A report by SWZD titled “Hardware Trends in 2022 and Beyond” says that although the public cloud is taking customer spend away from on-premises datacenters, they’re still crucial infrastructure.

The report shows on-premises server spending declined from 33 per cent of 2020 IT budgets to 30 per cent in 2022. By 2023, SWZD (Spiceworks Ziff Davis) expects 50 percent of workloads to run in public clouds, up from 40 percent today. However, hardware still represents the largest IT spending category and physical servers won’t go away. Instead they will evolve to integrate more seamlessly with cloud infrastructure.

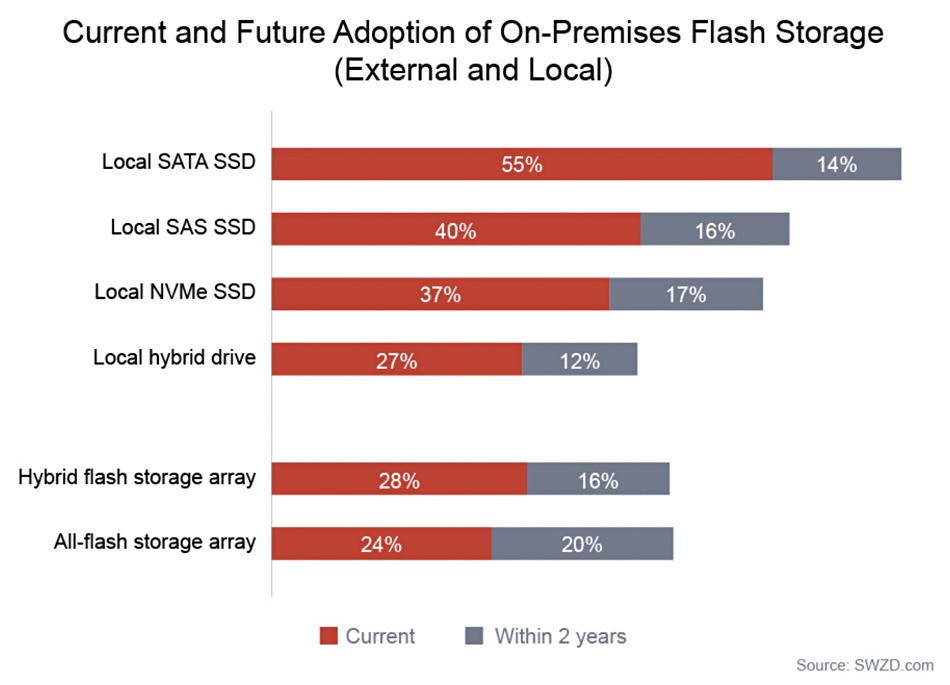

Server-attached SSDs are now growing in popularity. A majority of companies, 55 percent, use SATA-based SSDs in servers, with an additional 14 percent planning to within two years. A minority, 40 percent, use SAS SSDs, with another 16 percent intending to do so within two years.

NVMe SSD use is growing faster. SWZD found that 13 percent of businesses reported using NVMe locally in their physical servers in 2019. That has jumped to 37 percent in the 2022 report and will grow to 54 per cent inside two years.

NVMe adoption has risen even higher to 45 percent of enterprises with 500+ employees.

External flash array storage was used by 14 percent of businesses in SWZD’s 2019 report; 24 per cent currently use them and that will rise to 44 per cent within two years.

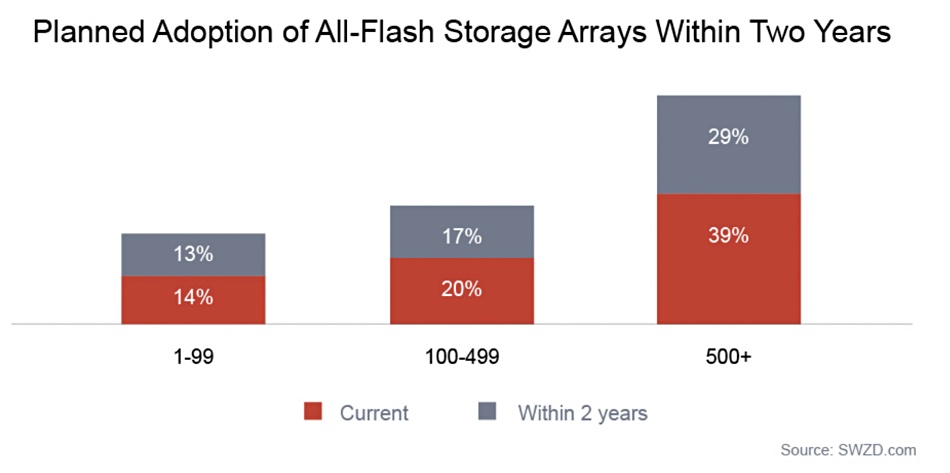

Only 14 percent of the smallest companies (1-99 employees) currently use all-flash storage, compared to 39 percent of larger enterprises.

