Hyper-converged and platform SW vendor Nutanix announced beat-and-raise revenues and subscription growth in its fourth fiscal 2021 quarter and made a thumping loss — equivalent to 92 per cent of its revenues.

Put another way, for every dollar of revenue it lost 92 cents in costs. Here’s the summary for the quarter ended July 31:

- Q4 revenues — $390.7 million, up 19 per cent year-on-year;

- Q4 loss — $358.2 million, compared to $185.3 million a year ago;

- FY2021 revenues — $1.39 billion, up six per cent;

- FY2021 loss — $1.03 billion compared to $872.9 million a year ago.

And yet its results were great, despite the losses, as President and CEO Rajiv Ramaswami explained in his announcement quote. “Our fourth quarter was a strong end to an excellent fiscal year, which was marked by consistent execution and solid progress across both financial and strategic objectives. We have entered our fiscal 2022 with good momentum and a solid plan for growth.”

William Blair analyst Jason Ader opined: ”The firm’s sharp focus on fewer, bigger bets on the product side and enhancing its solution selling capabilities and partner leverage on the go-to-market side appear to be paying off — in the form of better win rates, larger deals, and improving gross and net retention rates.”

He noted Nutanix is seeing strong traction for its unified storage, desktop-as-a-service (Frame), and database lifecycle management (Era) solutions.

The 19 per cent revenue growth was Nutanix’s fastest growth in the last three years. The company gained 700 new customers in the quarter, taking its total to 20,130. The even better news was about its subscription business.

- Annual recurring revenue — $878.7 million, up 83 per cent on a year ago;

- Annual Contract Value (ACV) billings — $176.3 million, up 26 per cent;

- Net dollar retention rate — 124 per cent.

CFO Dustin Williams said: “In fiscal 2022, we expect our growing base of low-cost renewals will drive further improvements in top and bottom line performance.” That’s because a contract renewal costs Nutanix 80 per cent less than selling a new product or winning a new customer.

The company is also selling more products on top of its base hyper-converged software to each customer. New ACV bookings from emerging products grew 100+ per cent year-over-year with a record attach rate of 41 per cent.

The lifetime bookings numbers improved, with 1512 customers spending more than $1 million with Nutanix — up from 1433 last quarter and 1207 a year ago. Basically more customers want more Nutanix products and stick with the company.

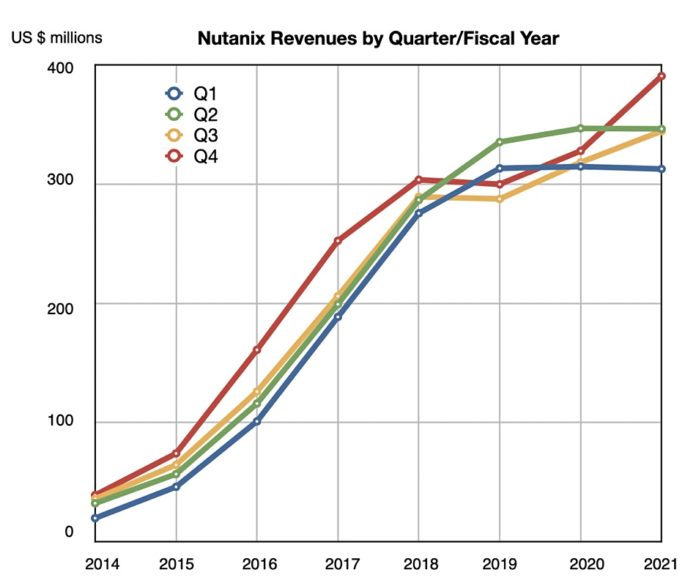

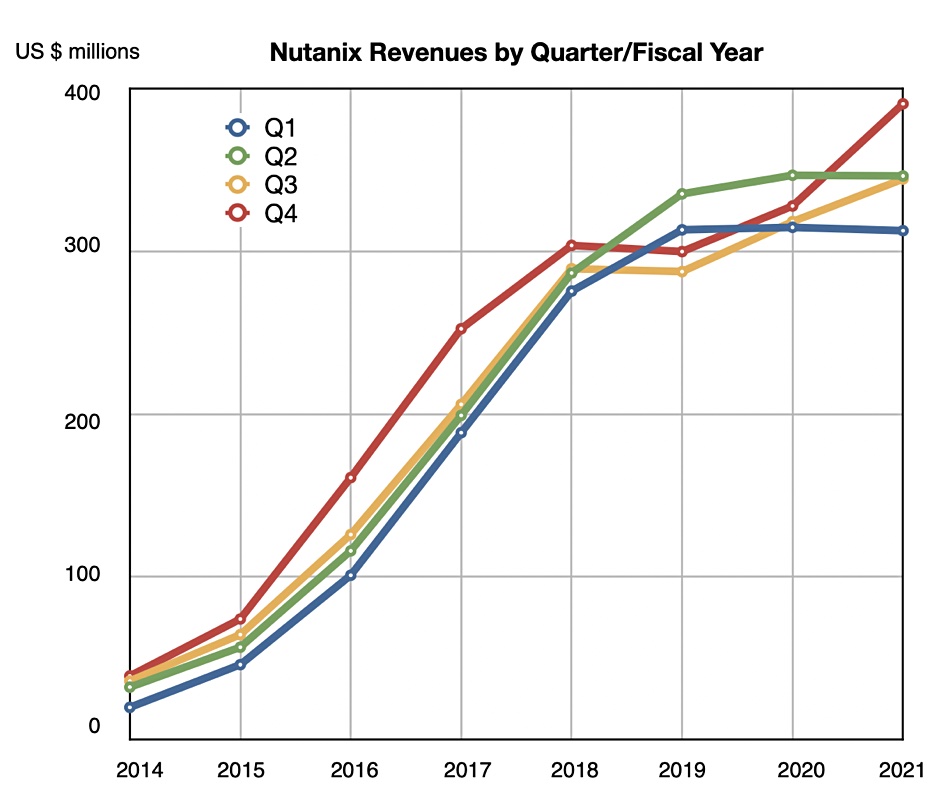

We spotted a sharp uptick in its Q4 FY20 to Q4 FY21 revenue growth rate (top right red line in chart below):

Wells Fargo analyst Aaron Rakers told subscribers: “The company … reiterated an expectation of driving toward positive non-GAAP EBIT and FCF in F2023,” which indicates GAAP profitability is still some way off — 2024 perhaps, maybe 2025. So long as Nutanix keeps on growing it can keep on burning cash until profitability rises to and beyond the burn rate.

Ader said: “Management continues to view its rapidly approaching renewal opportunity as the key to unlocking operating leverage and achieving its target of free cash flow breakeven in the next 12–18 months (as well as operating profit in calendar 2023).”

Free cash flow (FCF) from operations was -$42 million, compared to -$14 million a year ago. Nutanix says FCF in FY2021 was -$158 million and will be $50 million to $150 million in FY2023 and $300 million to $500 million in FY2025

Rakers reckons the average annualised revenue per average sales and marketing employee at $554K in Q421 was up from an estimated ~$468K in the prior quarter.

Cash and cash equivalents were $285.7 million at quarter end, down from the $318.7 million reported a year ago.

Nutanix reckons to pull in between $172 million and $177 million in ACV billings next quarter, up 26.4 per cent year-on-year. It didn’t provide a revenue guide for next quarter — but analysts were happy. So were investors. The stock rose from $36.95 on September 1 before the results came out to $40.85 today.