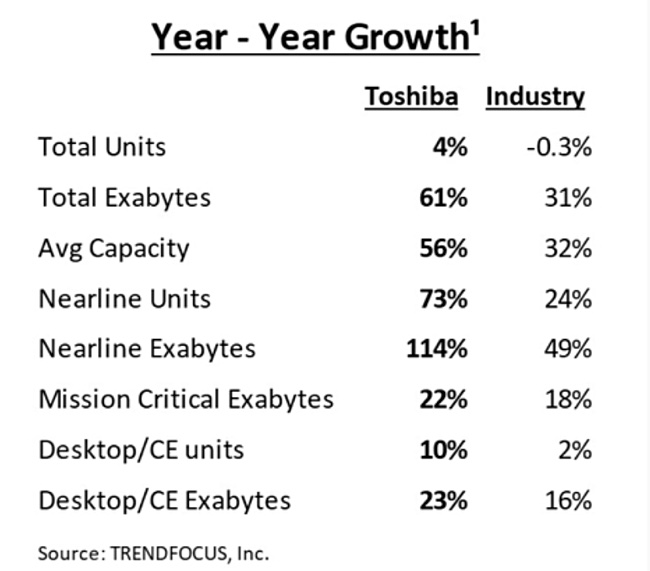

Toshiba was the only one of the big three disk drive manufacturers to increase its unit shipments in 2021, with exabytes shipped rising faster than the market average as well.

Disk unit shipments have been declining for several years as faster SSDs take over from slower, albeit cheaper, disk drives in notebook and desktop computers as well as performance-critical storage arrays. However, within the overall market, the 3.5-inch 7,200rpm (nearline) disk segment has been growing both unit numbers and exabytes shipped – so much so that overall disk capacity shipments have continued to rise while disk unit shipments decline.

US research house TrendFocus tracks the HDD market and its VP John Chen said “Toshiba’s leading year-over-year growth percentages in so many categories are the result of the company’s execution under challenging market conditions. … As some of the ongoing pandemic-related constraints begin to ease, Toshiba has positive momentum to post more milestones in 2022.”

Kyle Yamamoto, VP of Toshiba America Electronic Components’ (TAEC) HDD Business Unit, said “Our new technologies such as FC-MAMR (Flux-Controlled Microwave-Assisted Magnetic Recording) and MAS-MAMR (Microwave Assisted Switching Microwave-Assisted Magnetic Recording) are excellent examples of the effort that will propel the next generation of products forward.”

Toshiba shipped 54.68 million units equaling 187.24 exabytes for the year. It ships product into four products into four market sectors:

- AL series – mission-critical enterprise performance segment;

- MG series – nearline enterprise capacity and datacentre drives;

- MQ series – mobile client HDDs;

- DT series – surveillance and traditional desktop drives (3.5-inch).

TrendForce’s latest report shows that Toshiba grew unit and capacity shipments more than the market average in overall totals, nearline drives (MG series), mission-critical (2.5-inch and 10,000rpm) drives (AL series) and the desktop/consumer electronics (DT series) sectors.

That means competitors Seagate and Western Digital collectively lost share in these market sectors. We envisage that Toshiba was able to better manage its supply chain than the other two suppliers, who both alluded to supply chain issues in their results statements – here’s Western Digital and here’s Seagate.

Toshiba’s 2021 nearline exabytes shipped growth of 114 per cent more than in 2020 looks extraordinary against the industry average of, impressive as it is, 49 per cent.

In the final 2021 quarter Toshiba had a near-20 per cent unit ship share, Western Digital near-37 per cent and Seagate near-43-percent. Toshiba will have to keep growing its share for some time if it wants to get past Western Digital.