Micron and Western Digital are mulling rival bids over Kioxia, which would value their Japanese competitor at $30bn.

The Wall Street Journal which broke this news, describes Kioxia as a “Must-Have for Both Western Digital and Micron“.

The NAND business is a game where high volume chip output wins, with cost per bit reducing as manufacturing volume rises. Wells Fargo analyst Aaron Rakers has told subscribers: “We think any move toward NAND industry consolidation would be viewed positively.” In other words, fewer competitors means less glut and bust in a notoriously volatile market.

According to Rakers, Micron agrees that consolidation is needed but does not want to be the consolidator.

How ambitious is Western Digital CEO David Goeckeler? He’s been in the post for 12 months and a Kioxia acquisition would be an enormous deal. Does he want to make Western Digital the NAND market boss? Even if he was willing to push the boat out that far, would the Japanese government approve such a deal?

Western Digital previously made a ¥2 trillion ($18.2bn) bid for Kioxia when it was being spun-off from Toshiba in September 2017. The offer was rejected.

Western Digital has a JV with Kioxia, so buying the firm would give it sole ownership and there would be no technology integration problems whereas, from Micron’s point of view the Kioxia/Western Digital BiCS 6 162-layer 3D NAND technology differs from its own 176-layer technology.

That said, SK hynix faces similar integration problems bringing Intel’s 3D NAND layering tech in-house and it is still buying Intel’s NAND business.

Kioxia is owned by Bain Capital and SK hynix holds a minority stake. The memory maker has a joint venture with Western Digital to build NAND chips from semiconductor foundries in Japan. The foundry chip output is used by Kioxia and Western Digital to make and sell SSDs.

Kioxia planned to IPO in August 2020, at a $20.1 bn valuation. This was called off a month later due to the pandemic and US-China trade restrictions.

The Winner Takes it All?

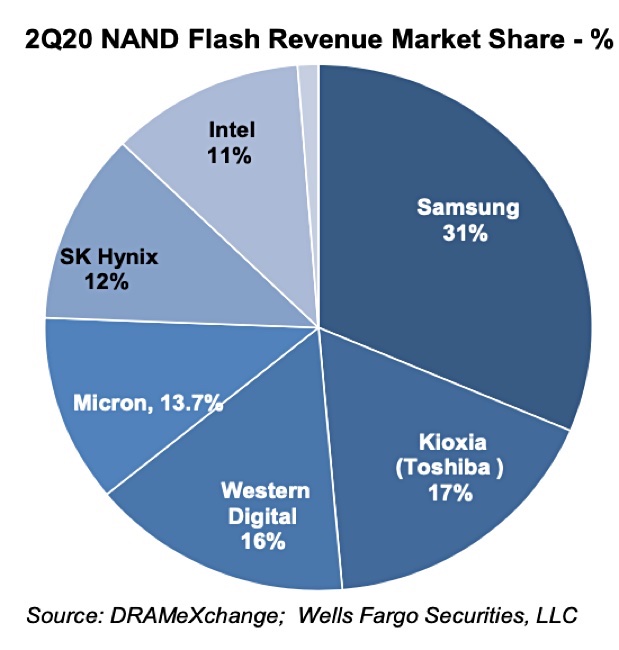

DRAMeXchange’s 2Q’ 2020 figures show Samsung is the leading NAND supplier, with 31 per cent revenue share, followed by Kioxia (17 per cent), Western Digital (16 per cent), Micron (13.7 per cent), SK hynix (12 per cent) and then Intel (11 per cent). SK hynix is currently buying Intel’s NAND business which will raise its market share to 23 per cent.

A Micron-Kioxia combo would total 30.7 per cent revenue share, and WD, with Kioxia under its belt would overtake Samsung, to take 33 per cent.