Datto could be going private again with equity investors understood to be circling the cloud backup and security supplier just 18 months after it listed on the NYSE, with its share price currently languishing below the IPO offer price.

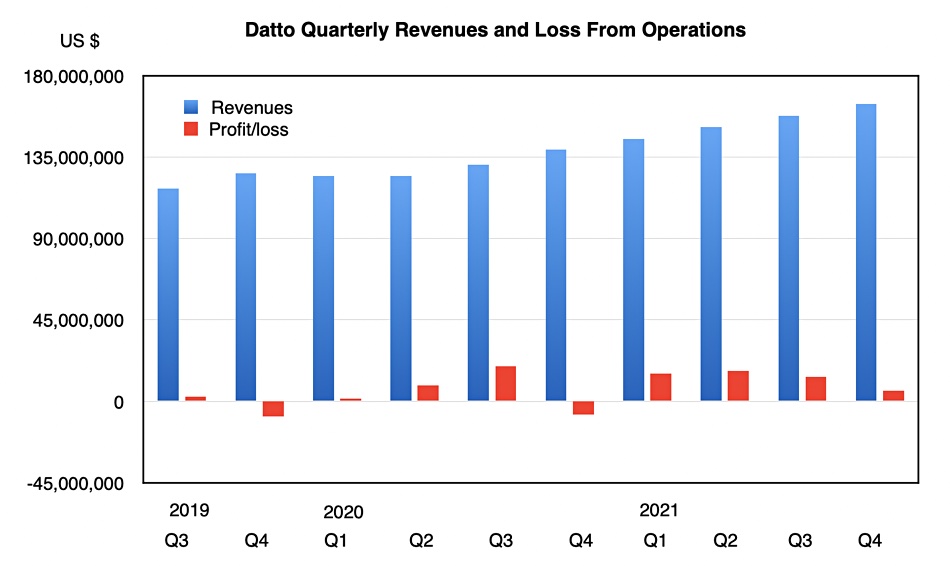

The company sells its cloud services to small and medium businesses through more than 18,500 managed service providers (MSPs). Revenues, including subscription, have grown steadily and Datto has been profitable for all but two quarters since its IPO in October 2020.

Bloomberge reported that Datto has received a takeover approach and was examining strategic options.

William Blair financial analyst Jason Ader told subscribers: “Takeover interest from potential buyers only provides us with greater confidence that the company is positioned as one of the clear leaders in the MSP software space – which is being driven by accelerating secular tailwinds (e.g. shift to remote work, digital transformation, labor shortages).”

A look at Datto’s history shows that it was bought by Vista Equity Partners in October 2020 and that firm still holds 69 per cent of the shares. In calendar Q4 2020, Datto brought in $164.3m and made a $5.7m profit. It has a stated goal of reaching a $1bn run rate in 2024, up from its current $657m, and expects to grow 20 percent annually.

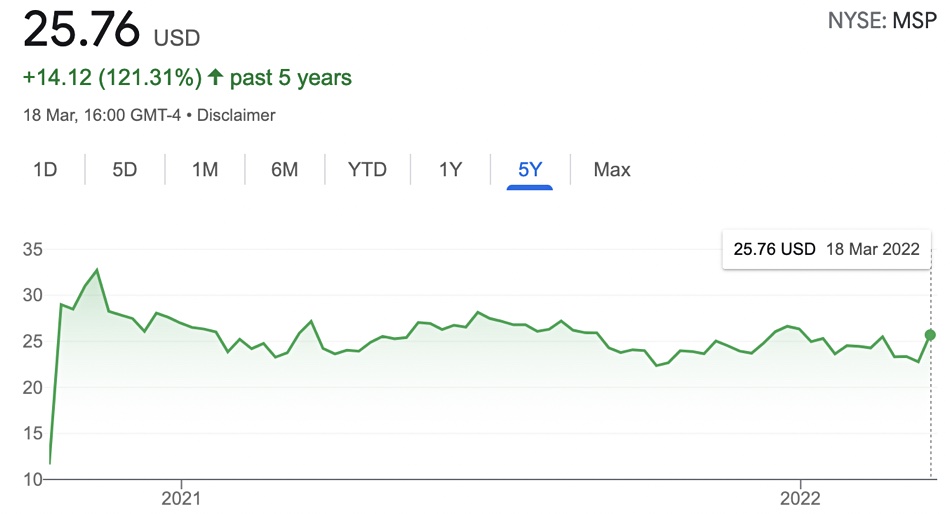

Despite this consistent revenue growth and its profitability, the stock market has not valued the company highly, as its share price history shows:

Datto’s competitors include ConnectWise, Kaseya, N-able, Barracuda, Acronis, and Veeam. Ader suggested that a risk for Datto is that the prolonged COVID-19 pandemic could restrict Datto’s SMB end customers, while another is that the MSP market could consolidate.

Ader reckoned: ”Ultimately, given our view that the MSP market is entering a golden age, we see scarcity value in the story as the top publicly traded, pure-play software vendor leveraged to MSP market trends.”

Datto has a wide, growing, and profitable cloud backup and security services MSP channel to SMB customers. A larger on-premises supplier could see an opportunity here to make a move into the cloud market and add its own services on top of Datto’s to grow its business. Hypothetically, Carlyle-owned Veritas could fit this notion.

Datto history

- 2007 – Started up

- 2013 – $25m A-round

- 2014 – Bought Backupify

- 2015 – $75m B-round

- 2017 – Bought Open Mesh

- Oct 2017 – Bought by Vista private equity and merged with Autotask

- 2020 – Bought Gluh and its real-time procurement platform

- Oct 2020 – IPO at $27.50/share

- March 2021 – Bought BitDam for cyber threat protection tech

- January 2022 – Bought cybersecurity supplier Infocyte

- 21 March 2022 – stock price $25.76 below IPO price

Datto has more than 1,600 employees.