HPE has announced additions to its GreenLake subscription offerings, marking the company’s shift into direct competition with public cloud data warehouses like Snowflake and SaaS-based data protectors such as Cohesity, Druva, HYCU and others.

We are told this represents HPE’s entry into two large, high-growth software markets — unified analytics and data protection — and accelerates HPE’s transition to a cloud services company. HPE announced GreenLake for analytics with Ezmeral Unified Analytics and an Ezmeral Object Store, GreenLake for data protection with disaster recovery (DR) and backup cloud services, and a professional services-based Edge-to-Cloud Adoption Framework. No HPE announcement is complete these days unless it includes the phrase “edge-to-cloud” — preferably several times.

Antonio Neri, HPE president and CEO, said: “The $100 billion unified analytics and data market is ripe for disruption, as customers seek a hybrid solution for enterprise datasets on-premises and at the edge. … The new HPE GreenLake cloud services for analytics empower customers [and] gives them one platform to unify and modernise data everywhere. Together with the new HPE GreenLake cloud services for data protection, HPE provides customers with an unparalleled platform to protect, secure, and capitalise on the full value of their data, from edge to cloud.”

HPE’s GreenLake platform now has more than 1200 customers and $5.2 billion in total contract value, and is growing. In its most recent quarter, Q3 2021, the Annualised Revenue Run Rate was up 33 per cent year-over-year, and as-a-service orders up 46 per cent year-over-year.

Unified analytics

HPE reckons to take on the big beasts in the cloud data warehouse and data lake market — like Snowflake and Databricks — who use proprietary technology, by offering a cloud-native, open-source software base with no lock-in. It has a two-pronged approach, offering Ezmeral-branded Unified Analytics and Data Fabric Object Store. These are available as services or software, deployed on-premises, in the public cloud or across a hybrid environment.

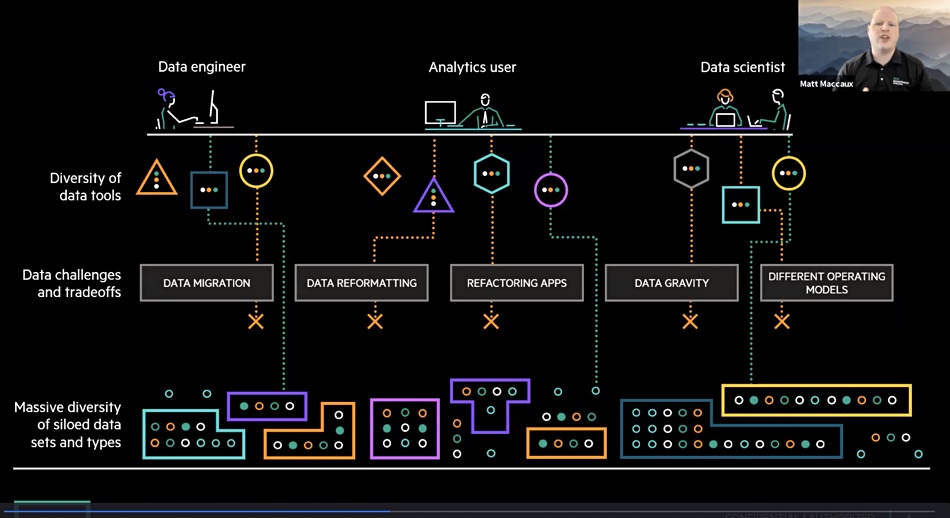

Matt Maccaux, the global CTO for Ezmeral SW at HPE, said that different analytics users — data engineers, analytics users and data scientists — faced a massive diversity of siloed data sets and types. Ezmeral Unified Analytics has a common set of application tools, is usable by all three kinds of user and based on an underlying data fabric file and object store.

There are three Ezmeral offerings accessing this:

- Ezmeral Runtime Essentials and Enterprise Editions — an orchestrated Kubernetes app modernisation platform;

- The new Ezmeral Unified Analytics — a hybrid lakehouse offering for analytics and machine learning (ML);

- Ezmeral ML Ops — integrated ML workflows, which Maccaux called the crown jewels.

The existing Ezmeral Data Fabric file and streaming data store has been used here, but the object store is new and can run on-premises or in the cloud. It can store files and streaming data as well as objects, and supports the S3 API.

Maccaux said it did not use MinIO technology, nor Scality’s: “We wrote our own object store abstraction and it’s based upon some of the underlying technology of the data fabric.” We understand it is cloud-native and optimised for small file performance — think 100-byte objects placed on NVMe flash, which are then aged into larger objects on slower storage.

Data protection

HPE is entering the rapidly growing Data Protection-as-a-Service market with GreenLake for Data Protection. This consists of two offerings:

- GreenLake for Disaster Recovery — this uses acquired Zerto’s journal-based Continuous Data Protection (CDP) technology for disaster recovery, backup, and application and data mobility across hybrid and multi-cloud environments. It helps customers recover in minutes from ransomware attacks.

- GreenLake for Backup and Recovery — backup as a service built for hybrid cloud with integrated snapshot, on-premises backup, and cloud backup. It provides policy-based orchestration and automation and protects customers’ virtual machines. HPE says it eliminates the complexities of managing and operating backup hardware, software, or cloud infrastructure.

The HPE Backup and Recovery Service code consists of new cloud-native micro services, along with existing Aruba Central, HPE Catalyst and HPE Recovery Manager Central code.

HPE storage czar Tom Black wrote in a blog, which we saw pre-publication, “With HPE GreenLake for data protection, now customers can secure their data against ransomware, recover from any disruption, and protect their VM workloads effortlessly across on-premises and hybrid cloud environments.”

The Edge-to-Cloud Adoption Framework is a professional services-led set of capabilities to help customers adopt HPE GreenLake offerings. It addresses eight domains which HPE says are critical to the strategy, design, execution, and measurement of an effective cloud operating model: Strategy and Governance, People, Operations, Innovation, Applications, DevOps, Data, and Security.

HPE supplies an AIOps for infrastructure offering, InfoSight, that constantly observes applications and workloads running on the GreenLake platform. A new capability, called HPE InfoSight App Insights, detects application anomalies, provides prescriptive recommendations, and keeps the application workloads running disruption-free.

Ezmeral Unified Analytics should become available in the first half of 2022.

Comment

Neri is in a tremendous hurry to transform HPE into a data services-led company, and boost GreenLake’s revenues. He has changed its leadership, recruiting VMware exec Fidelma Russo as CTO and effective GreenLake head. The move into analytics and head-on competition with Snowflake, Databricks and others is a massive bet that HPE, with an open-source unified offering can offer a compelling choice to customers who are no doubt feeling pressured to jump aboard the analytics juggernaut.

The move into SaaS data protection is much less of a risk. This market is, unlike the cloud analytics market, nowhere near being dominated by elephant-sized players. Zerto has good DR technology and HP acquired a failing company with tremendous promise. The SaaS data protection field is comparatively young. Dell has made its entry by OEMing Druva, and competitors such as Commvault (with Metallic), HYCU, Cohesity, Rubrik and others are not out of reach. If HPE’s backup service is good then it should grow nicely and penetrate HPE’s customer base.

Analytics is the one to watch. Snowflake is busily and effectively building out an ecosystem and marketplace around its offering. HPE will need to match that with its Ezmeral marketplace.

Game on.