Analysis: Fungible’s composable data centre announcement last week excited much discussion about the limits of the enterprise composability market. We look at views from storage architect Chris Evans, IDC, and MinIO founder and CEO Anand Babu Periasamy, Panasas product marketeer Robert Murphy and others that outline the limits of enterprise composability.

Start point

Evans tweeted: “The biggest question is really, who are these technologies aimed at? If I was a mid-market co-lo or bare metal provider, I see good use for this technology. But in the enterprise, how many IT shops really reconfigure their hardware every day?”

He continued: “Change is risk and if you’re not 100 per cent certain you can dynamically rebuild your infrastructure – then you treat it like a pet and leave it alone. I would posit that many enterprises just aren’t geared up to dynamically rebuilt infrastructure.

“So, if you gave them a Liqid/Fungible solution, the concept would scare them to death. It’s likely savvy IT organisations will realise the benefits of gaining more flexibility with “exotic” components and be the leaders here. Perhaps a slower adoption could indicate that many IT positions have been dumbed down and we don’t have enough internal visionaries to make projects like composability a reality.”

Evans foresees “an interesting philosophical debate arising around the choice of bare-metal composable hardware and composable software VMs.”

IDC research

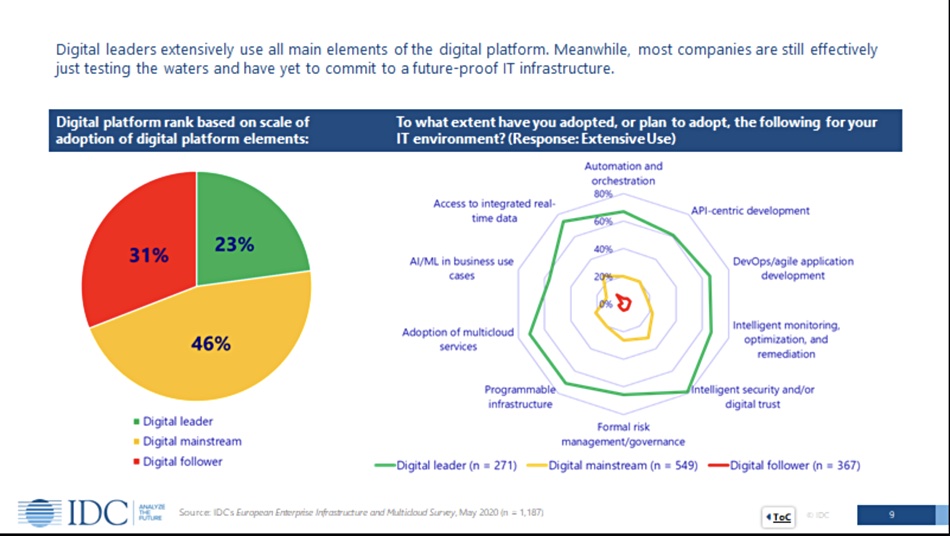

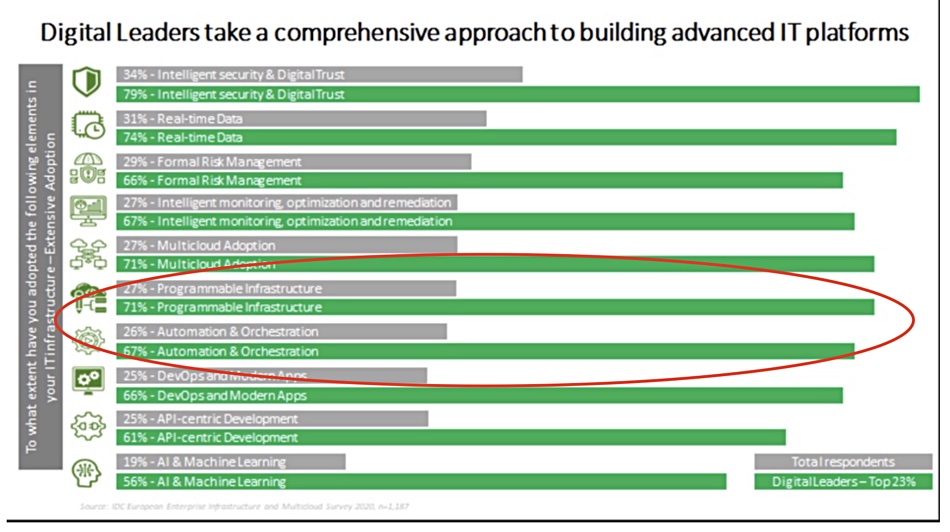

Andrew Buss, IDC Research Director – European Enterprise Infrastructure and European Edge Strategies, thinks three quarters of enterprises are not ready for data centre composability: “Only 23 per cent in Europe have sufficiently capable automation/orchestration and other advanced management and application development and deployment capabilities to adjust their IT service delivery dynamically, ” he tweeted.

