…

Japan’s Nikkan Kogyo newspaper reports Micron is going to spend up to ¥800 billion ($6.98 billion) on a new fab at Higashihiroshima city in the Hiroshima prefecture, Japan, near its existing fab there. The Japanese government could contribute to the cost. The plant would start outputting DRAM wafers in 2024 and employ 2,000 to 3,000 workers. Micron did not comment.

…

Veritas Technologies announced NetBackup Recovery Vault, a fully-managed storage as a service data repository for NetBackup. Generally available later this year, Recovery Vault will provide ransomware resiliency as a purpose-built, [virtual] air-gapped storage tier for backups, while reducing the cost and complexity of using cloud storage from a selection of leading providers for long-term retention and recovery of backup data. NetBackup is the management and cloud storage provisioning interface.

…

William Blair analyst Jason Ader runs a periodic VAR survey. His October-quarter survey of 111 VARs revealed a steadily improving demand environment, with more (and larger) projects getting approved and better quoting activity. Project velocity has not slowed down and long hardware lead times are driving more customers to place orders early. The lead times have lengthened — three to seven months for many products — with network devices (switches, access points, network firewalls) and endpoints seeing the worst delays. The gap between bookings and billings is the highest in memory and most hardware vendors have raised prices to account for component price increases, which is exacerbating customer and VAR frustrations.

…

Ader’s VAR survey revealed NetApp is taking market share. VARs said NetApp’s market momentum and share gains are continuing, with multiple seven- and eight-figure wins. The general view in the storage space is that in 2020 customers delayed refreshing storage arrays in favor of higher-priority items. A year later, customers have resumed spending on storage to keep pace with data growth, refresh aging infrastructure, and support IT modernization initiatives. While long-term headwinds to on-premises storage have not gone away, people may be underestimating the staying power of on-premises storage, especially for mission-critical, data-intensive workloads where cloud costs can be prohibitive.

…

TrendForce says contract prices of NAND Flash products are expected to undergo a marginal drop of 0–5 per cent quarter-on-quarter in Q421 as demand slows. The current cyclical upturn in NAND Flash prices will have lasted for only two consecutive quarters. NAND Flash suppliers appear likely to downsize their capacity expansion activities for 2022, resulting in a 31.8 per cent year-on-year increase in NAND Flash bit supply next year. Annual bit demand is projected to increase by 30.8 per cent year on year. With demand being outpaced by supply, and competition intensifying among suppliers for higher-layer products, the NAND Flash market will likely experience a cyclical downturn in prices in 2022.

…

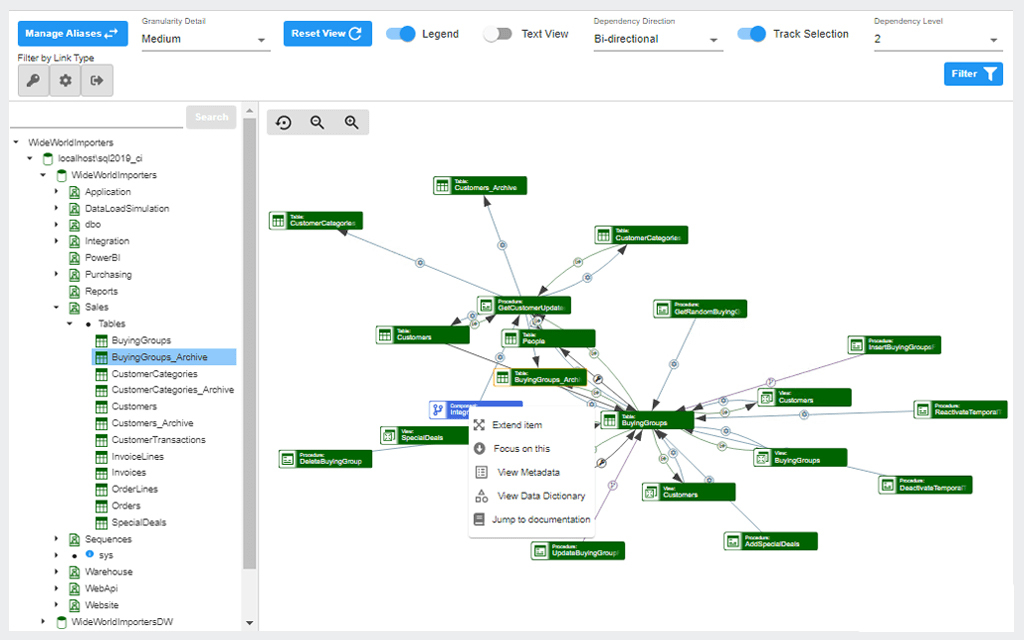

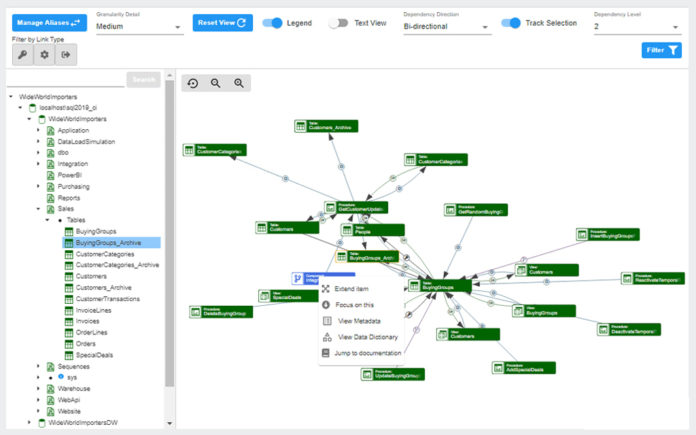

SolarWinds introduced SolarWinds Database Mapper for DataOps staff, providing a one-stop shop for data teams to maintain current documentation and visually track data dependencies and comparisons across the environment, streamlining data projects. Database Mapper includes support for Oracle, MySQL, and PostgreSQL databases. It’s available on-premises or as a SaaS offering and can be bought from the Azure Marketplace.