flash array sales faster than Pure Storage and to a higher revenue share in 2021’s fourth calendar quarter, according to Gartner research. The all-flash array market grew more rapidly than the primary and secondary storage markets, as well as the backup and recovery market.

Gartner has issued a report to subscribers about the external storage market in the final three months of last year, and we caught a partial glimpse courtesy of Aaron Rakers, Wells Fargo analyst – meaning hardly any actual revenue numbers and mostly percentages.

Supply chain disruptions, according to Gartner, shrank the total external storage market by 2 per cent year-on-year. Within the total market, all-flash arrays (AFAs) grew 14 percent, compared to hard disk drive (HDD) and hybrid flash/disk arrays falling 14 percent. The primary storage market declined 3 percent, secondary storage saw no change, but the backup and recovery market grew 2 percent.

AFAs represented 64 percent of all primary arrays sold and 14 percent of secondary arrays.

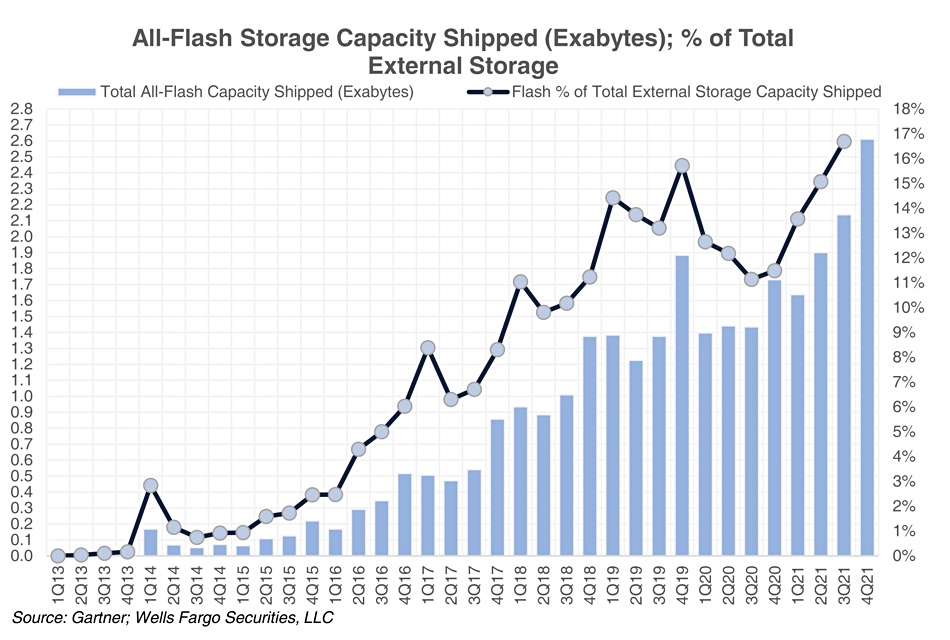

Capacity shipped in the total external array market declined by 6 percent year-on-year and the AFA capacity percentage of the total storage market grew from 11.5 percent in Q4 2020 to 18.4 percent in the latest Q4.

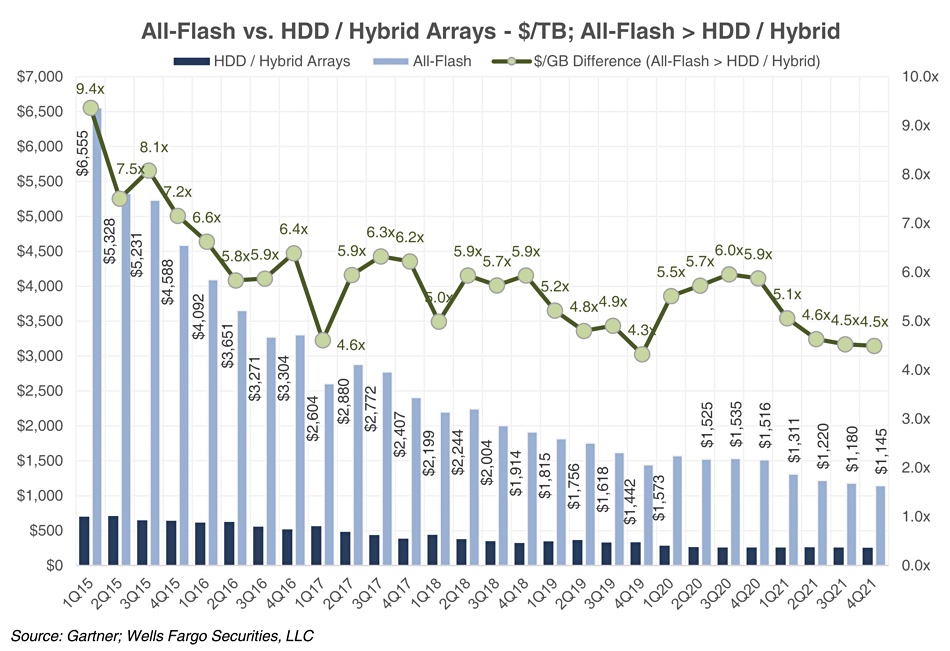

The cost differential in $/GB terms between AFAs and HDD/hybrid arrays was around 4.5x, down from 5.9x a year ago:

Dell EMC led the AFA market in the quarter, with a 23.7 percent market share at $708m. This was lower than its year-ago 26.7 percent share. Dell EMC also saw its leading total external storage market revenue share decline to 24.8 percent in 4Q 2021 from 27.3 percent a year earlier.

NetApp, on the other hand, increased its total storage revenue share from 11.5 percent to 11.8 percent year-on-year. Its AFA market revenue share rose to 17.1 percent or $511m, up 15.6 percent. In fact, AFA revenue represented 73 percent of NetApp’s storage revenues, higher than the 59 percent from a year ago.

Pure Storage, which only sells flash-based systems, increased its AFA market revenue to $453m, taking its share to 15.2 percent versus 14.2 per cent in Q4 2020. Rakers wrote: “Pure saw by far the largest storage capacity growth y/y in percentage terms at +60 percent vs. the overall market declining 6 percent y/y.”

Huawei had the next largest revenue share of the AFA market at 13 percent or $349m, unchanged from a year ago. This was followed by IBM with an 11 percent share, taking its haul to $339m, down from last year’s 12 per cent. HPE ingested $249m in sales, giving it an 8.3 percent AFA market share, down from 9.3 per cent last year. HPE’s overall storage revenues went down 4 percent on the year with its share moving from 10.8 percent to 10.3 percent.

The last identified supplier is Hitachi Vantara with a 3 percent revenue share of the AFA market, equating to $80m in turnover and unchanged from a year ago. The Others category’s share rose from 8 percent in 4Q 2020 to 9 percent in the last 2021 quarter.