Profile. Nutanix, that aggressive hunting leopard of hyperconverged infrastructure (HCI) new customer sales is changing its spots, becoming a farmer of hybrid multi-cloud software renewals.

The era of multiple hundred-million-dollar losses per quarter is evolving towards Nutanix actually making profits. This strategic morphing is associated with the ending of now-former CEO Dheeraj Pandey’s involvement with the company he founded, chaired and ran. Rajiv Ramaswami became CEO in December 2020 when Pandey retired from both the CEO and Chairman roles.

Now Nutanix’s Board has elected a new chairperson: Virginia Gambale. She joined the Board in June last year, becoming Lead Independent Director in December 2020 — the month the CEO changed. The Pandey period is over, with Ramaswami’s rule now reshaping the company.

Nutanix held an Investor Day meeting yesterday, and its new strategy and direction was made clear.

First of all, the days of breakneck expansion are over. Ramaswami said Nutanix was the HCI leader, citing Gartner MQ and Forester Wave ratings. His slide didn’t mention IDC’s latest software-defined infrastructure tracker report which declared Nutanix was the clear leader in storage controller software, commanding 25 per cent of the market versus second-placed VMware’s 15 per cent — but that would have been icing on the cake.

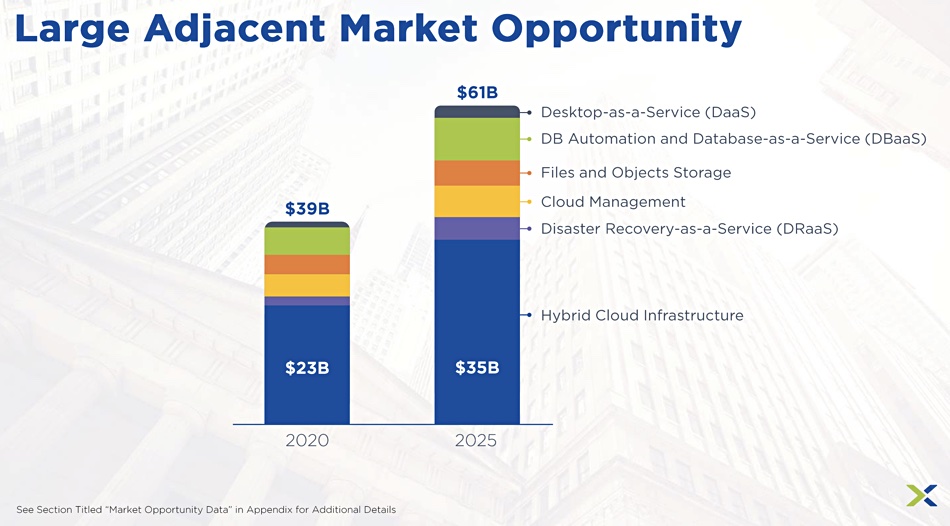

He outlined the opportunities ahead, with a $61B total addressable market in 2028 made up from a $35B hybrid cloud infrastructure market and another $26B from add-on products and services.

Profitability

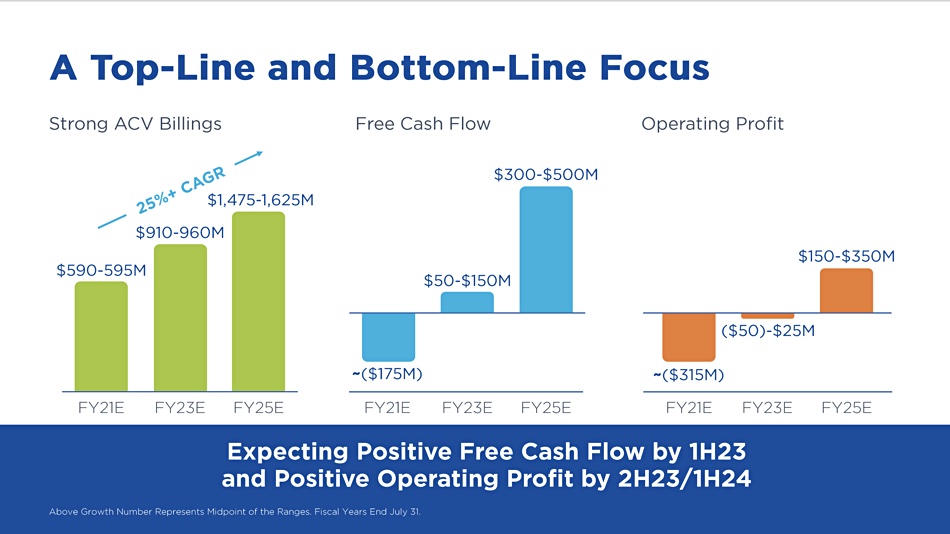

Customers want hybrid multi-clouds, and Nutanix is reshaping its product set to provide a transparent environment covering private (on-premises) and multiple public clouds. He sees a 25 per cent compound ACV growth rate for Nutanix from its fiscal 2021 to 2025, and a clear path to profitability. Nutanix should be cash-flow-positive by the second half of calendar 2022, the first half of its fiscal 2023.

