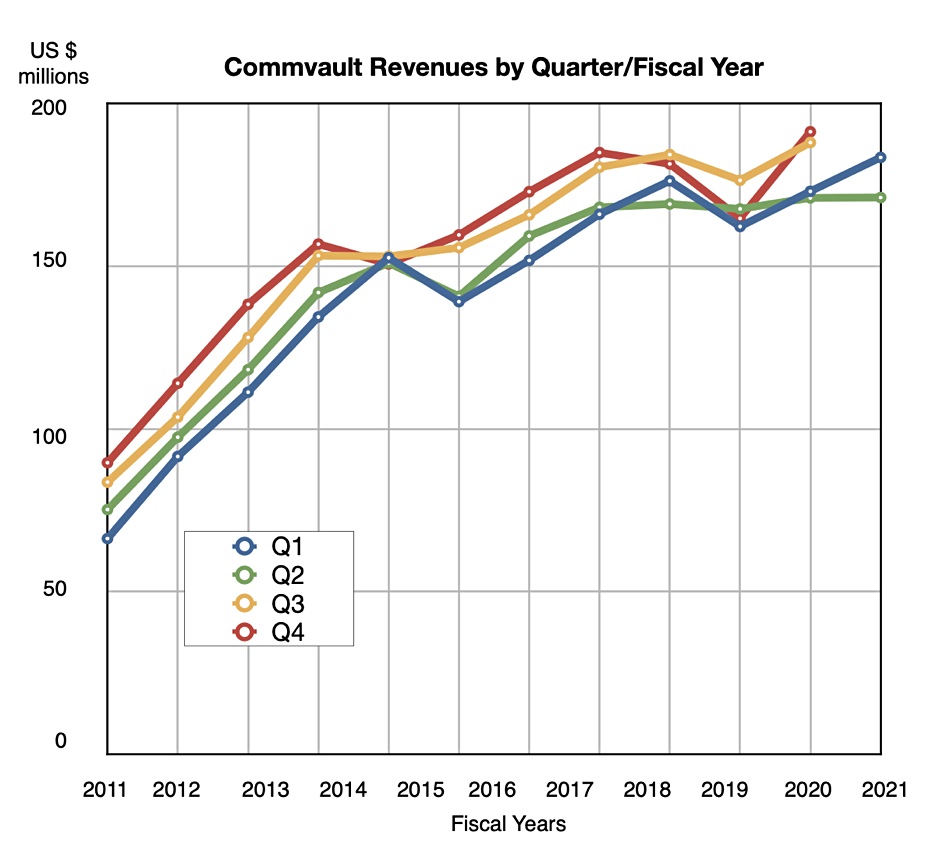

Commvault undershot its revenue expectations in its latest quarter as customers delayed IT transformation projects and suffered from hardware supply chain issues.

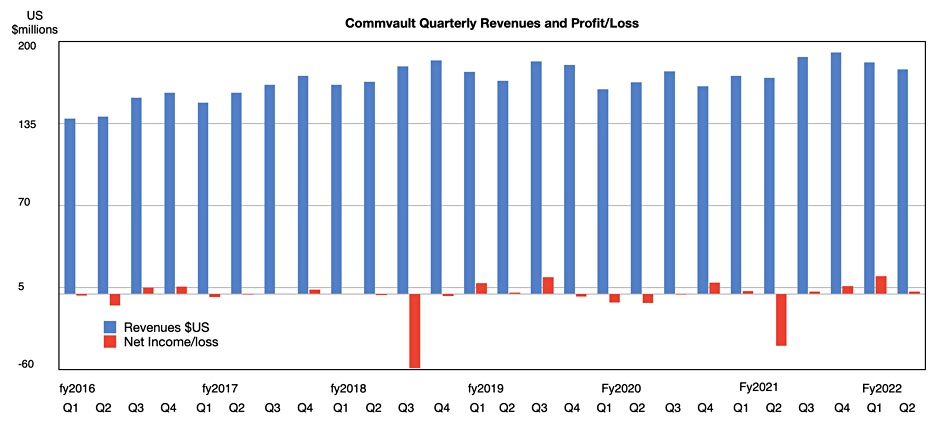

Revenues in its second fiscal 2022 quarter, ended September 30, were $177.8 million — that’s four per cent up year-on-year, but Commvault had expected them to be around $184.5 million. As a consequence, its profit was $1.73 million — far better than the year-ago $41 million loss, but disappointing compared to the prior quarter’s $13.9 million profit. However it is still Commvault’s sixth successive growth quarter.

