…

Datto management believes it is currently the largest pure-play backup software supplier to the MSP market and growing faster than competitors ConnectWise, Kaseya, and N-able. (Thanks to Jason Ader of William Blair.) It think it is well positioned in the long term to capitalise on secular trends toward outsourced IT via the roughly $130 billion managed service provider (MSP) channel. Datto counts more than 18,200 MSP customers (out of an estimated 125,000 MSP providers worldwide), which creates abundant opportunity for deeper penetration. Management is looking to substantially expand its security capabilities over time to fulfil its stated mission of securing all digital assets for its MSP/SMB customers.

…

Quest Software announced GA of SharePlex v0.1.2 which can replicate Oracle databases in real time to MySQL and PostgreSQL. This can be useful when creating mobile or API-based applications, supported by PostgreSQL or MySQL databases, that require data from a legacy Oracle system. SharePlex for PostgreSQL and MySQL supports AWS (RDS and Aurora) and Azure (Azure Database for PostgreSQL and Azure Database for MySQL). It also supports replication to Oracle data warehouses, SQL Server data warehouses, PostgreSQL data warehouses, Kafka, which can then feed other systems, and Event Hubs, which can then feed other systems in the Azure ecosystem.

…

A new release of Raidix’s Era software RAID, version 3.4, provides improved automatic error correcting in case of write hole (inconsistent checksum or data), file drive error monitoring, and support for multi-path NVMe drives.

…

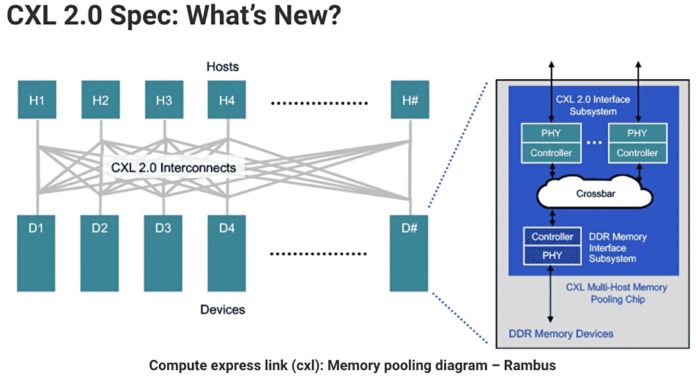

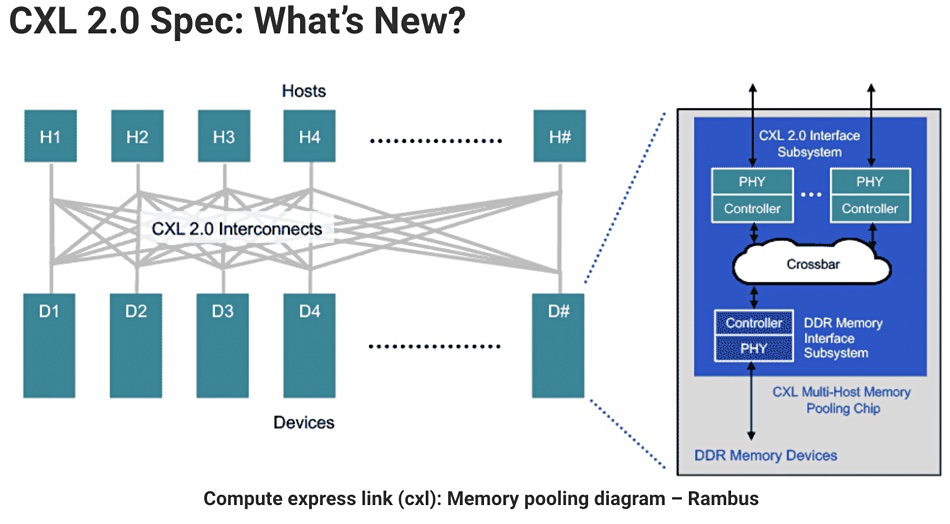

Semiconductor technology developer Rambus has posted a blog about CXL v2.0. It states:”Server architecture — which has remained largely unaltered for decades — is now taking a revolutionary step forward to address the yottabytes of data generated by AI/ML applications. Specifically, the datacentre is shifting from a model where each server has dedicated processing and memory — as well as networking devices and accelerators — to a disaggregated ‘pooling’ paradigm that intelligently matches resources and workloads.” CXL 2.0 supports memory pooling using persistent memory and internal-to-the-host DRAM.

“By moving to a CXL 2.0 direct-connect architecture, datacentres can achieve the performance benefits of main memory expansion — and the efficiency and total cost of ownership (TCO) benefits of pooled memory.”

…

SK hynix’s desire to upgrade its DRAM manufacturing operation in Wuxi, China, by using Extreme Ultraviolet (EUV) lithography equipment to draw finer lines on wafers and thus make denser chips, has had doubt raised over it, according to Reuters. The export of EUV gear to China could fall foul of US State Department rules preventing high tech exports to China.

…

The Taipei Times reports that China’s Alibaba group will lead a consortium offering ¥50 billion ($7.8 billion) to take over the bankrupt Tsinghua Unigroup which makes semiconductor products. There are several Chinese state-backed bids to take over Tsinghua Unigroup, which is seen as important to China’s desire to be self-sufficient in making semiconductor products. It owns, for example, Yangtze Memory Technology Corp.

…

DigiTimes reported Chinese NAND fabber YMTC has improved the yield rate for its 128-layer 3D NAND. Output could reach 100,000 wafers per month in the first half of 2022. That could/would mean lower NAND chip sales in China for Kioxia, Micron, Samsung, SK hynix and Western Digital.

…