The attempt by Western Digital to merge with/take over its flash fab joint venture partner Kioxia has led many storage buffs to think about NAND industry consolidation, down to just three suppliers, if the DRAM and disk drive industry examples apply.

Who might they be and how might we get there?

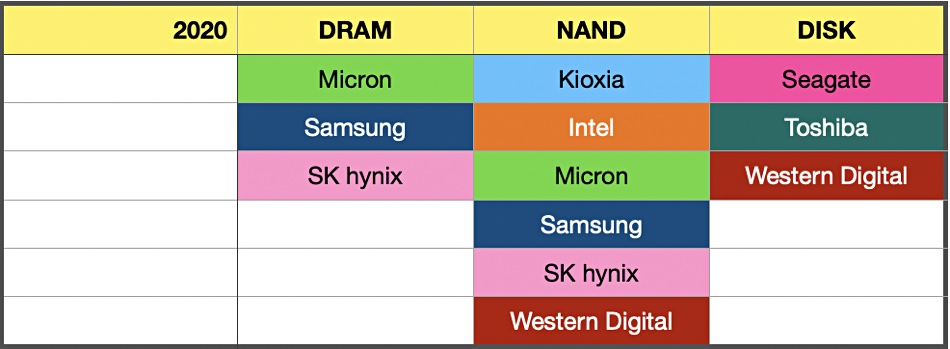

Currently we have six NAND suppliers compared to just three DRAM and three disk drive suppliers:

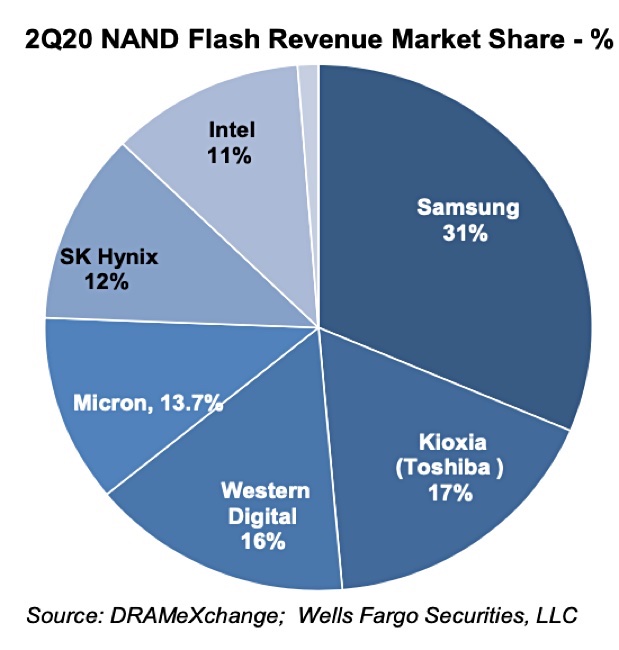

Their shares of the NAND market look like this:

Samsung leads with 31 per cent. SK hynix intends to buy Intel’s NAND business over the next five years, and that would give an SK hynix/Intel entity a 23 per cent share — smaller than Samsung but larger than anyone else.

Were Western Digital and Kioxia to join together then they would have a combined 33 per cent share, overtaking Samsung and leaving Micron smallest and last with 13.7 per cent.

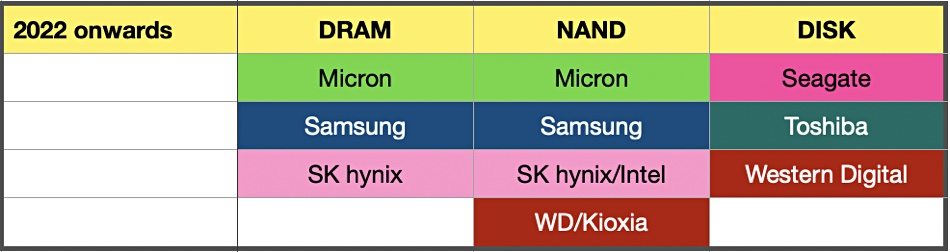

We can see that a WD/Kioxia combo has no DRAM manufacturing capability, whereas fellow flash fabbers Samsung and SK Hynix both do. Might it not make sense then for Micron to join with Kioxia/WD to bulk up its NAND business and enable WD/Kioxia to get into DRAM?

We would then arrive at a three-player NAND market with the WD component also making disk drives and looking a very strong company indeed.