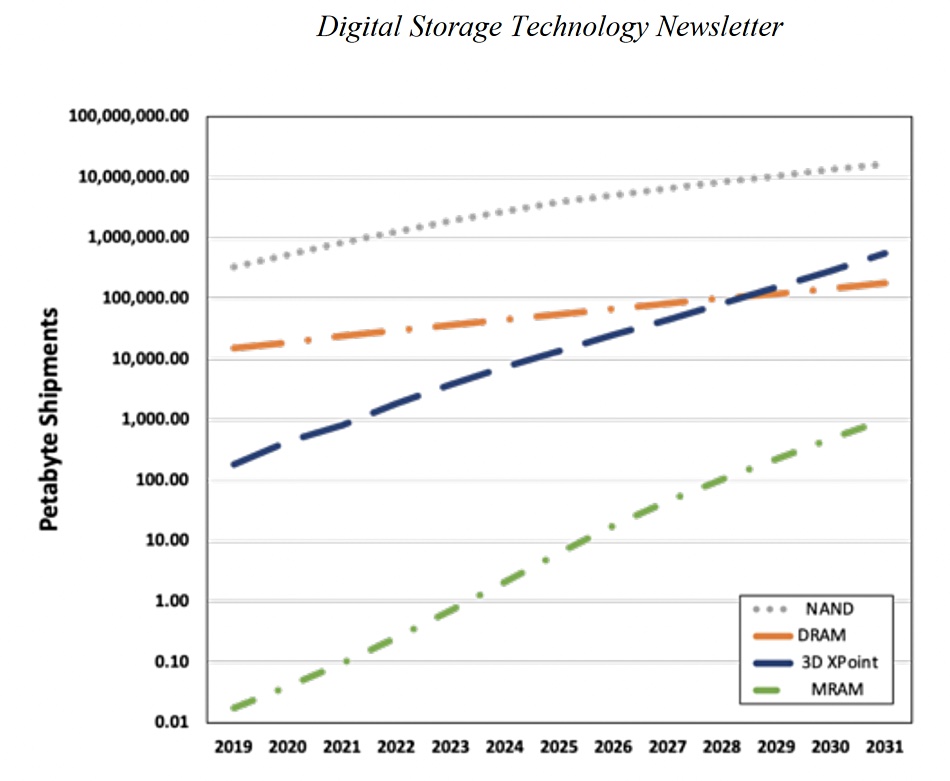

Analysts are predicting Intel’s Optane 3D XPoint memory capacity ships could exceed those of DRAM in 2028.

Update: Jim Handy points added. 7 September 2021.

We have just learned about a report by Coughlin Associates and Objective Analysis called Emerging Memories Take Off, courtesy of Tom Coughlin. The report looks at 3D XPoint, MRAM, ReRAM and other emerging memory technologies and says their revenues could grow to $44 billion by 2031. That’s because they will displace some server DRAM, and also NOR flash and SRAM — either as standalone chips or as embedded memory within ASICs and microcontrollers.

The emerging memory market is set to grow substantially with 3D XPoint revenues reaching $20 billion-plus by 2031, and standalone MRAM and STT-RAM reaching $1.7 billion in revenues by then. The report predicts that the bulk of embedded NOR and SRAM in SoCs will be replaced by embedded ReRAM and MRAM.

A chart shows XPoint capacity ships crossing the 100,000PB level in 2028 and so surpassing DRAM, whose capacity growth is slowing slightly.

The chart shows XPoint capacity shipped being 1000PB this year. That number will grow 100x to 100,000PB in 2028.

Jim Handy

We asked Jim Handy, the Objective Analysis co-author of the report, about how they came to their XPoint revenue amount.

He told us: “3D XPoint shouldn’t need a lot of wafers to achieve high revenues. You may recall that, during the technology’s 2015 introduction, Intel and Micron said that it would be “10 times denser than conventional memory” (meaning DRAM). That means that it takes 1/10th as many XPoint wafers as DRAM wafers to make the same number of exabytes.”

We should note though: “That said, the Objective Analysis 3D XPoint forecast is admittedly optimistic. It’s based on a server forecast that is ordinary enough, then makes assumptions about the acceptance of 3D XPoint DIMMs in those systems (officially known as “Optane DC Persistent Memory Modules”). Optane SSDs are not a big part of the equation, although they are getting more traction in data centers than they did in PCs.

“By the end of the forecast period (2031) we assume that XPoint DIMMs will have penetrated a little over 50 per cent of all servers, and that the majority of the memory in those servers will be Optane DIMMs, with a much smaller DRAM for the really fast work, much like a cache.”

Where will Intel get the manufacturing capacity as its Rancho Rio plant, where Optane chips are made, is more of a development fab than a mass-production facility?

Handy tells us: “Given Intel’s manufacturing aspirations, Rio Rancho should be a very tiny portion of the company’s production by 2031. If XPoint volume gets high enough the economies of scale will drive down the costs and make it profitable, which XPoint has not been to date. If it’s profitable, then other companies will be interested in producing it, should Intel choose to source it externally.

“This all depends on Intel’s success in getting major server purchasers to adopt Optane, and on Intel’s willingness to continue to subsidize the technology. Both are difficult to predict.”

This puts Micron’s March 2021 withdrawal from the XPoint market in a new light. Did it have different figures for XPoint capacity growth?

Handy thinks: “I believe that Micron in 2015 expected for the XPoint market to develop faster than it did, and for Optane SSDs to be better accepted than they have been. With the lack of a sufficiently large market, and with the subsequent lack of the economies of scale, Micron had no clear path to profits. It’s unsurprising that the company dropped out of that business.”