President and CEO Sanjay Mirchandani said in the results statement “During the quarter we saw a significant increase in new customer revenue. … At the same time, we did not meet our expectations for the quarter.” But he saw good news behind the lower revenue growth.

Reasons to be cheerful

Commvault is transitioning away from hardware to software sales and subscriptions rather than perpetual licenses. Software and products revenue was $75.3 million, up four per cent year-over-year. But, excluding pass-through hardware revenue, software revenue was up nine per cent year over year.

There was a six per cent increase in larger deals — those greater than $0.1 million — and such deals represented 67 per cent of Commvault’s software and products revenue. The downside of this is that delays in large deals affect Commvault proportionately more than before.

CFO Brian Carolan said in the earnings call: “We’re starting to see longer closing cycles as we get into larger IT transformation projects, and we can’t control the hardware delays that are out there.”

Services revenue in the quarter was $102.6 million, up four per cent year-over-year, with this increase driven primarily by Metallic subscriptions. Metallic is Commvault’s Backup-as-a-Service offering and was first introduced a year ago.

According to Mirchandani: “Metallic landed its largest transaction to date, a high six-figure deal that included multiple product offerings.” The total number of transactions involving more than one Commvault product increased 150 per cent year-over-year. About half of its seven-figure software transactions involve multiple products and services.

Total ARR (Annual Recurring Revenue) grew 12 per cent year-over-year to $543 million. Within that category subscription and SaaS ARR grew more than 40 per cent year-over-year to $278 million, representing more than half of total ARR.

Carolan said: “We added well over 200 net new subscription customers in the quarter. We added over 300 Metallic customers in the quarter — 60 per cent of those were new. We [have] now broken through 1,000 total customers for Metallic.”

He noted a subscription revenue achievement: “We’ve been forecasting … that at some point in time, our subscription and SaaS business will overtake and become the majority of our ARR, and that has happened this past quarter. It now represents over 50 per cent and that high growth is growing at greater than 40 per cent per year.”

Take outs

Commvault says it is winning against competitors, with Mirchandani emphasising: “We are driving this growth through market share gains as evidenced in part by Q2 revenue from new customers which finished at the highest level in years.”

He added: “Our largest transaction this quarter, a multimillion-dollar win at one of the biggest healthcare organisations in the world, was a new customer and a competitive displacement. Over 50 per cent of subscription transactions were new logos for Commvault, and more than 60 per cent of Metallic customers were new to Commvault.”

Mirchandani rejected an earnings call suggestion that Commvault was losing out to competitors: ”A good number, two-thirds of our business — the big business we’ve closed last quarter was competitive displacements.”

Analyst caution

Cognisant of Commvault’s history before Mirchandani, of over-promising and under-delivering with contributory sales execution issues, analysts on the call were concerned about a resumption of these historic patterns. The CEO rebutted such worries: “Nothing fundamentally changed with the business. It’s strong, we feel good about it, and we’re focused on getting back to where we were a quarter ago.”

Nevertheless analysts like William Blair’s Jason Ader were cautious: “We worry that rising competitive pressures and uneven sales execution may also be contributing to the recent slowdown in Commvault’s business.”

Commvault is forecasting revenues of about $192 million for the next quarter, a two per cent year-on-year increase, as it sees no immediate improvement in supply chain constraints or large project slowdowns. We think Mirchandani and his team are highly motivated to make it a seventh consecutive revenue growth quarter.