He wrote” “We did a study last year looking at this across Europe. Only 23 per cent gained Digital Leader status where they adopted 10 aspects of a transformed cloud-native Digital Platform extensively. The 46 per cent of the Digital Mainstream may do 1 or 2 aspects extensively but typically only adopt these to a limited extent. Fully 31 per cent don’t adopt these at all.”

Evans responded: “That’s interesting as it sets the limit of adoption right there. Both Liqid and Fungible need to find ways to justify the wider investment in tools/skills, otherwise this is a very limited market for them – other than hoping/praying for hyper-scaler acquisition.”

We suggested to Buss that “it doesn’t look good for large-scale adoption of composability.” He replied: “Our view is that it can hopefully tip that mainstream 46 per cent towards a more automated and agile future – can be helped by moving towards things like consumption-based approaches with managed infrastructure as a service, etc.

“So the future is there, but many customers need technological and cultural transformation to reach it.”

MinIO and Panasas views

Periasamy contributed to the Twitter discussion: “Customers prefer disposable servers to reconfigurable ones in a scale-out environment.”

He explained further: “The idea of the disposable server is all about commodity off-the-shelf servers and not about how expensive they are. Supermicro NVMe JBOFs and GPU boxes would also qualify. Customers do not want to be stuck with proprietary architectures that they do not understand or control.”

The notion here is that enterprises, particularly with scale-out systems, prefer to dispose of cheap servers rather than dynamically configure them but will reconfigure expensive server boxes.

That view resonates with Panasas’s Robert Murphy who thinks that the main composability market is in high-performance computing (HPC): “The primary opportunity for Fungible is the hyper-scalers, which sure is enough of an opportunity but have shown an aversion to sourcing this kind of IP by purchasing product, when they have the chops to do it themselves.”

“The most realistic opportunity are the tier 2 hypers, Telcos, Banks, Retail, that would need to purchase Fungible kit since they couldn’t develop it on their own. Fungible needs to … invest HEAVILY in finding customers here.” [His emphasis.]

“HPC could be considered a tier 2 hyper and it should be no surprise (even though it is) that both Fungible and Liquid have seen their biggest adoption in HPC to date. HPC, the king of disposable servers, is starting to look at composable, because those gold plated GPU DGX servers are not so disposable any more.”

Liqid US west sales lead Triet Phamh concurred: “Agreed! Servers with 8 x A100’s and 5k NVMe drives are not so disposable anymore. We are seeing a massive push for composable simply because of the astronomical costs of PCIe devices and customers simply don’t want those devices in a “static” state anymore.”

Evans agreed: “Yes, it makes sense. Certainly as a first market. Hyper-scalers will self-build or acquire and kill off, like they did with E8 Storage.”

The Co-lo perspective

Glenn Dekhayser, a Principal Architect at Equinix, chimed in: “The bet is that enterprises are giving up their data centres completely, and will use composable colocation where cloud doesn’t make sense.” He cautions us it’s not necessarily the bet of his employer.

But: “Don’t discount the edge as a huge motivator. CSPs will require partners to provide compute/storage at the metro and far edge to provide services at low latencies to consumers and on-premises use cases; i.e. robotics, gaming, autonomic driving…composability provides advantages here.”.

Comment

Enterprises using expensive general compute and GPU servers and facing a need to support widely different workloads will see server utilisation going up and down as workloads change and be incented to drive overall utilisation up.

In particular this applies to HPC data centres and also to co-location/managed service suppliers facing workload variability as tenant workloads come and go. All three types of installation will likely have hundreds if not more servers, both general compute and GPU, and associated storage and networking infrastructure.

If they can drive utilisation higher through composability then their costs are less likely to eat into profit margins (co-los, MSPs) or bust up against budget limits (HPC).