China’s state-backed chip manufacturer Tsinghua Unigroup is staring bankruptcy in the face. The Wuhan municipal government has taken over the company, which has applied to the Beijing No. 1 Intermediate People’s Court for reorganisation.

Update: Action to add YMTC to USA Entity list noted; 13 July 2021.

Wells Fargo senior analyst Aaron Rakers told subscribers that Tsinghua had more than $30 billion in debt and just $8 billion in liquid assets. According to Nikkei Asia a creditor, the Hong Kong-listed Huishang Bank, has requested a court to begin bankruptcy proceedings.

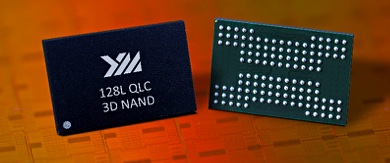

The group owns Yangtze Memory Technology (YMTC) which is building string-stacked 128-layer NAND using separate controller logic chips and NAND chips — a technology called Xtacking. Rakers cites TrendForce research saying YMTC accounted for slightly more than one per cent of total NAND industry capacity in 2020 and could grow that to four per cent this year. It also owns mobile chip developer UNISOC.

Tsinghua Unigroup also owns a DRAM venture. Setting up NAND and DRAM fabs is a multi-billion-dollar exercise.

The group is a conglomerate 51 per cent owned by Tsinghua University and 49 per cent by Chairman Zhao Weiguo. YMTC is a designated Chinese national champion in the Made in China 2025 project, whereby China aims to produce 70 per cent of its own semiconductor chips by 2025.

In December last year it was reported that the group was defaulting on several bond repayments totalling more than $3 billion, after having defaulted on a $199 million debt in November.

A group statement said: “Our group will fully cooperate with the court to conduct a judicial investigation and proactively to solve debt risks. We support the court to protect the creditor’s legal rights in compliance with the laws.”

Tsinghua Unigroup tried to buy Micron in 2015 for $23 billion, but that bid failed — not least because of US concerns about technology transfer to China.

It seems possible, if not probable, that the Tsinghua Unigroup will soon be restructured and parts sold off. Blocks & Files thinks it seems inconceivable that YMTC could collapse, as NAND and DRAM chips would appear to be a central feature of semiconductor chip self-sufficiency.

Update: Two US politicians have written to US Commerce Secretary Gina Raimondo to say YMTC should be added to the USA’s Entity List and so subject to technology export controls.