Other findings in the report concern technology use by percentage of businesses:

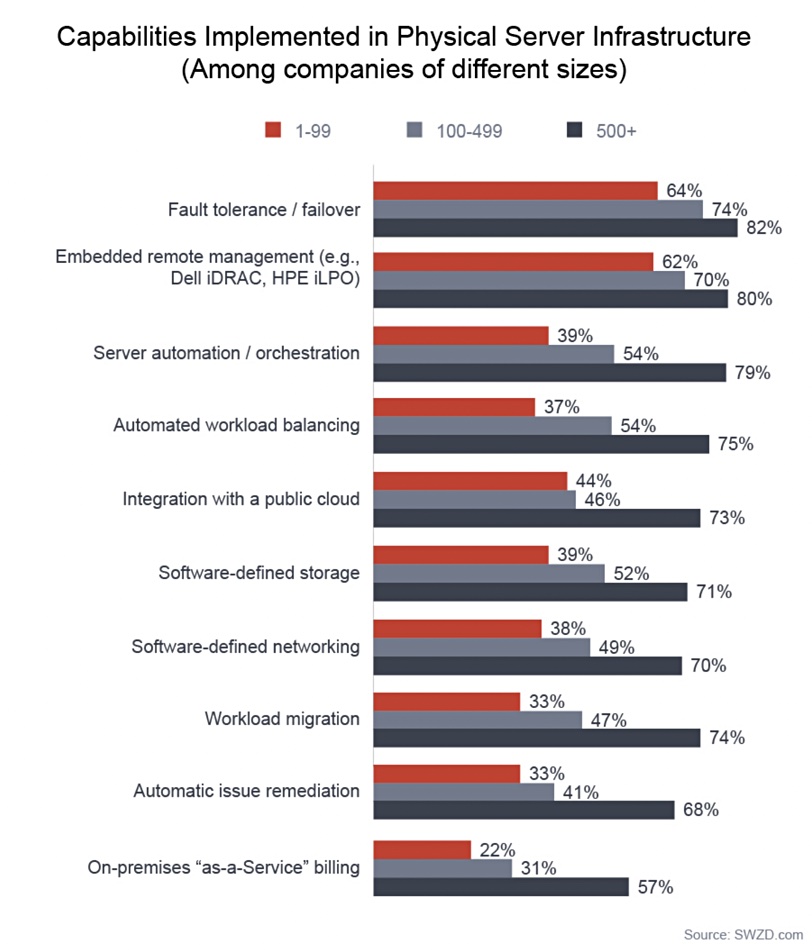

- Software-defined storage (39 percent)

- Server automation/orchestration (37 percent)

- Software-defined networking (36 percent)

- Integration with a public cloud (36 percent)

- Workload migration (34 percent)

Currently, 36 percent of organizations have integrated their on-premises infrastructure with a public cloud. Within two years, an additional 18 percent plan to implement this capability, meaning the majority of companies are expected to have hybrid cloud capabilities by the end of 2023.

Nearly half (49 percent) of enterprises (500+ employees) are hybrid cloud-capable, compared to approximately 29 percent of SMBs (1-499 employees). Enterprises plan to add this capability at a faster rate going forward, with three out of four businesses planning to integrate with a public cloud within two years.

Public cloud-style billing is becoming more popular. Only 25 percent of organizations use this consumption-based infrastructure technology today but 57 percent of enterprises expect to adopt “pay-as-you-go” consumption-based infrastructure by the end of 2023.

Overall, the larger the enterprise, in headcount terms, the faster the adoption of new technology:

Enterprises are looking for more automation and more remote management. Overall there is great encouragement in the report for all-flash array, hybrid flash-disk array, and hybrid on-premises/public cloud infrastructure, particularly for subscription-based offerings such as Dell APEX, HPE GreenLake, and Pure Storage’s Pure1.