The SmartNIC revolution is going to be a slow-burn one, with Gartner predicting there will only be $1.6 billion of sales in 2026, up from $50 million in 2020.

Wells Fargo analyst Aaron Rakers passed on a Gartner report summary to subscribers, saying: “Gartner forecasts that shipments of SmartNICs (also known as DPUs and IPUs) will grow 18x from 2021 to 2025 as data centres move from top of rack (TOR) switches to SmartNIC leaf switches.”

A SmartNIC (Network Interface Card) or DPU (Data Processing Unit) has processing power and software to look after network, storage and security functions currently managed by the NIC host server or dedicated devices. It is worth putting these functions in a SmartNIC because, in larger data centres with hundreds if not thousands of servers, an increasing amount of network traffic is solely between servers (so-called east-west traffic) and not between applications in servers and customers, partners, etc. outside the data centre (north-south traffic).

Example SmartNIC products are NVIDIA’s BlueField-2 card, Intel’s IPU products, Xiliinx’s Alveo FPGA, Nebulon’s SPU and chips made by Pensando and Fungible.

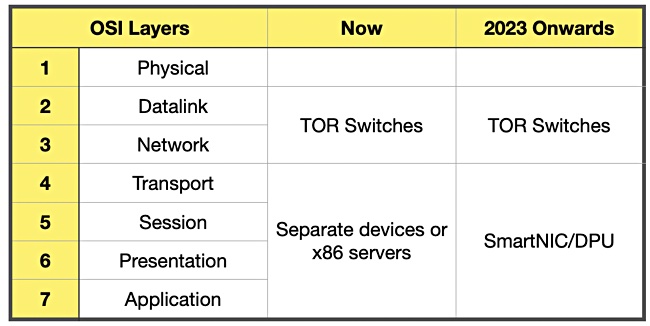

A Juniper blog discussed how SmartNICs offload layer-4 to -7 network processing in the OSI model from host servers:

If we take the easy-west network traffic off host servers and have SmartNICs handle it instead then the x86 servers have more cycles that can be used by applications. The Gartner forecast suggests that the number of server and hypervisor licenses can be reduced by between ten per cent and 30 per cent because internal data centre networking, storage and security workloads can be offloaded to the SmartNICs.

In April this year Gartner estimated that, by 2023, one in every three network interface cards shipped will be a SmartNIC, according to the Juniper blog. Intuitively it feels as if the SmartNIC market has cooled from this level.

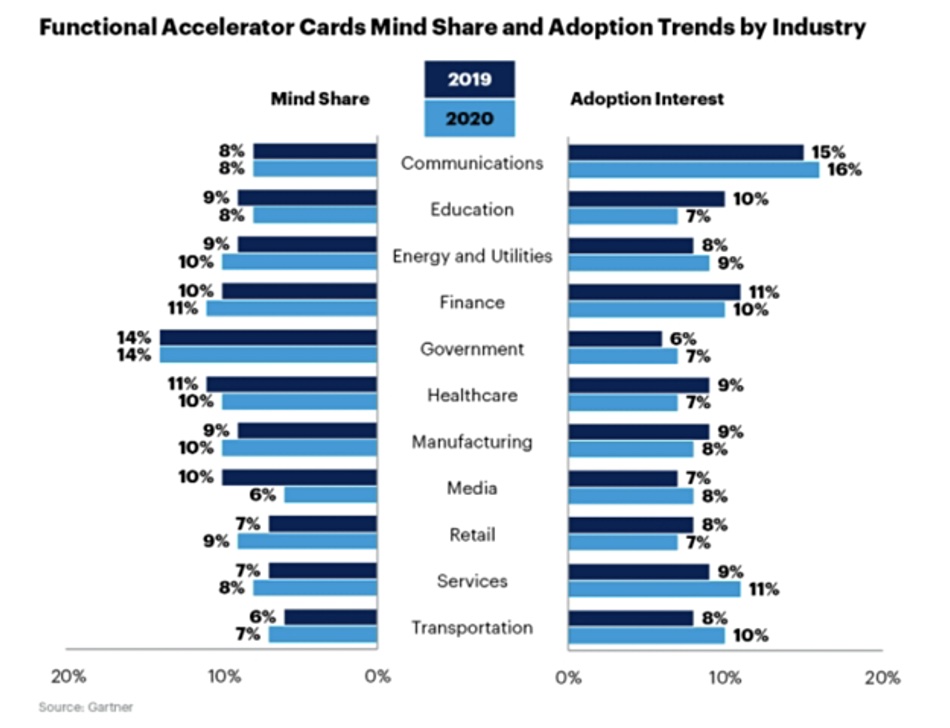

The Gartner forecast included a chart showing market sector interest in SmartNICs:

The right-hand bars show that SmartNIC adoption waned from 2019 to 2020 in the education, finance, healthcare, manufacturing and retail market sectors — possibly as hype gave way to reality. That would slow down SmartNIC adoption. The communications sector has, unsurprisingly, the highest interest in SmartNICs with, Rakers says, “use cases like virtual 5G routing, switching, and user plane functionality targeted.”

Intel says it has the leading share of SmartNIC sales in the hyperscaler market, and that is cross-sector as far as the Garner chart is concerned. It’s also a niche. A thumping great big one, but a niche nonetheless. The Gartner slow SmartNIC market growth forecast indicates that enterprise on-premises adoption of SmartNICs is going to be a low-temperature one, and not a raging fire.