More than a year into his tenure as Nutanix CEO, Rajiv Ramaswami is shaping the company into a more sustainable entity, one that looks on course to turn a profit in the not-too-distant future.

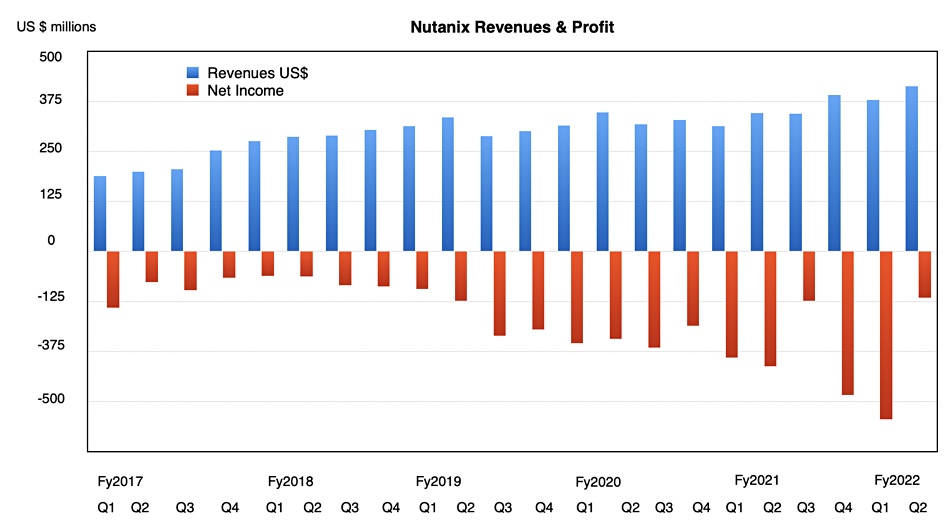

Nutanix has been a heavily loss-making company for several years – aside from a relatively small loss in its third quarter of fiscal 2021 – and as the graph below shows the red ink columns continued to widen into the first quarter of the HCI software player’s fiscal 2022.

However, things are improving: Nutanix registered the smallest loss for 13 quarters in its Q2 FY2022 results for the three months ended 31 January, and vitally it became free cash flow positive for the first time in three years:

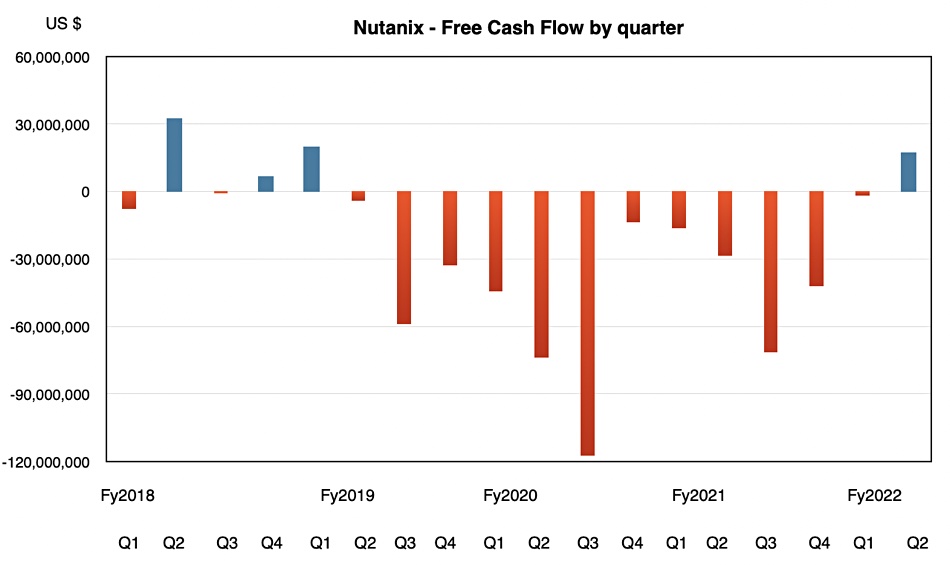

The company started moving away from hardware sales towards a software subscription business model in January 2018 and the effects on free cash flow were dramatic as the chart above illustrates – 12 quarters of cash flow negativity. It burned cash and the result in the second half of 2020 was dramatic.

Founder and CEO Dheraj Pandey retired and was replaced at the top by Ramaswami in December 2020, during Nutanix’s second fiscal 2021 quarter.

