Quantum grew first quarter fiscal 2022 revenues 22 per cent year-on-year with a high hyperscale customer order rate and a growing backlog due to supply constraints. It is bringing out a cold storage-as-a-service offering and an offline anti-ransomware product codesigned with a hyperscaler customer.

The media, entertainment and life sciences unstructured data lifecycle management supplier provides primary, secondary and archive file/object storage services integrated with customers’ workflow procedures. Revenues in the quarter ended June 30 were $89.1 million compared to $73.1 million a year ago. There was a loss of $4.l2 million — much better than the year-ago $10.7 million loss.

Chairman and CEO Jamie Lerner’s results statement said: “Demand in the first fiscal quarter continued to be strong, with a significant sequential increase in customer orders. A large majority of these orders were from hyperscale customers for products that are most affected by the current supply constraints. This dynamic has caused our backlog to reach unprecedented levels.”

The backlog has grown to $30 million. It was $14 million, in the prior quarter and $2 million in the year-ago quarter. Network HW supplier Arista complained of semiconductor supply issues a few days ago, and attributed them to the pandemic. Quantum is similarly affected by a single supplier/country sourcing arrangement in the component supply area for tape libraries.

Lerner said the “supply constraints have created near-term revenue headwinds”. He expects the physical supply backlog to go back down to a $2 million to $3 million level, but he wants to grow the subscription-type backlog, meaning rateable, deferred revenue.

The hyperscale business is for Quantum’s tape products, and these are the ones most affected by the component supply difficulties. The supply difficulties could start to ease in the second and third quarters with some improvement this quarter.

Financial summary

- Total operating expenses: $37.3M vs $36.6M a year ago;

- Cash and cash equivalents: $24.6M vs $33.1M last quarter;

- Outstanding long-term debt: $81.3M vs $90.9M last quarter lowering annual interest expense by $7M;

- Product revenues: $52.1M vs $39.7M a year ago;

- Service revenues: $32.8M vs $30.4M a year ago;

- Royalties: $4.14M vs $3.23M last year.

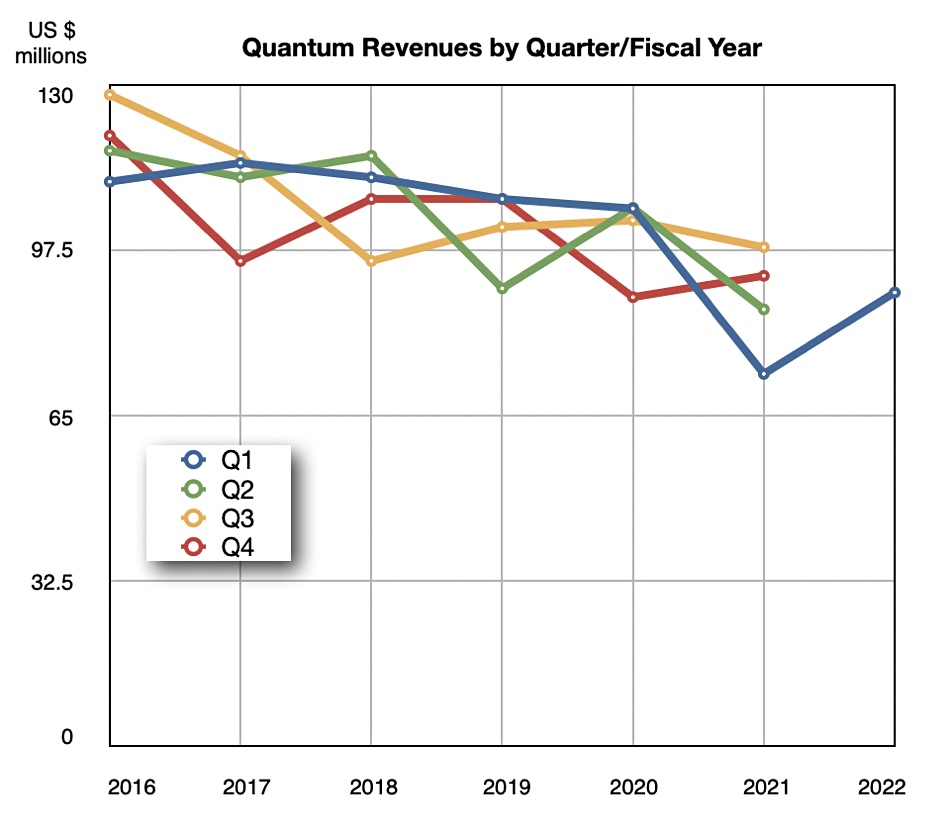

This is Quantum’s second consecutive growth quarter, following on from the prior quarter’s five per cent year-on-year growth to $92.4 million.

It is also Quantum’s first Q1 growth quarter since FY2017. These two points indicate that Quantum could have returned to being a growth company. It expects next quarter’s revenues to be $88 million +/- $4 million — so $90 million at the mid-point. That would be a $7.7 million increase on the year-ago quarter’s $85.8 million — a 4.99 per cent rise. If achieved, that would be the third consecutive growth quarter.

Earnings call

Lerner said in the earnings call that: “software and subscription customers grew more than 20 per cent sequentially with bookings up two-times. While still off a small base, I’m pleased with the progress we continue to make toward our shift to a more recurring revenue model.”

Another source of pleasure was this: “We delivered an all-time quarterly revenue record for our recently formed cloud software and analytics group. This group, which represents the acquisitions of Square Box Systems and the CatDV media asset management business, benefited from the increased scale of the Quantum global salesforce and generated a strong increase in six figure contract wins during the quarter.”

He said that the 500-strong acquired Pivot3 customer base represented a great selling opportunity for Quantum products in the future, and: “We see a meaningful opportunity to cross-sell and upsell surveillance solutions to our customers in sports, media and entertainment, higher education, retail, and government, and we are already seeing early trend traction.”

He also said Quantum was now selling its software into the hyperscale market, following on from tape library sales. It’s engaged with six of the top ten hyperscalers, either in production or in product trials. He said: “I would say we are hands-down the share leader in the top ten hyperscalers. When it comes to cold storage, we simply are ahead of everyone by a lot in that space.”

New products

Lerner sees Quantum’s cold storage hardware and software expertise opening up Fortune 500 enterprise opportunities — described as webscalers in opposition to hyperscalers, as they deal with increased cold data storage needs. He said we should expect product news in the cold storage area in the coming months, and cold storage-as-a-service was mentioned. Also he said: “We have a product coming out later this month that clearly targets the webscalers and the Fortune 2000 … that will make [our] selling motion much more packaged and repeat.”

Next he mentioned this: “There’s a strong ransomware opportunity for us. We actually have a very specific physical product that we’re building for that. We have it in limited productions with a few hyperscalers who really need it.” The product has been co-designed with a hyperscaler and he said there is no other product like it in the market — the data is physically turned off and not on a network. That sounds like a specialised tape (or disk) library.

“We’re going to make that more widely available towards the end of the year, but we’re actually building some unique intellectual property around … really physical ransomware protection.”

The cold storage-as-a-service product will include the anti-ransomware package.

ActiveScale and StorNext are already available on a subscription basis. Other existing products like CatDV and the Dxi deduplicating backup target range will also move to a subscription model.