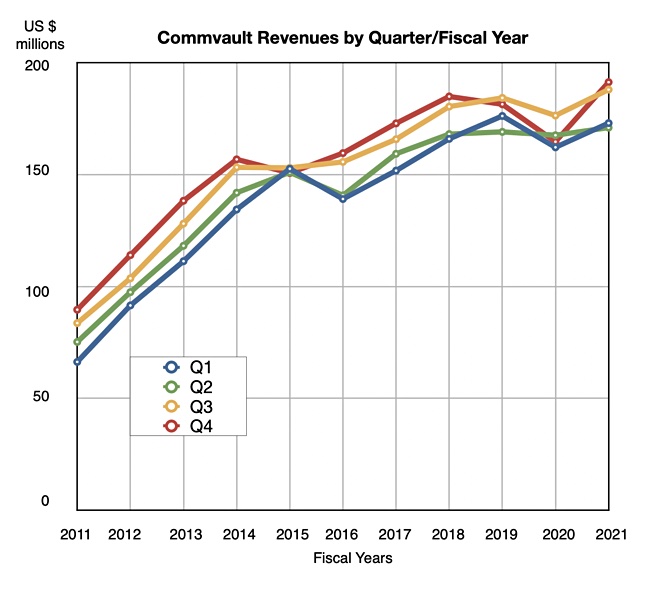

After having cranked out a large topline upswing in its third quarter, as well as its first profit after a few loss-making quarters, data protector and manager Commvault has done it again, with a 16 per cent Q4 revenue rise to a record $197.3m and its best-ever full year revenues of $723.5m, up 7.8 per cent.

There was a profit of $6.3m in the quarter, ended March 31, less than last year’s $8.9m, and not enough to pull the company out of loss for the year: it lost $31m for full year 2021, up from a loss of $5.6m in fy2020. Total operating expenses in the quarter were also up: $151.4m, 8 per cent more than the year-ago $140.3m.

Commvault’s Sanjay Mirchandani, President and CEO, was chipper: “Our portfolio and roadmap are strong, our team is focused on execution, and our vision is resonating in the marketplace. While our work is never done, our transformation efforts thus far have been successful and we expect will fuel our continued growth in the new fiscal year.”

Financial summary:

- Total recurring revenue – $145.6m, up 24 per cent Y/Y,

- Annualised recurring revenue – $517.9m, up 15 per cent,

- SW and products revenue in quarter – $89.4m, up 35 per cent,

- Services revenue in the quarter – $102m, up 4 per cent,

- Operating cash flow – $64.7m in quarter, $124m in full year,

- Cash and short-term investments – $397.2m.

Much of the increase was driven by large deals, ones greater than $100K, which represented 69 per cent of software and products revenue in the quarter. There were 198 such deals in the quarter, up 30 per cent Y/Y, with a $335K average dollar amount, and 673 in the year, up 12 per cent.

William Blair analyst Jason Ader noted: “Fourth-quarter outperformance was attributed to 1) enterprise deals…, 2) Metallic momentum (which doubled ARR quarter-over-quarter, with enterprise customers now one-third of Metallic’s base), and 3) strength in the Americas geography (record software revenue of roughly $54 million).”

In Ader’s view: “Commvault’s turnaround looks real, with today’s results offering further evidence of this.”

We can see that the subscription business is motoring along, and the software and products revenue increase has grown substantially, at 35 per cent. Perhaps it can even swing a full year profit next year if it continues on this path.