ACV is the total annualised value of a customer’s subscription contract, excluding professional services and hardware.

The company will get to cash-flow positivity by obtaining more revenue from contract renewals, and from associated lowering of sales and marketing costs. CFO Duston Williams said the cost of renewals will be about 80 per cent lower compared to new/upsell business, and renewals will play an increasingly important role over new ACV billings. Nutanix is targeting a greater than 90 per cent customer renewal rate.

William Blair analyst Jason Ader amplified the details, telling subscribers “management expects renewals to grow from roughly 13 per cent of total billings in fiscal 2021 to 25 per cent in fiscal 2023 and 40 per cent in fiscal 2025. As the renewals mix rises, the sales and marketing cost structure starts to benefit as straight renewals require fewer sales resources paid at substantially lower commission rates (as compared to new or up-sell business).“

Nutanix Chief Revenue Officer Chris Kaddaras said sales execution was improving. and Nutanix’s go-to-market efficiency will be increased first by the lower cost of renewals, and second by digital marketing. Nutanix will move to solution selling of a simplified product line, using reference architectures, validated designs, and product packaging changes

Ader said “The emergent path to profitability is the culmination of several years of heavy lifting on its subscription transition and investments in building out a comprehensive software stack.” It’s an ambitious target for a company that only a year ago was losing hundreds of millions of dollars.

Streamlined products

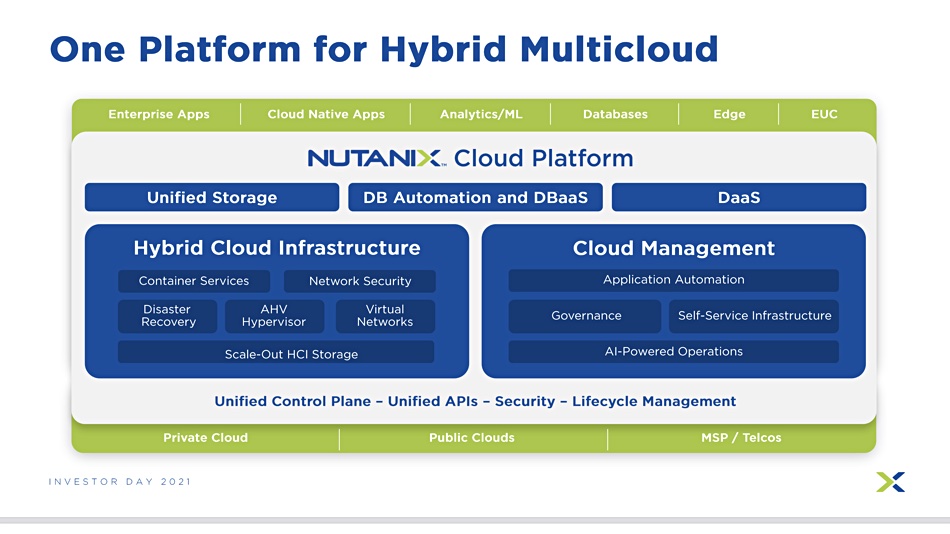

Nutanix is streamlining its product set into three main categories:

- Hybrid cloud infrastructure (the core platform);

- Cloud management (add-on solutions like Prism Pro, Beam, and Calm); and

- Stand-alone solutions — specifically, unified storage (file + objects) , database management (Database automation, Era, and DBaaS), and desktop-as-a-service (DaaS, Frame) — which all will ultimately be decoupled from the core platform to drive greater adoption.

Nutanix will still pursue new business but no longer as the be-all and end-all. It has a sustainable differentiation based, Ader says, on its “simple-to-use, cloud-, hardware-, and hypervisor-agnostic platform [which] offers customers unrivalled flexibility to run any app in any location, without the need to refactor the app. Key multicloud use-cases enabled by the company’s Clusters software (on AWS today, soon to be on Azure) include data centre consolidation (lift-and-shift to the cloud), disaster recovery, test/dev, and cloud bursting.”

In effect Nutanix has achieved what VMware has built with its VMware Cloud Foundation. It has a platform-agnostic hybrid multicloud business that enables its customers to lift and shift on-premises apps running on Nutanix into the public cloud, still running on Nutanix. This, Ader says, provides Nutanix with “long-term staying power”.

Nutanix is betting the farm on this strategy. Pandey’s youthful creation is maturing into a harvester of renewals under Ramaswami, as the warring on-premises and public-cloud markets grow up into a stable hybrid multicloud world.