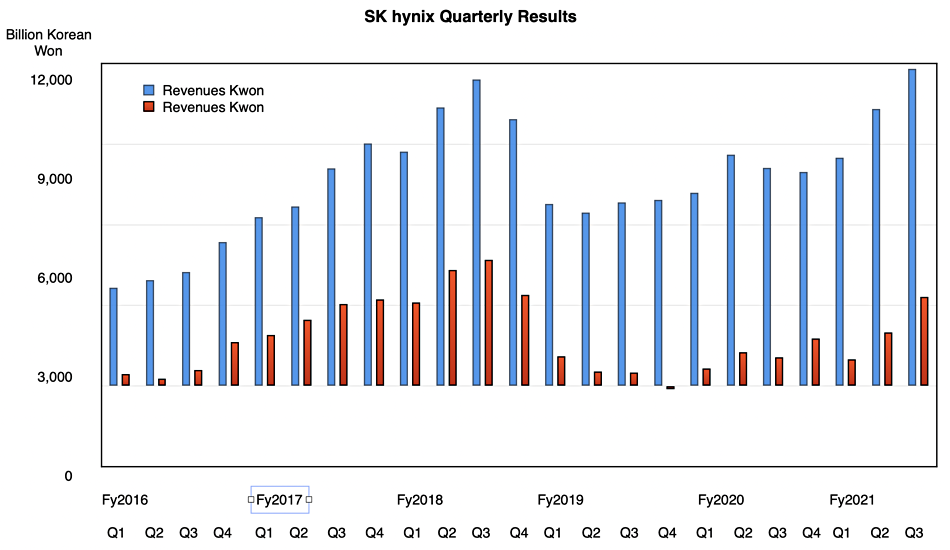

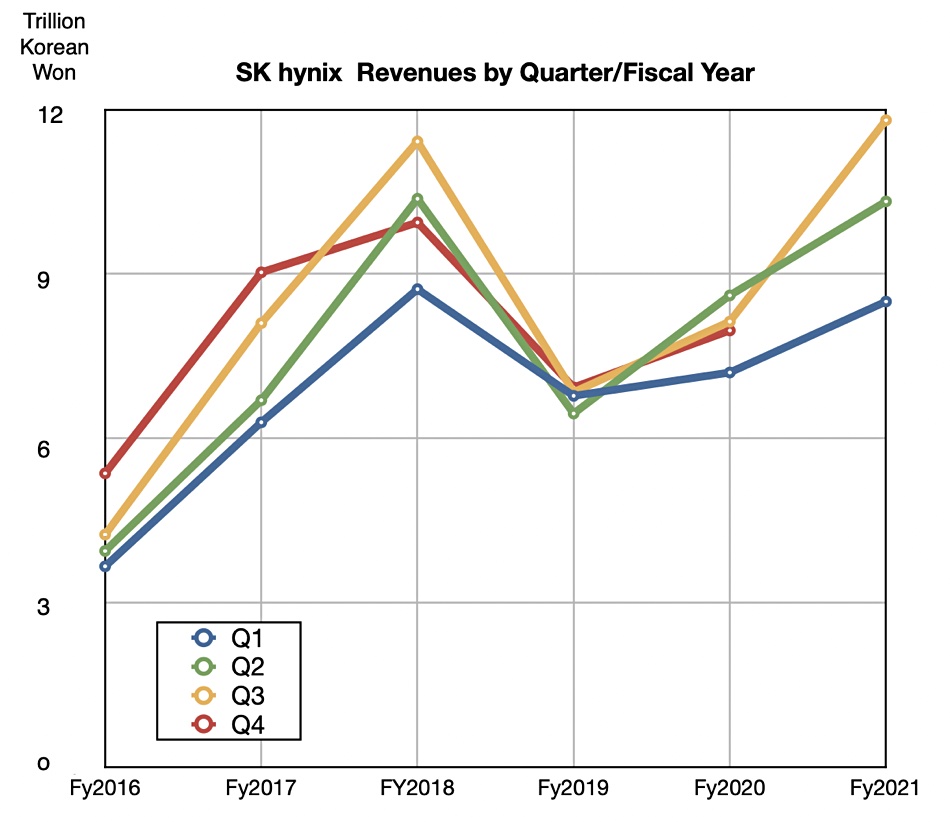

Korean DRAM and NAND supplier SK hynix reported record quarterly revenues on the back of strong semiconductor memory demand, and its NAND business made its first surplus.

Revenues in the quarter ended September 30 were 11.805 trillion won ($10.13 billion), up 45.2 per cent year-on-year, with a profit of 3.3156 trillion won ($2.84 billion) – 206 per cent higher than a year ago.

Kevin (Jongwon) Noh, EVP and Head of Corporate Center (CFO) at SK hynix, issued a results statement, saying: “Despite the concerns over recent global supply chain disruptions, the remarkable quarterly performance signals that the semiconductor memory industry is continuing its growth momentum.”

The company increased its production of leading-edge 1nm DRAM, which saw yield improvements, and 128-layer 4D NAND flash, lowering its product costs relative to DRAM and NAND density. It said 128L accounted for 75 per cent of its quarterly bit output. This, and increased DRAM and NAND demand in the server and smartphone markets, enabled its significant quarterly revenue and profits rise.

It expects demand to stay high, and the NAND business should get even better because of the coming completion of the Intel NAND and SSD business acquisition.

Noh said: “After the completion of the acquisition, SK hynix will establish [a] complementary product portfolio which maximises both companies’ strengths, and seek to achieve economies of scale. For the future SK hynix will expand its R&D foothold and evolve into a global semiconductor memory leader.”

There won’t be a single, combined product portfolio. Instead the individual SK hynix and Intel NAND technologies will stay separate.

Wells Fargo analyst Aaron Rakers added some colour to reported results, telling subscribers: “Hynix reported [a] DRAM bit shipment decline in the low-single-digit q/q range in 3Q21, falling below the company’s expectation of low-single-digit q/q bit growth (driven by PC slowdown).”

NAND bit shipments did the opposite, and Rakers enthused: “Bit ship grew in the low-20 per cent q/q range, which was ahead of the company’s prior expectations of high-teens per cent growth q/q in 3Q21. … Hynix expects its 4Q21 DRAM bit shipments to grow in the mid-/high-single-digit q/q range and NAND bit shipments to grow in the double-digit q/q range.”

More generally, he observed: “Hynix noted that it expects to see improved Chromebook PC demand trends into late-2021/2022, while also pointing to an expectation of improved smartphone demand in 4Q21 and continued strength in server DRAM demand.” The company was: “particularly positive on the demand trends it is seeing in enterprise SSDs (eSSDs), which continues to be somewhat constrained by component supply.”

It looks like the boom times for SK hynix are set to continue; its product and company strategies are winning in won terms.