Cohesity has announced another record quarter of results. It’s selling to more customers, who are spending more, via partners who are bringing in more business. Subscriptions are soaring as well.

The company sells data protection and management software for on-premises and hybrid cloud workloads, and is moving a software-as-a-service product offering with customers paying through subscriptions. Founded in 2013, it was valued at $3.7B in March and has taken in $660M in funding, with the most recent round bringing in $250M last year.

CEO and founder Mohit Aron issued a statement: “Our record-breaking results show that more businesses are trusting Cohesity to manage their data in a world in which hybrid cloud is the norm, ransomware attacks are soaring, and the need to derive value from data has never been greater.

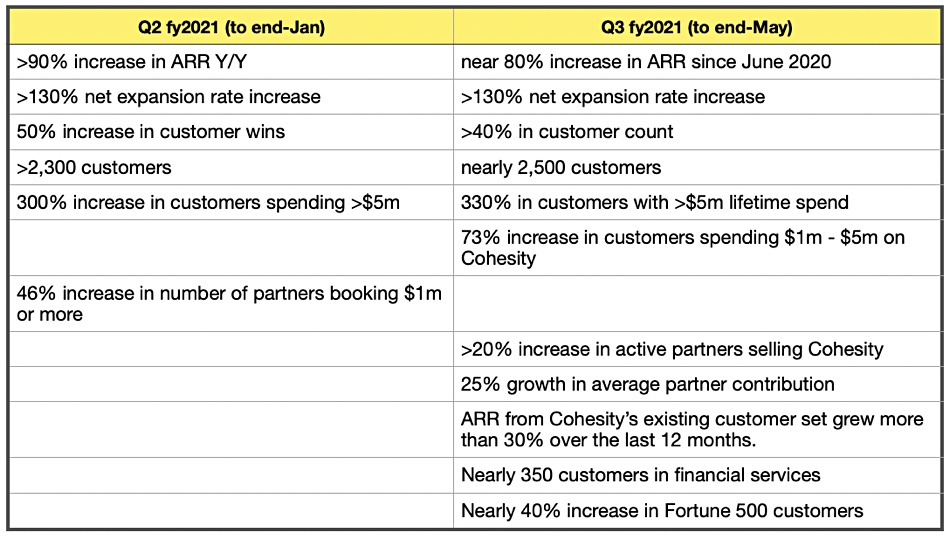

The business momentum is continuing following its last quarterly results. Subscriptions are growing, customer count is increasing, more partners are selling its software, and customer lifetime spend is increasing. We’ve tabulated the various bullet points from last quarter’s announcement and the latest one to enable as direct a comparison as possible:

The net expansion rate increase number is the rate of expansion net of churn from existing customers over the last year.

Comment

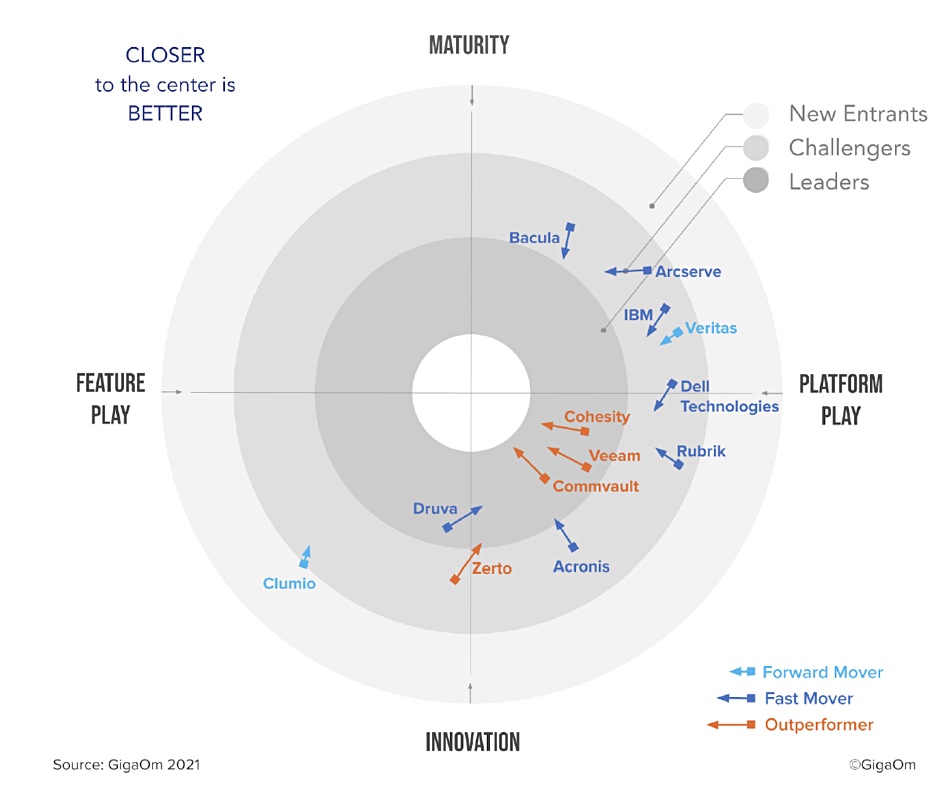

What we see here is, in our view, a company heading towards an IPO. It is distancing itself from another massively funded data protection and management startup, Rubrik, according to a GigaOm analysis of suppliers competing in the hybrid cloud enterprise data protection market.

The GigaOm analysis identifies a missing Kubernetes-orchestrated container data protection offering in Cohesity’s BaaS product set; it’s present in the enterprise product. Our understanding is that this gap will be filled by the end of the year.

Rubrik faced some exec churn earlier in the year. Since then it has signed up NetApp as a reseller and has also announced protection for containers in the Kubernetes environment. Both moves position it well for the future and its own potential IPO.