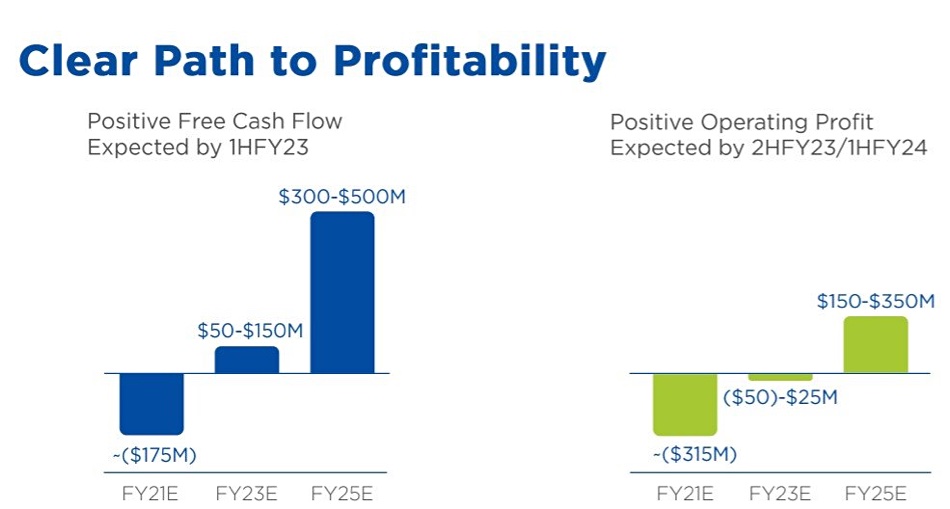

One of his focus areas is profitability, and in June last year Ramaswami said the company had a clear path to profitability at an investor meeting, with positive cash flow forecast for this current calendar year.

One of the positive signs, $17.2m free cash flow in its latest quarter, means more money flowed into Nutanix’s bank accounts than flowed out. If Ramaswami can keep this up, the next big external event signalling Nutanix’s newfound maturity will be a profit, a GAAP profit and not just internal profitability measures.

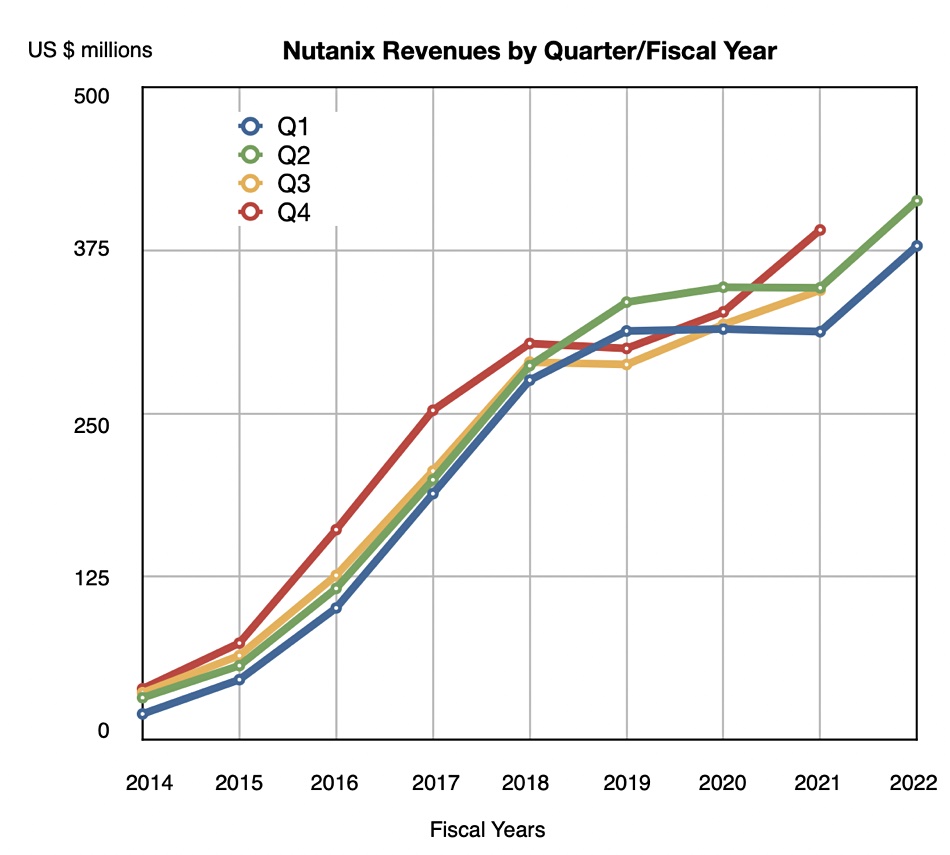

For that to happen the CEO will be trying to boost revenues while keeping tight control of spending. The quarterly revenue growth lines are certainly going in the right direction:

We have had four successive quarters of revenue growth, as the chart above demonstrates. Keep that up and Nutanix could move into profitability inside the next two quarters, absent economic shocks from outside forces.